The T-Report: Where’s The Beef

Where’s the Beef?

The fiscal cliff was allegedly the last big hurdle for America. Once the cliff was “resolved” all this consumer pent up demand would be unleashed, and businesses that had been holding back on growth were about to launch new initiatives. As in the old Wendy’s commercials, where’s the beef?

Due to the timing of economic data, there isn’t much that covers the post cliff period, other than maybe jobless claims. They weren’t that good. Not bad, but more noticeable for finally having a downward revision than anything else.

I continue to believe that those people and business that were “worried” about the cliff, will find something else to be “worried” about, like little final demand. On the other end of the spectrum, those that weren’t worried will soon realize their take home pay is smaller and will reduce rather than increase spending.

I must have missed the big announcements of companies that are creating jobs all I’ve seen is that MS and now AMEX are laying people off. That is hardly supportive of the notion that the cliff was preventing growth.

Bank Earnings

One reason given for some of the strength yesterday is the fear of missing today’s WFC earnings. Banks have been a key driver of the move to new highs. JPM is back above the $46 price and seems set to break through.

I too think bank earnings will be a catalyst, but not in the right direction.

I expect big numbers for this quarter. Many things have gone right for banks:

- The Fed has been successful in at least stabilizing housing

- Europe has stabilized

- Credit spreads and yields did well during the quarter

Those are all good things for the banks, but primarily from a loan loss reserve standpoint. Banks should be able to release reserves and have a big quarter, but what does the future bring? That is the question, and most of the answers, I think are bad

- Low turnover doesn’t help as it reduces fee and trading income and this is across the board from mortgage origination to secondary trading of CDS, the volumes are lower and that is not good for banks

- While the Fed has “successfully” put a floor on housing, they have done it but creating very low rates and tight credit spreads, none of which are good for bank earnings. NIM is hard to get, and anyone looking at “steep curves” is looking at wrong curves, look at rate banks pay on interest to depositors vs 10 year mortgage, hardly cheap

- As the bond market has replaced the loan market as primary source of funding, banks enjoyed record fees on new issues, but as that slows, and decent yielding assets disappear from the bank books, they lose the fee income and have a carry problem

- Higher margin business is available but banks avoided it for so long, much of that market has been captured by alternatives to the big banks, with middle market lending just one good example

I might yet be surprised, but I don’t see bank earnings going forward being a driver.

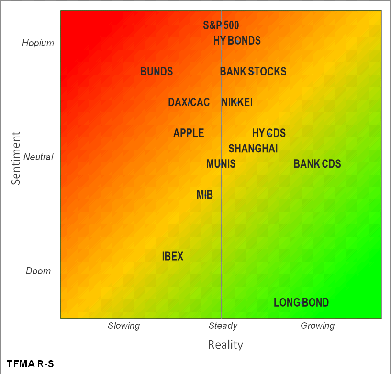

China, No Longer Contrarian

Some people were almost giddy yesterday looking to buy stocks because China would do well. I am not sure where they were when things like FXI were at $32, but at $42 everyone is in love with it? That makes me nervous. I have been a bull on China and now I am concerned that has gone from unloved to “liked” too quickly. Separately, if you think China is about to rebound from its slumber and weakness, buying China is still probably better than buying the S&P 500, at least at current levels.

Spain and Italy

If last year was the year of the “bond” in PIIGS land, I think this will be the year of the bank. While I continue to like Spanish and Italian bonds under the simple view that real money will be forced to buy as those who are underweight underperform, and that the banks won’t sell their existing holdings. As money is made, the investment banks will also rush to increase limits and trading positions, further helping the limited supply of bonds in available for sale accounts to trade higher.

Banks benefit the most from this. The banks in Spain and Italy last year became so intertwined with the country it almost makes for crude mental images, but they really went all it. The separation of banking and state was non-existent. Now that is working for them, and I think there are so many shorts in that sector that these banks can perform extremely well. It will make what happened here with banks last year look like child’s play.

Longer term I question whether anything is fixed, but in the short to medium term I think the rally there continues.

At the same time, Germany will be weaker, especially in bunds where the redenomination risk premium should be eliminated.

Disclaimer: The content provided is property of TF Market Advisors LLC and any views or opinions expressed herein are those solely of TF Market Advisors. This information is for educational and/or entertainment purposes only, so use this information at your own risk. TF Market Advisors is not a broker-dealer, legal advisor, tax advisor, accounting advisor or investment advisor of any kind, and does not recommend or advise on the suitability of any trade or investment, nor provide legal, tax or any other investment advice.