The T Report: Dumb Troika Plans for Greece

Pythagoras Rolled Over in His Grave

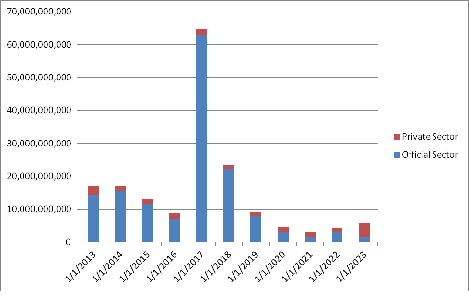

All basic math seems to have been forgotten in Greece. Whatever the Troika is trying to do, it lives in some world devoid of reality. Here, to the best of my knowledge is where the Greek government creditor payments go over the next 10 years (ignoring rollovers, etc.).

Those little red lines are the amounts due to be paid to the private sector. These are mostly PSI bonds with a smattering of old English Law bonds that didn’t participate in the original PSI.

It doesn’t take much of a genius to see that the focus on the PSI bonds is just a silly creation of the Troika. They are trying to goal seek their 2020 target of 120% debt to GDP. That is a fine goal but is largely irrelevant.

Before going much further, I work under the assumption that 2 identical companies, but where one company has $100 billion of 5% coupon debt due in a year is far more likely to face default than the one that owes $100 billion of 1% debt in 20 years. If you disagree with that premise, I am sure I can find some names where I would like you to sell me short dated CDS. In any proper restructuring, the goal is to get reduced debt, with longer maturities. Reduced coupons are nice, but a high coupon on much smaller debt is a better outcome.

So What is the Troika Thinking?

I have ignored the T-bills, which continue to live in their own world. I basically found debt in 3 different categories.

Central Bank holdings from their SMP bond purchases total about €46 billion from what I can tell.

A variety of loan programs (where the detail is by far the sketchiest) total €146 billion. This seems to be in 2 big blocks. A block of 5 years loans made by the Troika when they thought they could fix the problem and in their ongoing support, and a chunk of longer dated obligations that are associated with the original private sector restructuring. I used a 3% coupon for all this debt, which may now be too high, but I can’t tell. I assumed no amortization of the debt, which may be wrong and would understate the pressure on Greece.

Private Sector Holdings make up the rest of the €258 billion in debt, so about €66 billion in total.

This data is a bit rough as it came from Bloomberg and there are some bonds that I couldn’t tie out, a few bonds that seem to exist but shouldn’t, and very little information on the loans. It is the best I could come up with for now, but I think it capture the bulk of what is going on.

So the buyback program is designed to reduce total debt outstanding.

Let’s say the Troika was able to buy all of the PSI debt back at 30% of par. That is €62 billion of PSI debt. It would cost Greece €19 billion and would reduce debt from €258 billion to €214 billion. So that is why the Troika likes this idea. Greece would see debt outstanding drop.

That Debt Reduction is Totally Meaningless

First, why would investors who have already taken a haircut, managed to get English law treatment on the new bonds, capitulate and lock in losses at extremely low prices? The PSI was done earlier this year! It isn’t like this is something that has had time to run its course. So I expect at the prices the Troika wants, there will be few sellers. But even that isn’t the problem.

What isn’t discussed, or at least I haven’t seen, is what will the new loans to Greece look like? If the ESM is willing to lend to Greece for 20 years at 2%, then the idea is more interesting. But if the ESM is willing to do that, why not just reschedule all existing official sector debt into 20 year 2% loans?

Without knowing what maturity and rate the ESM is offering, it is hard to judge how successful the program would be. Here is a simple example:

If ESM lent at 4% for 5 years and the cost was 50% of par, Greece would be WORSE off after the program. Greece is paying 2% for the money which is 10 years or longer. If it knocked 50% of the debt off but stepped up the coupon to 4%, there would be NO annual savings. The Troika would get their “debt reduction” but it wouldn’t save Greece any money.

Worse than that, instead of having 10 years before making the first redemption payment on a PSI bond, the entirety would come due in 5 years. That is far worse from Greek perspective.

What is the Average Purchase Price of the ECB’s Holdings?

Why not sell the ECB holdings to the ESM at cost. No “losses” in that case. No “financing”. If the average purchase price is 85% (reasonable assumption) that would know $10 billion off the debt right there.

If the ESM would lend for 10 years at 2% on that, then annual coupon drops and redemption is pushed off. Great for Greece.

Except for HUGE AND GENEROUS AND LUXURIOUS Lifestyle, why does IMF need profit?

I’m not sure what the IMF does anymore, but it does seem to be morphing itself into something that looks more like a James Bond villain than an international group helping promote stability. Seriously, have you seen their “lair”?

Another obvious spot to extend and do this at “cost” which seems to be about 0%.

Official Sector Debt Forgiveness is Coming

The buyback program is largely stupid, will be ineffectual, and highlights how unwilling the Troika is to think like an actual creditor. They live in a world devoid of reality, for now, but that ability to ignore reality is chipped away at daily, and they will eventually accept involvement in trying to give Greece a workable program. That will be good for the Greek people and the PSI bonds. As I have written before, Greece could help themselves by working on some actual alternatives, rather than showing up at the negotiating table with empty threats and a bailout cup.