The Spanish Bank Bailout: Separating the Wheat from the Chaff

The Spanish Bank Bailout – What to Watch For

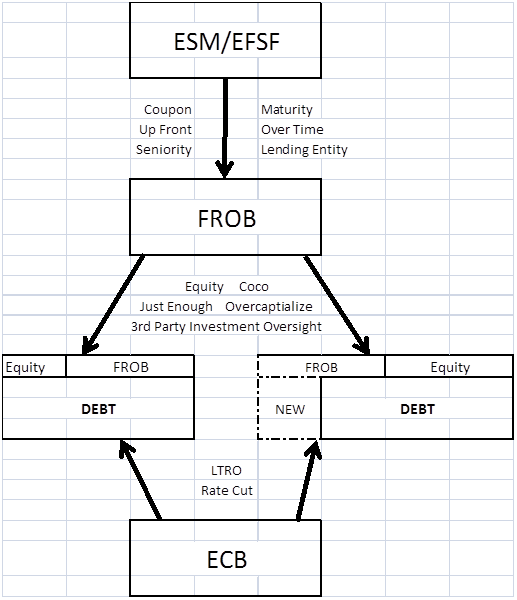

Coupon and Maturity

This is a key indicator of how aggressive Europe is being. Longer maturities and lower coupons are key. If we see 3 year loans at 5%, we get a very different message than 10 year loans at 3%. Lower coupon makes the current costs more bearable, and the longer the maturity, the greater the commitment.

Up Front or Over Time

The money can be provided all up front or pledge over time. One of the problems with Greece was that just enough money was given at any time to stop immediate default, but never enough to get to back to business as usual. Any “pledges” will come with conditions so the market will continually fret over whether the conditions will be met and pledges will be honored or not. This, like the coupon and maturity is another primary focus point when determining what the deal can accomplish.

Seniority and Lending Entity

In spite of the hype surrounding this issue, it is only of secondary importance. EFSF and ESM are actually quite similar to each other. If EFSF has to be used here, it will be important that ESM is set up and used for other purposes, but it really isn’t that important in terms of cost of funds. ESM would also show that Spain and Italy are contributing to the “bank” bailout, but again, that is more of a subtle signaling effect.

There has been a lot of talk about “seniority”. While it is good if ESM waives seniority, the reality is that it is far more important that FROB receives cheap, long dated, money all at once then the exact subordination. The impact of letting ESM participate at a non senior level would be good, but really is second order.

Equity or CoCo

It makes a bit of difference whether FROB gets money or gets debt issued by EFSF/ESM and uses that debt to buy stakes in banks, but only a small difference.

FROB should use equity for the weakest banks. I would be more comfortable with wiping out existing shareholders in weak banks and have FROB effectively take them over (they have done that in the past). Using CoCo’s for weak banks would be a signal that FROB isn’t as serious about recap and reform as I would like them to be.

For better banks, making CoCo’s available would be a good choice. It might encourage those banks to recapitalize without the full dilution effects of an equity injection. Also, depending on the interest rate charged on the CoCo’s and the amount issued, the FROB could be self-financing. That would take pressure off of Spain to meet the current interest payments on the FROB loan.

Wiping out some of the smallest and weakest banks would also be good. No point wasting money on them and the impact of letting them go should be very manageable. It would hurt the banks’ ability to borrow from the private sector, but the reality is most of Spanish bank borrowing is coming from the ECB, directly or indirectly these days.

Just Enough or Overcapitalize

Will the FROB provide just enough money to kind of make the market a little happy, or will they force dilution to the point that there is actual excess capital? They will probably go for the former as it takes less money and is an easier negotiation with existing shareholders, but isn’t optimal. Seeing excess capital that will truly calm the market, or may even let some stronger banks add to their balance sheet would be big.

To be able to see a BBVA get CoCo’s at a fair price and then provide new loans to consumer and companies based on having fresh excess capital would be ideal. I don’t think that will happen but would be a real turning point.

3rd Party Investment Oversight

IMF and ECB oversight of the FROB’s decisions should be welcomed. This is basically EU taxpayer money and you have to work under the assumption that Spain would have a tendency to invest without demanding enough. There will be crony capitalism at work. The banks will make all the usual noise that wiping out shareholders will stop them from lending – in spite of the fact that it won’t.

Each investment will have to be judged on its own merits as will how the banks that receive the money perform, but I like the idea of oversight at the time of initial investment and over the life of that investment.

LTRO

Any new lending facility would be helpful. Something longer than 3 years would be good, but even more 3 year money isn’t bad. It would allow banks in particular to sop up more of the short term debt outstanding. By making it clear that LTRO will be back whenever banks need it there will be less enthusiasm for shorting bank credit spreads or the short end of the sovereign debt market. It is a potential ticking time bomb, but by easing collateral requirements, the ECB has already taken a step towards delaying detonation. This may all still blow up, but pushing it further down the road gives more time to fix the real structural issues.

Rate Cut

A rate cut is largely symbolic, but it could help lower the costs of EFSF debt since it trades so cheap to the average of the good countries that back it. If other parts of the program are successful, it may trickle in and make Spanish and Italian t-bill yields more reasonable again. Finally, since most of the LTRO was available as floating rate, it could lower the cost of bank funding a little further, adding marginally to the carry.

Two Pronged Attack of Cheap EFSF Equity and Cheap ECB Loans

The best hope for stabilizing the banking system is an equity capital infusion that is essentially converting German and French borrowing power into equity investments, followed up by more cheap lending to the banks by the ECB. These actions, even if aggressive solve nothing, but can give real breathing room to trying to fix the real structural problems in the economies and the budgets and the deficits.