The T-Report: Applesauce

The Market is Always Right – Wrong

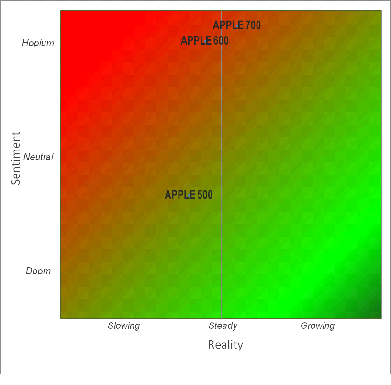

You learn very early on in this business that the market is always right. That whatever your view or your opinion or your valuation, the market is always right. Something about Apple seems to be breaking that for me. I disliked apple at 650 and felt like I was crazy. At 500 here I actually like it, but that is the point. It is the fact that this company has market cap swings that are almost impossible to justify, and largely based on nothing important.

Maybe there was a bit more optimism on how many products they could sell, or what the potential tax consequences could be, but when I look long and hard at Apple, the main difference I can see from Apple at 700 and Apple at 500 is sentiment.

As Apple hit 650, analysts rushed to raise their estimates. Not a single one said, enough. They didn’t take a victory lap and call it a day. They all (or very nearly all) raised their price targets. Media was in a rush to push it higher. Apple was going to attract retail investors. It was like a feeding frenzy to come out with the highest valuation and try and get it publicized. I want to believe even Mr. Blodget blushed.

I’ve made the arguments why it is hard for a tech/gadget company to continue to grow. We’ve looked briefly at the “cash” pile and what could be done. I have to admit that the term “cash” may need a better definition if it is so tightly tucked away offshore in tax havens that it isn’t actually useful.

More of a Market Opinion than a Specific View on Apple

What concerns me about the moves in Apple is what it potentially says about the market as a whole. For the past 2 weeks, I’ve argued that the high yield market in general, and the high yield ETFs in particular have no upside and more downside than people realize. I haven’t been right, though I’m not as wrong now as I was on Wednesday afternoon. The moves in Apple give me comfort that this market can actually be wrong.

Apple to me is now just a number. It remains more of an asset class than a stock. Whether the price is 525, 500, 450 or 700 it is all about positioning for the next forced buyer or forced seller. It doesn’t seem to be any attempt at reflecting value.

The moves in apple convince me of a couple of things:

- Retail isn’t coming back to stocks anytime soon, as the price movements seem unbelievable for what is actually a relatively simple company that is widely followed

- Crowded trades can work, but the reversals can be more punishing than ever

I’ve been wrong on my call that high yield is overvalued, particularly the high yield ETFs. I started that call almost two weeks ago and got more aggressive as the week progressed. While still wrong, I’m less wrong than I was on Wednesday. I am more convinced that the downside is greater than people realize. While “valuation” may be okay, and while the Fed may be pumping in liquidity, I think far too many people who are paid on monthly returns are leveraged long (always dangerous) and more traditional funds have minimal cash, and retail is more or less fully allocated to high yield and not adding.

So it remains time to be extra cautious in any crowded trade, especially one where you can’t understand the valuation the “market” is giving something.

Newtown

Newtown is a tragic event that has touched the nation and many families. Our family has played them many times in sports (usually losing) and was at the field being used as a backdrop by CNN just in October. It is terribly sad and scary. Kids are scared to go to school today. Parents are scared to send their kids to school. Simply tragic, but I wonder if it will impact the country in a good way. I don’t want to appear insensitive, but I do think this might help the politicians make it through the fiscal cliff negotiations. Maybe fewer of them will want to appear crass fighting over fringe issues when the entire country knows compromise is needed and there is no “right” answer. Maybe.

Almost Bullish

In spite of my bearish sounding commentary, I am only slightly bearish (as I wrote Friday morning when I took some of the recently increased bearishness down). If anything I am tempted to cover any remaining shorts, go long and close my eyes. If that trade wasn’t so crowded, I would be doing it already. Right now I’m just trying to rationalize the fact that crowded isn’t the same as being wrong.

Disclaimer: The content provided is property of TF Market Advisors LLC and any views or opinions expressed herein are those solely of TF Market Advisors. This information is for educational and/or entertainment purposes only, so use this information at your own risk. TF Market Advisors is not a broker-dealer, legal advisor, tax advisor, accounting advisor or investment advisor of any kind, and does not recommend or advise on the suitability of any trade or investment, nor provide legal, tax or any other investment advice.