The T-Report: Keeping it Simple

As Simple As it Gets

This is probably the simplest technical chart out there. A basic RSI chart which is signaling overbought for the first time since September. It was good in September and was good in March of last year. It was awful at the start of last year. So is this another January/February where the market can continue to rise in spite of overbought conditions or will we succumb sooner than later?

Last year we had LTRO helping Europe back from the brink in Q1 and were getting some pretty outstanding (possibly outlandish) jobs reports. I don’t think we see a repeat of last year and with this simple RSI finally breaking overbought yesterday, it is worth paying attention.

Less Simple, Similar Story

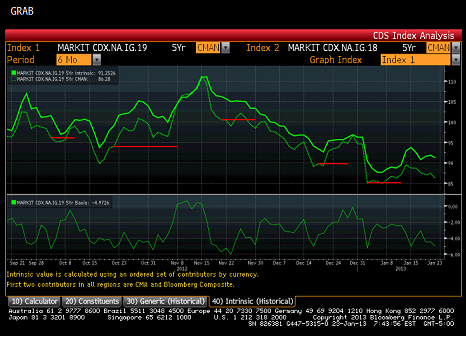

So this is IG19 versus intrinsic value and typically getting 5 rich to intrinsic has been a warning of some weakness ahead. There is a perception that people are getting too short IG19, but that doesn’t seem supported by the fact that it is trading so rich. Maybe some of it is a function of abysmal liquidity in single names, or the roll is more dramatic in reality than where it is being priced, but we are at a level that should give some pause for those thinking of being long via the CDS index.

More of the Same

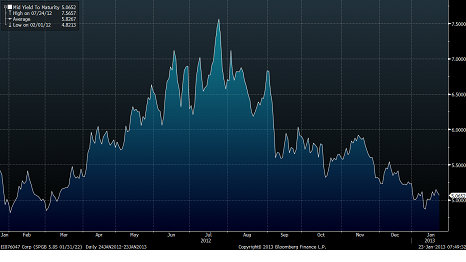

A quick look at Spanish 10 year bond yields. We are back to levels where they stalled out last year. As mentioned earlier, last year saw heavy reliance on LTRO and a general inability of banks to get funding on their own. That has improved. There are more signs of real ECB and “official sector” support, but in spite of all of that, in spite of the global chase for yield, it is worth watching the recent weakness. Last year’s sell-off in global risk at the end of March was preceded by a small but unnoticed move in Spanish bond yields. It doesn’t feel like that this year, but it doesn’t feel that different. Everyone in Europe is declaring victory in spite of signs that the market has run out of steam. The Spain can tap the markets is a big deal, so I’m not overly worried and being long Spanish and Italian debt versus bunds remains one of our “Best Ideas” but I am starting to dig deeper as something doesn’t feel quite right.

Someone Forgot to Tell the Long Bond that it is Dead

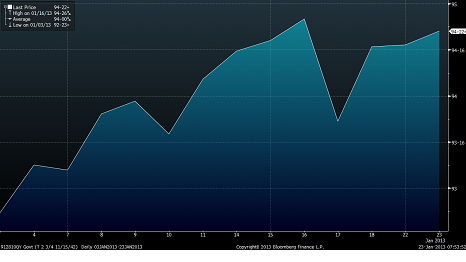

If there is one asset class that seems universally hated this year, it is longer dated treasuries. I cannot find many bond bulls, yet here we are grinding steadily higher. If you can say something with trillions outstanding is scarce, this is the market you can say it about. The Fed has done an exceptional job of building a portfolio of long dated treasuries, which coupled with those bonds held in not available for sale accounts has left a relatively small free float, which the Fed is happily buying more of via their QE programs.

I don’t think you need a “rotation” out of bonds into stocks to get a rally and think the strength of bonds in spite of the equity rally is encouraging and is worth leaving on.

Google and Apple

We finally get the much awaited apple numbers after the bell today. Google has shot up more than 5% after hours – not bad for a company with a $250 billion market cap. Can apple do the same? Personally I don’t think so, but if it behaves like Google we could see a move back to $550 where it was as recently as January 2nd. That’s not what I think happens, and I’m not sure Google will last much past the opening bell, but in terms of data, those seem the most important to watch, especially since the market demonstrated an ability to ignore Richmond Fed and Home Sales yesterday.

IBM earnings were impressive. That is the most positive sign I have seen, but it still seems more like an outlier than the norm during this earnings season.

What Catalyst?

If I knew how to track trends, I am pretty sure that I could prove that the more people ask “what catalyst” the more likely we are not to need much of one. Price is its own catalyst, with down moves causing further down moves as investors lock in gains and then start interpreting the same news negatively or stop ignoring negative news because the downward pressure on prices affects their assessment of information (just like right now the upward pressure is adding to the upward momentum). I am not particularly concerned about what catalyst we could get, because I don’t think we need much of one, and I don’t think people are actually trying hard to think of a catalyst.

Anyways, I just can’t bring myself to change direction or view here based on what I am seeing.

E-mail: tchir@tfmarketadvisors.com

Twitter: @TFMkts

Disclaimer: The content provided is property of TF Market Advisors LLC and any views or opinions expressed herein are those solely of TF Market Advisors. This information is for educational and/or entertainment purposes only, so use this information at your own risk. TF Market Advisors is not a broker-dealer, legal advisor, tax advisor, accounting advisor or investment advisor of any kind, and does not recommend or advise on the suitability of any trade or investment, nor provide legal, tax or any other investment advice.