Weekly Fixed Income ETF Review & Positioning: Ramones Edition

I Want to be Sedated!

Continuing on our investing for “boredom” and a market addicted to morphine themes, I couldn’t think of a better song to channel and I really do think the Ramones are under utilized in investment letters.

This was just a dull week in fixed income. Treasuries provided probably the most excitement, but that was more in their failure to collapse into oblivion than anything material happening.

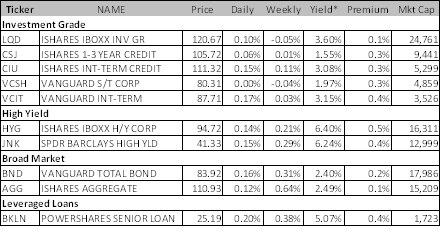

The head scratcher of the week is why did IG19 finish unchanged. There were plenty of reasons for CDS to do better, but it didn’t. It may be that a short base is finally developing that could be squeezed, but it is critical to keep watching this. We also saw LQD, the investment grade bond ETF slide a tiny bit on the week and we continue to see outflows, albeit small, from that sector.

We have mentioned it before, but it is worth mentioning again, it is a shame that there is no real good “spread” product out there. The concern that is out there about treasuries (that we disagree with) is putting pressure on the price of these bonds. Without a way to invest in corporate credit on a spread basis, retail investors in particular, are handicapped.

Some products attempt to address this, but don’t really do a good job. FLOT invests in floating rate bonds that would benefit if LIBOR increases, but that doesn’t seem likely to happen anytime soon and is almost exclusively a bet on financial credit spreads – not necessarily a bad bet, but very concentrated.

BKLN as an investment in leveraged loans in theory has some upside if rates increase, but this market now seems overbought. The first problem is that as credit spreads come down, most of the existing loans are callable and will be called and replaced with lower spread debt. The second problem is that most of these loans have LIBOR “floors” that are significantly higher than current LIBOR, so you won’t see a coupon increase.

So with a lack of spread product, a lack of enthusiasm, and a lack of fear, we still have to figure out how and where to make money in fixed income.

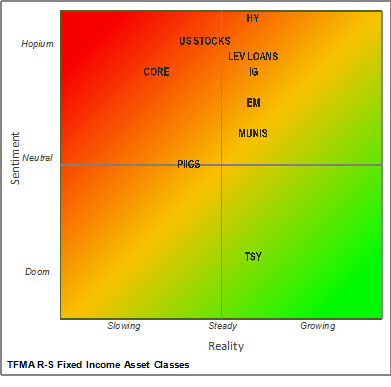

Sentiment versus Reality, or What is Priced In

Our assessment of what the real outlook is for various asset classes versus our sense of how people are positioned. Red indicates overvalued, Green is undervalued, and Yellow, is neutral. It isn’t exact. In our view, positioning and sentiment is more important, at least from a contrarian view. While it is possible to have strong support for an asset class with strong fundamentals still be a “buy” it is far more common to see sentiment diverge from reality and that is the opportunity.

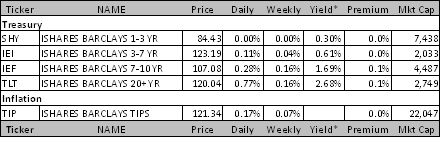

Treasuries – Never Forget it isn’t a Market

Our ongoing theme remains the same – the float of longer dated treasuries (2018 maturity and beyond) is small and the Fed continues to pour money into this market – offering strong price support. I think the theory that you need a “rotation” out of bonds into stocks is wrong, and both can go up at the same time.

With our overall view that valuations are now stretched and little of what has been done – Fiscal Cliff, Debt Ceiling Extension, QE Unlimited, will impact the economy and has been more than priced in leads us to remain favorably inclined towards treasuries. The 10 to 20 year part of the curve is probably the sweet spot (an even small float and not impacted by issuance) but the long bond is the trading vehicle of choice.

4% Is NOT High Yield

This is the week that we could see high yield breach 5%. HYG currently has an SEC yield of 5.07%. This seems to be the most accurate yield to worst calculation on the website. That is far lower than the “current” yield of 6.4%. All else being equal, the pull to par effect will come into play. It is just hard to get excited about owning junk bonds at such a low yield. I expect we will see some new ETF’s targeting either small illiquid bonds & loans, or that target CCC bonds, as the chase for yield remains alive and well.

So I cannot be excited about high yield, and I can’t get excited about leveraged loans here either for the problems mentioned earlier. Investment grade bonds, on a spread basis are a bit more intriguing. CDS actually offers the best value for long investors though we remain short the IG CDS Index in our “best ideas” because of its role as the first choice for hedgers.

The market is in no way set up for heaving selling of corporate credit. I don’t know what could or would spark that (seemingly nothing) but that would be a serious pain trade as too many have come to love their bond positions and view them as scarce assets.

So, while not particularly concerned here I can’t get really excited. HYG accrues about 1.5 cents per day in interest. I am content to forego that in belief that better opportunities to buy will be there.

It is worth mentioning, with the noise around Dell, that LBO’s are good for stocks, but not for fixed income investors – at least not investment grade bonds without covenants. LBO’s are a risk factor for IG bonds that wasn’t there a few weeks ago.

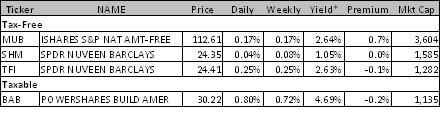

Muni’s – Fairly Priced

After the well deserved brisk rise once the fiscal cliff mess was out of the way, the bonds seem back to offering okay value. There is a lot of duration risk but with California showing signs of life, these bonds could continue to outperform. We remain a little cautious on them here because of the run up they have had, but that is probably us being more stubborn than smart. It is depressing to think that 2.64% after tax yield is cheap, but it just might be. If anything looking to add risk here.

EM Bonds are NOT EM Stocks

Another decent week for EM as the EMBI index did well. The problem here is that the spread is getting squeezed out in a big way. While I am a believer that EM is one of the likely outperformers this year is in the stocks not the bonds. The bonds caught that wave last year, and while still riding it, are not obviously cheap. I wouldn’t own EMB outright here, maybe with a treasury hedge, but again, probably best to avoid and if anything look at the stocks. Local currency debt should be more interesting, but continues to lag. That is something I will keep a closer eye on going forwards as it does at least seem to offer some currency appreciation along with some spread tightening.

Europe has been Sedated

European leaders have been trotting out their victory speeches this past week. Crisis Fini! That has pretty much market the previous few tops. While I think the situation there is actually the best in the past few years, I am getting nervous that Europe is once again not pushing hard enough, long enough and are about to slip back towards crisis mode. Bernanke, whether you agree with him or not, is determined to push and push and push until he is sure the crisis is past. He doesn’t want to take the foot of the gas only to see everything come to a screeching halt and reverse course. He is going to push until the momentum is strong enough to continue without him. Europe seems to do just enough and then they go back to their own internal issues. I can’t bring myself to be bearish Europe here, yet, but I am starting to get extremely nervous about the next move there. So I am a nervous long there, particularly for Spanish and Italian bonds versus bunds, and the equity markets of those two countries. Greek bonds, I missed the last 6 points or so in these, and am kicking myself. As scary as it is to say, they should probably be bought as any further pain really has to come from the official sector and that would benefit these bonds. The warrants may be interesting. In any case, I’m nervous enough about the new found complacency in Europe so won’t look to add right now, but I do have to admit I find the Greek PSI bonds compelling.

Dividend Stocks as an “Other”

I think we will be adding more here. With our view that treasuries should remain stable, utilities could be interesting. Mortgage REITs remain interesting. I want to get a better sense of what was priced in for dividend tax rates, but I suspect 20% leaves some upside for many of these stocks. That line is from two weeks ago and I should have listened to myself and added more.

Fixed Income Allocations

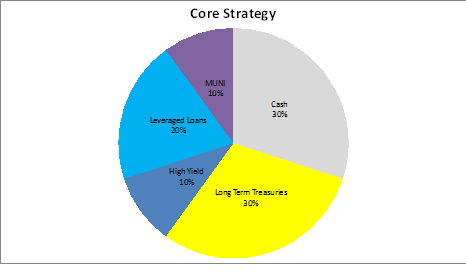

The “Core” strategy is meant to have limited number of trades. It would only be readjusted as longer term views change, or short term views become very large or very strong.

This strategy would have made 0.16% for the week bringing the YTD return to 0.96%.

Leveraged loans actually did the best, but almost everything else returned about the same. Slow and steady is the name of the game here. Holding off on selling the leveraged loan and high yield exposure was the right trade, but they will likely be reduced this week.

The core strategy has moderate duration risk and medium high on the credit exposure.

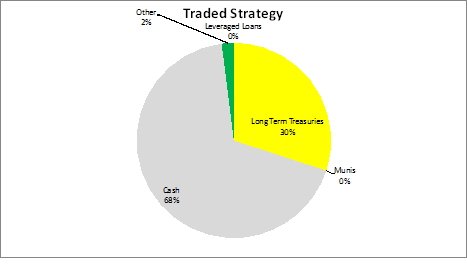

The “Traded Strategy” is meant to have more frequent rebalancing and to capture smaller moves in the market.

The traded strategy made 0.05% last week bringing the YTD return to 0.45%.

Lack of risk taking here dragged limited the returns, but remain in no rush to add risk, though picking up some muni’s might be in the works to add some additional carry and ideally some spread tightening. Dividend stocks may also be added if we get comfortable with some of the other names that got beaten down and haven’t really recovered.

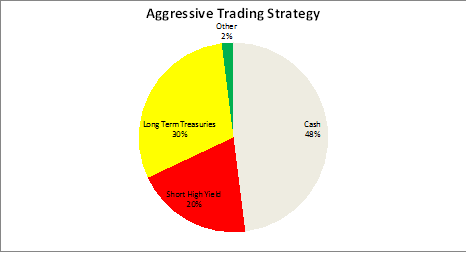

The “Aggressive Trading Strategy” is meant to be traded frequently and will expect to generate more from positioning than from yield.

The strategy was flat last week leaving the YTD return at 0.34%.

Too conservatively positioned, but will not add risk yet, but the underperformance is enough not to add to shorts and if anything lean towards getting a little more aggressive in risk taking.

The portfolio is defensively positioned.

E-mail: tchir@tfmarketadvisors.com

Twitter: @TFMkts

Disclaimer: The content provided is property of TF Market Advisors LLC and any views or opinions expressed herein are those solely of TF Market Advisors. This information is for educational and/or entertainment purposes only, so use this information at your own risk. TF Market Advisors is not a broker-dealer, legal advisor, tax advisor, accounting advisor or investment advisor of any kind, and does not recommend or advise on the suitability of any trade or investment, nor provide legal, tax or any other investment advice.