YTD Fixed Income Summary – Updated

Risk On, Off, and On Again

On January first, I mentioned that we might get some wild gyrations on the back of the cliff agreement. Rarely have I been so right. The market started the year in complete “risk on” mode, followed by a lull, even a bit of weakness, only to close this week with some strength.

In world of manic depressive moves over the past week, where so many stocks and assets seem to either be loved or hated, treasuries have found their own place in investor hell.

I don’t think there is a single asset class less liked right now than treasuries. That wouldn’t be enough to like treasuries here, but there are several reasons to like treasuries:

- I don’t really believe that the fiscal cliff, or platinum coin, or a rebound in China, or aggressive stimulus by Japan will succeed in raising final demand, particularly in the U.S.

- The Fed, contrary to popular opinion, is buying treasuries, not stocks, and while it may force people into other asset classes, so many have already left treasuries for other asset classes, it isn’t clear how much more rotation is left to happen

- The “free float” of longer term treasuries is actually low, the Fed owns 30% or so of treasuries maturing beyond 2018, and is adding, while a significant portion of the rest is held by insurance companies in not available for sale accounts

Yields are under some pressure because of treasuries, but at the same time spreads did well, with high yield leading the way, and muni’s doing great, but at least there we had stories that California, yes California, might run a surplus this year.

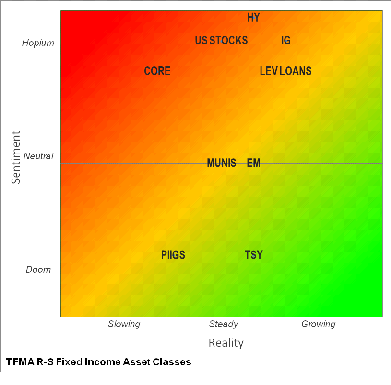

Sentiment versus Reality, or What is Priced In

Our assessment of what the real outlook is for various asset classes versus our sense of how people are positioned. Red indicates overvalued, Green is undervalued, and Yellow, is neutral. It isn’t exact. In our view, positioning and sentiment is more important, at least from a contrarian view. While it is possible to have strong support for an asset class with strong fundamentals still be a “buy” it is far more common to see sentiment diverge from reality and that is the opportunity.

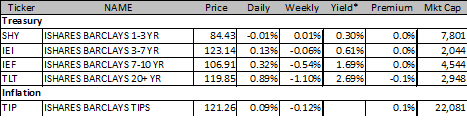

Treasuries – Some Serious Volatility

As I’m late in writing this as I’m in Jackson Hole, it is convenient that I can use the same sub-title for treasuries as I did last week, but it was volatile.

The long bond gapped from 2.95% to 3.04% on January 2nd, with some follow through on the 3rd pushing it to 3.13%. It is back to 3.05%. The bear argument is that all the central banks will be successful in creating growth and thus inflation – I find that hard to believe. They think investors will have some huge rotation out of treasuries into stocks – while ignoring the fact that investors actually have relatively small exposure at the longer end of the curve – the Fed is the biggest holder there, by far, and has no intention of selling.

They are also missing that with credit spreads so low the Fed needs to defend treasuries to keep borrowing costs for individuals and companies down. That is different than prior QE’s.

I’m not saying I love long dated treasuries forever here, but I think the next move is for the rally to continue, particularly in the 10-20 year part of the curve, where the Fed impact is exceptional.

For all the talk of inflation, there was little to no follow through in TIP’s either.

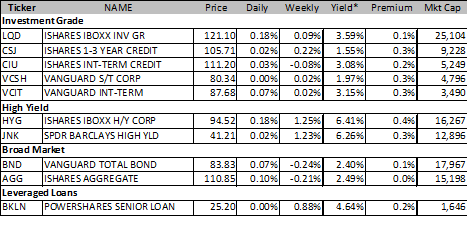

Nervous About Credit

The High Yield market seems exceptionally overbought. In some last gasp to reach for yield on the hopes the economy is improving, high yield bonds found a strong bid at the end. The paradox that so many high yield bonds are rate sensitive, and “everyone” hates rates, doesn’t seem to have sunk in yet.

Investment grade has its own set of problems. It is owned by retail, but almost universally, retail owns investment grade in yield format rather than spread format. LQD actually saw shares outstanding decline. Investors are nervous about their holdings of investment grade bonds on a yield basis. If they start selling, dealers may wind up holding them (using their recently found risk appetite). If the market is overbought and we get a deluge of supply (with financials being the most likely culprit as the surprising BAC deal exemplified) then we might well be set up for further pressure.

Of all the things in the market this week that were hard to understand, was the weakness in IG19. Yes, CDS may be esoteric, but it could not rally this week with stocks. To the extent “credit leads the way” this should be watched. Although we think CDS is actually “cheap” and attractive, it is one of our “best ideas” as a short candidate precisely because so many investors seem to be long credit and if they decide to hedge, the CDS market will be the first to see the brunt of the move.

Finally, I think investors may have lost their mind on bank debt. Okay, that is an exaggeration, and we have been consistently bullish leveraged loans for almost a year, but the latest move seems to be based on bad information. We like leveraged loans because of their seniority and the strength of the CLO market, and because it offers good carry.

Leveraged loans DO NOT offer much protection in a risking rate environment, nor do they offer much upside in a “risk on” environment. The latter is easy to explain as the loans are all callable. Maybe at a slight premium, but in the end, these loans just don’t have much upside. The fact that these are “floating rate” loans isn’t exactly accurate. While they do typically pay LIBOR + Spread, most have a LIBOR “floor”. So many of the loans could see LIBOR increase 2% before it impacts the coupon.

I am very cautious credit products in the near term and in a perfect world would be getting long via credit derivatives than bonds when the time comes.

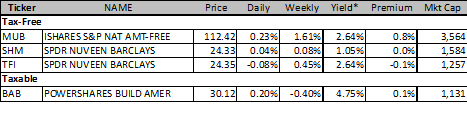

Muni’s, Too Much of a Good Thing

While I do think most municipal bond issuers are improving, the spread performance was just too much. While not hit as bad by the Fiscal Cliff as some feared, neither were dividend stocks. With the moves we saw in treasuries, and munis still being a potential target for politicians looking to tax the rich, I don’t understand this degree of outperformance and think there will be much better entry points.

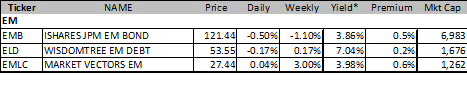

EM – The Fixed Income to Equity Rotation

Emerging market stocks did well. Local currency debt did well. Dollar denominated bonds, not so much. This makes sense as we have said that EM debt had attracted far more attention than the equities last year. With limited upside left in spreads and concerns about treasury yields, the shift into local currency debt and stocks makes is smart. I am getting concerned that overall, the risk chasing is getting extreme, so while I wouldn’t be short EM stocks, it is hard to be as excited as I was a few weeks ago.

Spain and Italy the Renaissance

So we now like Spanish bonds and Italian bonds. We made that decision early last week as we finally accepted that the next move is “real money” who has been underweight the debt of these countries, having to capitulate and buy.

Still value there, especially versus short the bunds, but the banking sector (stocks and bonds) should do even better as there are still shorts in those areas that haven’t understood just how critical this stabilization in sovereign debt is for earnings there. The positioning is so extreme to the negative that I think Spanish and Italian banks are likely to be the best performing markets sectors out there this year.

Dividend Stocks?

I should have added more when I suggested as they benefitted from risk on and from less fiscal cliff damage than anticipated. I am making a list I want to own, but not just ready yet given the view that the market as a whole has outpaced itself.

Fixed Income Allocations

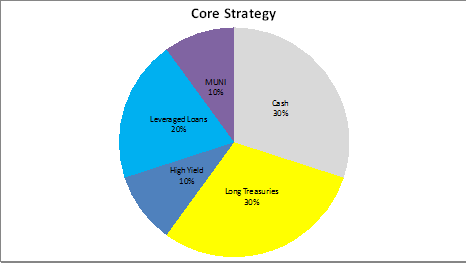

The “Core” strategy is meant to have limited number of trades. It would only be readjusted as longer term views change, or short term views become very large or very strong.

This strategy would have made 0. 80% YTD (as of Sunday Jan. 13th).

In hindsight should have kept muni exposure a bit longer, same for high yield and waited a day or so to add long bonds, but as a whole not a bad start to the year. Looking for weakness to add back to high yield. Leveraged loans may have to be sold just on valuation and the same goes for munis.

The core strategy has moderate duration risk and moderate credit exposure.

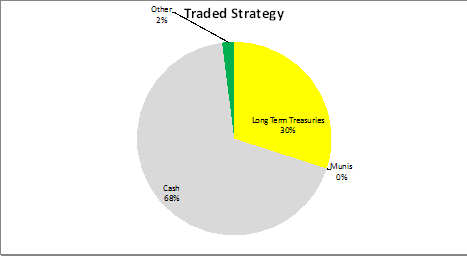

The “Traded Strategy” is meant to have more frequent rebalancing and to capture smaller moves in the market.

The traded strategy had a gain of 0.40% YTD.

Starting with less risk than the Core portfolio and aggressively trading out of it was a mistake. It cost money exiting hy, leveraged loans, and munis early. Will be patient here looking to add back risk. NLY performed very well.

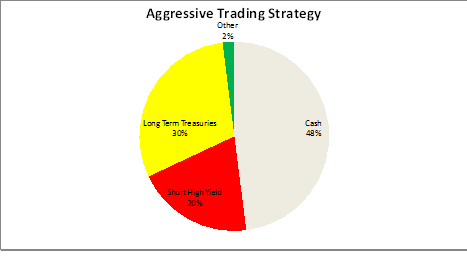

The “Aggressive Trading Strategy” is meant to be traded frequently and will expect to generate more from positioning than from yield.

The aggressive strategy started the year with only a 0.34% gain.

Getting short HY added to the underperformance in this portfolio relative to either “traded” or to “core”

The portfolio is decidedly bearish.

Disclaimer: The content provided is property of TF Market Advisors LLC and any views or opinions expressed herein are those solely of TF Market Advisors. This information is for educational and/or entertainment purposes only, so use this information at your own risk. TF Market Advisors is not a broker-dealer, legal advisor, tax advisor, accounting advisor or investment advisor of any kind, and does not recommend or advise on the suitability of any trade or investment, nor provide legal, tax or any other investment advice.