Treasuries, QE, Float & the Hotel California

This if from a couple of weeks ago, but has been part of the premise that has encouraged us to be vocal about liking longer dated bonds since the January 2nd route.

Treasuries, Still a Market?

It is impossible to read about the markets and not come across opinion after opinion about what moves in the treasury market mean for the overall market. Whether people are looking at the 10 year yield versus the S&P 500 yield, the shape of the curve, or daily price, the treasury market is looked to for guidance. Should it be?

What has the treasury market become and what are the implications? I’m not really sure, but I think it is important to figure out as it is a key element of any other fixed income product’s total return, and offers possibilities in its own rights.

The things I want to look into are:

- The Fed’s Impact on the budget

- The “float” of tradable treasuries

- The need to keep yields low from a policy standpoint

The Big Picture & The Fed’s Role in the Budget

I start with just the straight treasury bonds. I thought T-bills were uninteresting, and TIPS too confusing, or at least the ratio of difficulty to work with, versus size and additional meaning, to not make sense.

|

|

Treasury |

Non Fed |

Fed |

|

Total Debt |

8,619,645,000,000 |

7,040,818,691,569 |

1,578,826,308,431 |

|

|

|

81.68% |

18.32% |

|

Total Interest |

203,207,298,750 |

145,888,793,281 |

57,318,505,469 |

|

|

|

71.79% |

28.21% |

|

Average Coupon |

2.36% |

2.07% |

3.63% |

|

Average Price |

108.04 |

105.94 |

117.37 |

|

Average Maturity |

1/10/2019 |

2/22/2018 |

12/15/2022 |

|

Average Maturity (yrs) |

6.1 |

5.2 |

10.0 |

This helps put the Fed in some perspective. They own about 18% of the total amount of treasuries outstanding. That is big, but operation twist has skewed their ownership in a more meaningful way.

The Fed owns bonds with an average coupon of 3.6%, the rest of the world owns bonds with a 2.1% coupon. In part, this is because, of the average of the Fed’s portfolio (10 years, versus the rest of the world’s 5.2 years), but there is more going on than that.

The Fed owns 43% of all bonds with coupons of greater than 4.5%.

So the Fed has targeted higher coupon paper. The Fed’s average price of a bond (as of Thursday) was 117 versus 106. Again a lot can be explained by duration, but there is a concerted effort here to keep the governments costs low.

On Treasuries alone, the Fed added $57 billion to the budget. Without that direct contribution, the deficit would be $57 billion per annum more. This does NOT count in the ongoing calculations used by the OCB, but maybe it should?

There are additional benefits, both from non treasury holdings (mortgages, etc.) and from the low rates as a whole. What is that, another $50 billion in direct saving, and $100’s of billions in indirect savings?

So over the next 10 years, it seems likely the Fed will contribute $1 trillion of direct savings to the government by redeeming coupons, staggering. That is without the current plans to grow the Fed balance sheet by $85 billion a month.

The Fed has become a policy tool, and an important player in the budget. That was not the case as recently as 4 years ago. I’m not completely sure what it means, but I don’t think it is an accident, or “unintended consequence” so that has to be considered.

Bernanke is very smart, and is maximizing the value returned by extending maturity and sopping up high coupon debt. That also reduces our risk to a rate shock, since so many of the long dated treasuries are locked away, and he believes he can control the front end with the Fed Funds programs and other ways that would entice banks to own them.

What’s the Float?

The Fed is buying the long end. That protects the government from refinancing risk. It gives the Fed more options on the “exit” strategy. Okay, I’m joking on that. What it does is let the Fed not exit any time soon. If they owned the short end of the curve, they would have to roll, or start exiting. By extending so far out, they don’t have to deal with that issue.

The Fed currently has bonds totaling $23 billion maturing in the next 3 years. And that data might be old.

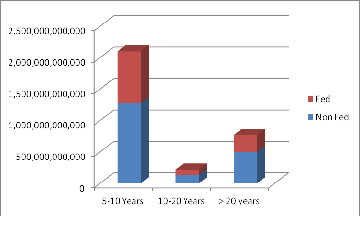

The Fed owns 39% of all treasuries maturing in 5 to 10 years, 41% of the treasuries in 10 to 20 years, and 35% of all longer dated bonds. The SEC gets concerned when someone owns 5% in a stock. Many credit hedge funds get nervous about liquidity with a 10% holding in a specific bond. The Fed “owns” these markets and that needs to be considered.

The Fed isn’t planning on selling any time soon (ever, as I think we will conclude). The free float is relatively low. The free float in the 10 to 20 year range is miniscule, less than $130 billion bonds outstanding in that range not held by the Fed, heck, Greece almost has more bonds outstanding in that maturity range that are “freely traded”.

It is hard to shake the idea that treasuries are the most liquid market in the world. It is a bit like being told 1+1 isn’t 2, its 1.98757. I’m not saying that treasuries aren’t still incredibly liquid, or that they still don’t trade well, but I am saying that they aren’t as free as we might think.

And so far I have just taken out of the “float” tied up by treasury. I’ve ignored their dedication to add $45 billion a month. There is “only” $1.9 trillion of debt not held by the Fed longer than 5 years in maturity. That would let the Fed buy up 28% of the remaining float in a year. Ignoring new issuance, the Fed would own over 50% of the debt maturing in 2018 and beyond by September.

What about other bonds that aren’t really in the “float”. Insurance companies do have big ownership of bonds held in “not available for sale” accounts. How much of the “float” is in available for sale or trading accounts? I cannot get a good grip on that yet, and not sure how to get a more exact answer, but of the $500 billion of longer dated treasuries in public hands, I wouldn’t be surprised if at least 20% of that was held in “not available for sale” accounts. Honestly, I think the number is higher than that, but not yet sure how to figure it out.

I took a look at the 3.75% bonds of 2041. Only 56% of the outstanding showed up on Bloomberg. 38% of that was the fed. Of the rest, a lot seemed to be owned by insurance companies, but I can’t tell if available for sale or not. Some were clearly owned by funds, so would expect those to be tradable, and even some insurance companies had shown a reduction in amount held, so maybe I’m too concerned about how limited the float is? The data isn’t great, and I need more, or a better way of figuring it out.

This lack of float concerns me about reading things into treasury price movements. You have an indiscriminate buyer, one who has money to put to work every month regardless of price, and the float is already greatly reduced. Reading too much into price action or shape of the curve when there is such a buyer distorting prices is highly dangerous.

Too Much To Lose or Why the Fed Can’t Sell?

We can and should worry about inflation. That is a real risk. I’m skeptical the Fed policies will accomplish much so am a bit blasé about the inflation risk.

What concerns me more, or I find more interesting and immediate is how many investors seem concerned about treasuries. They seem “hated” once again. The hatred stems from those concerned about inflation. Other hatred comes from those salivating out of a rotation from fixed income into equities. Little of the hatred seems to come from bona fide, die hard bond investors, but there is some there too.

So while investors think that, let’s look at what the Fed is saying and doing. The Fed is NOT selling, they are buying. Ben is going to buy and buy. He cannot afford to let treasuries go lower in price or have higher yields, because of what that would mean for mortgages, municipal bonds, investment grade bonds, and even some high yield bonds.

In 2010, his actions were as much about getting credit spreads to compress as keeping rates low. In fact, rates have often moved higher on treasuries during periods of their activity, but the Fed didn’t care, so long as credit spread contraction outpaced that. Ben is concerned about the yields on those other asset classes, and for the first time, it is not obvious how much more spread compression can come. Mortgages seem tight. Investment grade bonds – tight (CDS has more room). Muni’s seem potentially to have some room, but the credit story this is sketchy for some, and growing concerns about the tax advantage hurt that market. If you try and tell me that the HCA 6.5’s of 2020 have no interest rate risk, I would have to laugh.

So the entire credit market, which he wants to keep as cheap as possible for borrowers depends on treasuries more than ever. He knows that and is aware of that. If you think he isn’t aware and conscious of the fact that so many retirees are now in investment grade and high yield bonds, with no rate hedge, than you are underestimating him. He gets it, and is concerned. Yet another reason for him to protect treasury yields.

Then finally, let’s look at the alternative. He announces he is planning to start selling the Fed’s balance sheet. Now you have the Fed selling as much, or more paper than the treasury, which will be busy with its own auctions, due to our massive deficit and the need to roll maturing debt.

Quantitative Easing is like the Hotel California, you can check-out any time you like, but you can never leave!

I think I am bullish treasuries here. More than I thought. In many ways I cannot believe I’m saying that, and want to think more about it, but that is what is coming to me after running through these numbers. More work to do, but think things like the float and policy intentions are as important or even more important than anything else right now when looking at treasuries.

E-mail: tchir@tfmarketadvisors.com

Twitter: @TFMkts

Disclaimer: The content provided is property of TF Market Advisors LLC and any views or opinions expressed herein are those solely of TF Market Advisors. This information is for educational and/or entertainment purposes only, so use this information at your own risk. TF Market Advisors is not a broker-dealer, legal advisor, tax advisor, accounting advisor or investment advisor of any kind, and does not recommend or advise on the suitability of any trade or investment, nor provide legal, tax or any other investment advice.