Monday’s T-Report: Another Brick in the Wall of Worry

Actually there are no brick’s in the wall, at least not in the so called “Wall of Worry”. Wall Street is full of clichés that usually annoy me, but that I also have no problem using when the occasion fits. And today’s cliché is that the markets need to “climb a wall of worry”. Let’s be honest, that adage is only brought out by some nervous analyst who has been long the market for months and watched it decline steadily in his or her face. That is when the good old wall of worry is mentioned. It is hardly ever trotted out during a nice run-up in stocks. Well, maybe it should be.

Lack of Bad News Is Hardly Reason Enough to Set New Highs

So I most recently became bearish the S&P 500 at 1,251. I made a mistake of getting out of longs at 1,425 on the 31st and not only missed the January 2nd rally, but have been on the wrong side of that particular market for 15 points in moderate size. So of course the big question is where is the market headed from here? I have been wrong on this move for about 1% with a medium level of conviction. Should I change my mind? Should I decide to go long? Have I missed something that everyone else sees much more clearly?

I don’t think so. I scoured the papers and what newsletters I get looking for what I’m missing. In the end, the same story kept coming up time and again. There is “nothing bad lurking” anywhere, so buy the marekets. The closest I could come to seeing anything truly positive was about housing – which I think is okay, but not great and is not helped by the recent move in rates, and that the fiscal cliff “resolution” really will add growth to the economy – which I cannot find much anectdotal evidence of.

In Spain, I could see a lack of bad news being good enough to push that market up 10% or more. It is beaten down. Here we are near multi year highs, and without government and Fed stimulus (I will naively pretend that the Fed is still not a branch of the government), the economy and market would be in serious trouble. We have done little to fix the economy. What is even more interesting is that while government seems to be done with the notion of a trickle down economy, and the fear of taxing the “job creators” seems to have lost steam, the Fed continues to believe in trickle down cheap money. That somehow making plant and equipment purchases more attractive than hiring is good. That letting companies increase their stock price by borrowing cheap money to fund dividends and stock repurchases is good for all will work. I don’t think it will.

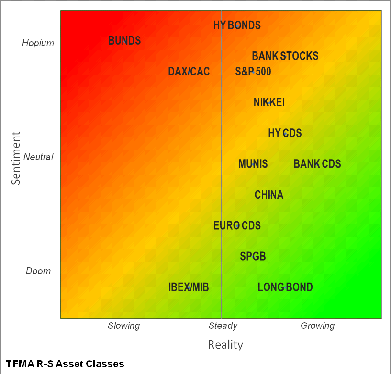

So as hard as I looked, I couldn’t get excited about U.S. markets here. I just don’t see enough evidence of a really improving economy or the potential for good earnings to push the market higher from here. I’m not expecting a crash or anything, but I am looking for a pullback to the 1,400 to 1,425 range. I continue to like credit better than equities, CDS better than bonds, and Europe/Asia better than the U.S.

What Could Start the Sell-Off?

I don’t know. I don’t know what could start a sell-off, but with VIX back below 14 after having one of its fastest declines ever, and the RSI on many “risk on” assets looking stretched, it doesn’t have to be much.

The move lower in the long bond may by itself be enough. At these levels can we really sustain that sort of a move? Will the strength in housing be sustained with an uptic k in mortgage rates? Have too many investors over rotated out of fixed income into equities? I have to say that I find it a bit disturbing that 100% of equity people currently hate treasuries as an investment, having done only a cursory amount of work; whereas fixed income investors seem less nervous. If the equity crowd hates something they don’t understand (or don’t try to understand), there is probably opportunity.

Then there is the mid-East which is allegedly calm, but always one step away from detiorating. The “platinum coin” is going to let us avoid the debt ceiling? That theory seems stretched, but would also seem to go hand in hand with another reason to shun the US dollar as the reserve currency, which is unlikely to be a positive for us in the medium to longer term.

Maybe it will be the realization that Apple products aren’t that exciting, aren’t that light, and are more expensive than people realize? Seriously, the one thing that has bugged me about the iPad, and iPhone is that by the time you are done buying a case to protect them, and maybe a keyboard, the cost and size is 25% more than the cost of the product. The surface, with something that seems to function as half keyboard half screen protector, included highlights that a little. The number of people complaining about Apple products seems to be growing at a faster rate than sales. To paraphrase Marc Andreessen, “Steve jobs used to make products which he didn’t care if they sold, yet they sold because the products were so good, it remains unclear how successful an Apple that is trying to make products to sell, will be”. I only mention Apple because it is such a big part of U.S. indices that if it cannot sustain its growth, the indices here will struggle.

I don’t know what will start any weakness in the markets, but I think the market is positioned very aggressively and has outpaced the actual economic situation by far and it is easier to see weakness than strength.

Disclaimer: The content provided is property of TF Market Advisors LLC and any views or opinions expressed herein are those solely of TF Market Advisors. This information is for educational and/or entertainment purposes only, so use this information at your own risk. TF Market Advisors is not a broker-dealer, legal advisor, tax advisor, accounting advisor or investment advisor of any kind, and does not recommend or advise on the suitability of any trade or investment, nor provide legal, tax or any other investment advice.