Weekly Fixed Income ETF Summary and Trading Strategy

Deal or No Deal?

We weren’t going to get a deal, then we were, then we weren’t and as I type we have half of a deal. The Senate agreed to what seems to me an amendment of the “Bush” tax cuts, where a new, “rick” bracket was added. In the end I don’t see the deal doing much good for the markets. While in theory it reduces “uncertainty”, I don’t think there was that much “uncertainty” in the markets. The reality is there was barely any uncertainty in the markets, and the real economy is less fickle.

We may get some wild gyrations in the next few days as the markets digest what was done versus what was priced in. The 20% rate for long term capital gains and dividends is a change from 15% but possibly not as bad as some feared? Good for qualified dividend stocks? I will watch that, as things like utilities have underperformed, but might get interesting.

The mood out there seems to be expecting a big rally. I certainly think the market can attempt another rally, but at this stage think that is more of a selling opportunity than one that needs to be chased.

So once we finish with year-end flows, new year flows, and fiscal cliff deals, we can focus on the growth story in the U.S. or how little the fiscal cliff accomplishes and what is to happen with the debt ceiling. Somehow I think the latter will get more play.

Sentiment versus Reality, or What is Priced In

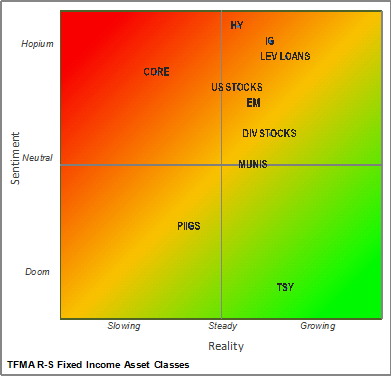

Our assessment of what the real outlook is for various asset classes versus our sense of how people are positioned. Red indicates overvalued, Green is undervalued, and Yellow, is neutral. It isn’t exact. In our view, positioning and sentiment is more important, at least from a contrarian view. While it is possible to have strong support for an asset class with strong fundamentals still be a “buy” it is far more common to see sentiment diverge from reality and that is the opportunity.

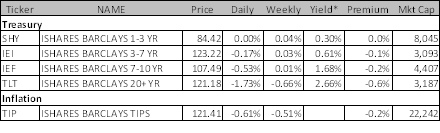

Treasuries – Some Serious Volatility

Not often that the long bond can drop 1 ¾ points in a day and only be down by less than a ½ point for the week. We had liked treasuries, but thought they had gotten overdone on fears of the cliff. We will look to add back as again, our thesis is that we won’t see great growth, that “measured” inflation will seem low, and that the Fed’s direct purchases will continue to keep prices stable. Had you timed it perfectly, and sold treasuries on the Friday, you could have made more than 1% on TLT. Timing in treasuries is as important as timing in any other market. Our timing on getting out of TIPS and treasuries in the model portfolios was good (not perfect), and we will be adding back, though want to see how the markets open for the new year.

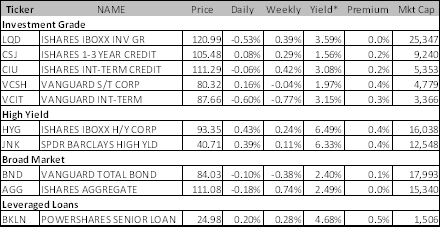

Our Aversion to Credit has Dissipated

For the past several weeks we have been negative on credit markets in general and high yield ETF’s in particular. The primary view is that the market has been crowded. While still “crowded” we got comfortable that the weakness we saw finally provided the buying opportunity we had been waiting for. HY CDS was our favorite way to play the bounce and while we were a bit early on Thursday with that call, it should have worked out very well – it “closed” at 100.625 at noon on Monday so it should be higher as stocks rallied into the 4pm close.

Investment grade bonds were weak as the move in treasuries offset their credit spread tightening. That is why CDS offers better risk/reward right now than bonds, particularly bonds not hedged for rate moves.

The leveraged loan space continues to do well, with CLO demand driving pricing. It is getting tempting to sell out of this soon.

So while we have increased our high yield allocations, we will look to trim them rather than add. The trade is still crowded and I think once the initial enthusiasm for a deal fades, there will be better buying opportunities. Also, we should see a decent sized calendar contribute supply, adding a little more pressure.

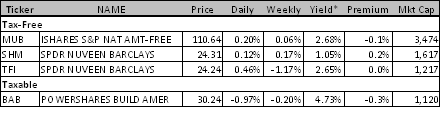

Muni’s, Better to be Lucky than Smart

Muni’s actually did okay last week. They were basically able to absorb the move in treasuries with some significant spread tightening. So far, from what I can tell about the fiscal cliff, the muni market should benefit as I haven’t seen any limits placed on how much tax free interest can be earned, and with the highest tax bracket increasing, and even dividends getting taxed at a moderately higher rate, we could see further improvement in muni spreads. If we were nervous about treasury yields, we would pull out of muni’s here, but we aren’t worried about that so continue to like this sector.

EM, Almost Time to Short thEM

EM did well again. That is getting a bit repetitive, in fact far too repetitive. The performance last week was almost staggering in the face of the sell-off in treasuries. I just don’t see much value left here as the bonds are now yielding below 4% on average. Will local currency be the way to play it? Is it time to short dollar denominated EM? Right now we are out of this sector altogether, but are eying the local currency debt, and at same time seriously considering outright short.

Spain and Italy, A Renaissance?

Six months ago, writing about Italian and Spanish bonds would have seemed out of place and maybe even dangerous. But we did and we liked them. We haven’t liked them for awhile and that has been a decent call. They have chopped around of late, with Spain being more stable than Italy.

Our view was the situation was pretty unstable, that OMT would only protect the front end, and risk that the ECB would force subordination on non ECB holders seemed real. Hedge funds were running out of steam on the trade. It is one thing to pick up bonds on the cheap, but with Spanish and Italian 5 year paper trading at 3.99% and 3.29% respectively, that isn’t so cheap. You certainly need leverage to make decent returns as a hedge fund. So that is why we had remained on the outside looking in for the past month or so.

I am starting to change that view. I think Spain and Italy could go “mainstream” again. Instead of being a badge of honor to be underweight these countries, it may become a hindrance to gathering assets. If some traditional money managers start owning these bonds and outperforming other managers will be forced to chase the bonds higher. Last year it was viewed as being “safe and prudent” to avoid these bonds, so most traditional managers did. This year, they might get forced into them.

I actually think we are even seeing the first signs of that. The recent Italian auction did well, and that seems very positive given it was done at a time when many potential investors are out and without any overt support from the ECB. That is positive. A Pimco analyst was out there touting Italian bonds. To me, that means they are long, getting longer, and are going to put their marketing efforts into the trade to chase other bond investors into it. None of these provide any fundamental reason to buy the bonds, but little about this market has been about fundamentals.

I also do NOT see banks deleveraging. Spanish banks own Spanish debt are happy to collect the carry in accrual books. The same is true for Italian banks and Italian bonds. Banks in the Core and the UK are very light on bonds from these countries (if they hold any at all). Desks across the street had limited risk taking limits for these countries. If anything, wall street is likely to add more money to these sectors as they have performed so well.

So, I ran out of reasons to buy these awhile ago, but think the reasons to be involved are growing again. Will likely add back to our recommended portfolios.

Dividend Stocks as an “Other”

I think we will be adding more here. With our view that treasuries should remain stable, utilities could be interesting. Mortgage REITs remain interesting. I want to get a better sense of what was priced in for dividend tax rates, but I suspect 20% leaves some upside for many of these stocks.

Fixed Income Allocations

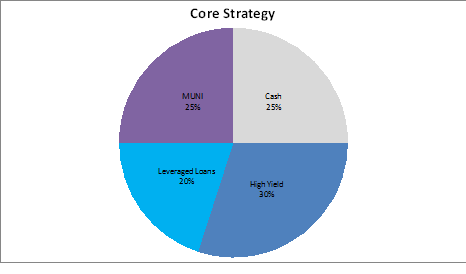

The “Core” strategy is meant to have limited number of trades. It would only be readjusted as longer term views change, or short term views become very large or very strong.

This strategy would have made 0.18% for the week bringing the 2 month return to 1.77%.

High yield and leveraged loans drove the returns. Reducing TIPS and increasing high yield exposure also helped.

If anything we may reduce the muni exposure, and both high yield and leverage loan exposure is getting uncomfortably high at these levels. Would look to add risk to the treasury market.

The core strategy has medium high duration risk and medium high on the credit exposure.

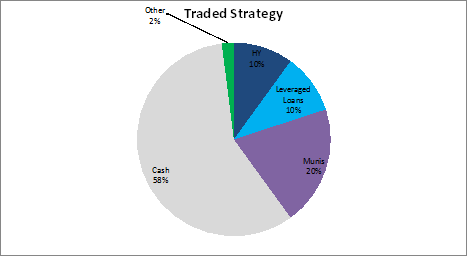

The “Traded Strategy” is meant to have more frequent rebalancing and to capture smaller moves in the market.

The traded strategy would have made just 0.03% last week bringing the 2 month return to 1.34%. We managed to move out of treasuries just in time and added some high yield, but as a whole remained too risk averse. Dividend stocks hurt.

We are looking to add dividend stocks and treasuries while thinking of trading out of high yield.

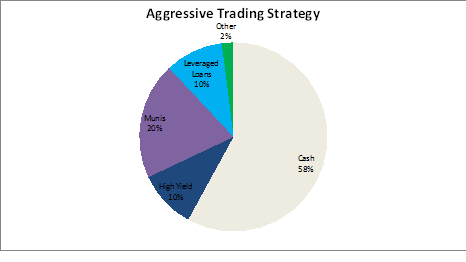

The “Aggressive Trading Strategy” is meant to be traded frequently and will expect to generate more from positioning than from yield.

The strategy should have made 0.05% last week for a 2 month total of 1.64%.

The high yield short was covered at a slight gain, and we exited treasuries in nick of time. Similar to the traded portfolio, we remained too light on risk for too long. That hurt total returns.

The portfolio remains defensively positioned.

E-mail: tchir@tfmarketadvisors.com

Disclaimer: The content provided is property of TF Market Advisors LLC and any views or opinions expressed herein are those solely of TF Market Advisors. This information is for educational and/or entertainment purposes only, so use this information at your own risk. TF Market Advisors is not a broker-dealer, legal advisor, tax advisor, accounting advisor or investment advisor of any kind, and does not recommend or advise on the suitability of any trade or investment, nor provide legal, tax or any other investment advice.