The T-Report Redacted: How do you get those shirts so clean?

Last Year’s Dirty Shirts Did Pretty Well

Personally I don’t like the dirty shirt analogy but it seems to have gained almost as much usage as “risk on/risk off” and “BTD or buy the dip” so I will run with it.

Somehow it is always the U.S. that is the cleanest shirt or least dirty shirt or most wearable shirt or something. Pundit after pundit goes on and talks about the U.S. as being the least dirty shirt, basically saying we aren’t great but other countries are worse. I have not seen anyone (other than us) say that the U.S. isn’t the least dirty shirt. But let’s look at the facts:

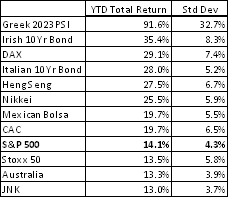

For all the confidence people had in re-iterating that the U.S. was the best place to invest, many other markets outperformed.

Many of the markets most mentioned as markets to avoid, if not being outright despised did very well. PIIGS debt blew away the S&P 500, and in many cases had reasonably low volatility on top of it.

The Nikkei, suddenly on everyone’s radar screen had a very good year. Even the Euro Stoxx 50 almost beat the S&P 500 and adjusted for currency, it did.

Then I added in high yield bonds. I don’t think they return so much this year, but for all the people lamenting a “bond bubble” the returns in the high space were very good, and on a risk adjusted basis, even better.

I didn’t put in U.S. banks which were great, but spent most of the year, and certainly the start of the year on everyone’s do not touch list.

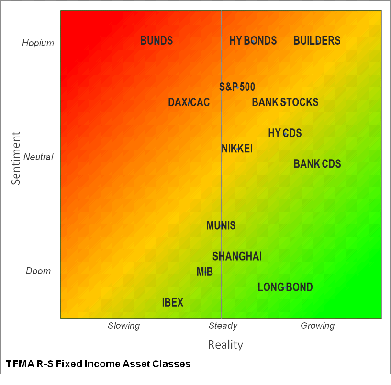

So Where Do We look for Returns Now?

There seem to be a few themes out there right now. Many still subscribe to the cleanest dirty shirt argument. I think they are horribly wrong. I think the U.S. is now the dirtiest shirt, and I can’t help but think of that old Calgon commercial and think about “Ancient Chinese Secret”.

Contact us at tchir@tfmarketadvisors.com for full report and more info