TF Mkts Weekly Fixed Income Overview & Strategy

Finally Some Volatility

This week, we finally saw some real volatility. It doesn’t show up so much in the weekly numbers, but it was there. Brief spikes or dips, driven by weak hands, were the order of the day. The big one happened outside of fixed income.

S&P futures closed at about 1,440 on Thursday. They drifted briefly higher, then in the space of 2 hours, dropped 50 points. From 1,442 to 1,392 with most of that coming in one brief swoon. I am not sure that many people believed the move, I for one was shocked by it, and it didn’t last long. We almost immediately bounced back to 1,420 and spent most of the day there. Yes, it was in a super thin overnight session, but that sort of move is not supposed to happen.

In fixed income, it wasn’t as big, but on Thursday, HYG was up about 0.5%, much of it coming in a frantic last few minutes of trading. Short covering, dealers trying to replace specific inventory, greed, someone who couldn’t be bothered to put in a limit order? I’m not sure the reason, but it seemed powerful. Friday gave up the entire gain, and more, for most of the day. We have crowded trades in think markets, and are seeing the impact of that – reasonably large, reasonably inexplicable moves.

Even the treasury market participated in the volatility. TLT dropped 3 points in the first two days, only to bounce back strongly on Friday, finishing the week with a small, loss. It is that volatility that is adding to the confusion. While I think High Yield is overbought, I am becoming more convinced that treasuries are actually under owned given all that is going on.

Anyways, this should be a calmer week with markets virtually shut down, and Washington unlikely to say or do much.

What is unclear to me, but I think we saw on Friday, is what the gun debate will do for the markets? In theory, the gun debate would not be a market driver, but with so much confusion over the fiscal cliff, it is yet another item for Washington to argue over. I don’t see the gun debate helping us get to any longer term solution for the economy.

I’ve had this thought for awhile, in fact, I first thought it would be an impetus for Washington to stop bickering on the fiscal cliff. I was wrong there. The reason I bring this up is that on Friday, the market was rebounding a bit, but seemed to sell-off as the NRA spoke. It may well be co-incidence, but the market starting falling to new lows as the NRA spoke. It may have been the European close, some other headline, so many other things, but it seems like more than a co-incidence to me, and certainly dominated my twitter stream as it was going on.

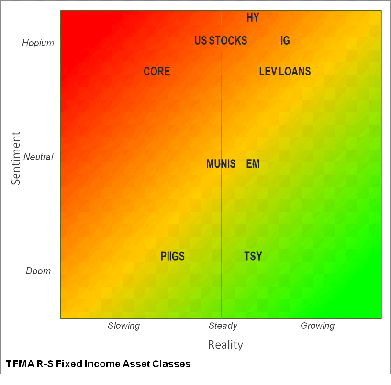

Sentiment versus Reality, or What is Priced In

Our assessment of what the real outlook is for various asset classes versus our sense of how people are positioned. Red indicates overvalued, Green is undervalued, and Yellow, is neutral. It isn’t exact. In our view, positioning and sentiment is more important, at least from a contrarian view. While it is possible to have strong support for an asset class with strong fundamentals still be a “buy” it is far more common to see sentiment diverge from reality and that is the opportunity.

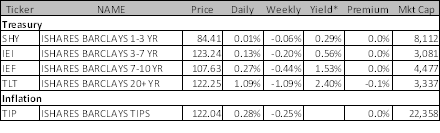

Treasuries, what are they good for? Absolutely Everything!

We have started doing more work into treasuries and frankly are coming up with a more bullish view. It is based on Fed activity and how many people assume we need a rotation out of bonds and into stocks or look at credit spreads versus equities and all come up with the conclusion that treasuries and credit are all over valued. We are actually getting more interested in treasuries because, quite frankly, Ben needs them to stay low to drive low yields in other products. Simple, and not a raging bull here, but do like them and as we dig deeper, liking them more. We missed trading the volatility well this week, had gotten in too early and were too scared to add more. It is worth noting that the longer dated bonds underperformed, possibly as a sign of inflation risk, yet TIPS did poorly as well.

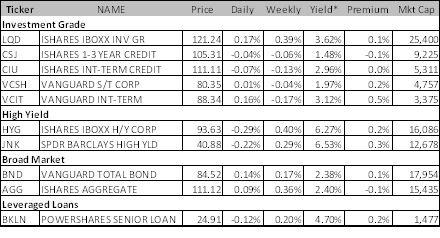

Still Crowded But Less Healthy

For the first time we saw signs that the market could sell-off. The bull case has been the strongest, with over crowded being the primary bear case, and the bull case has been winning. In fact there has been relatively little to challenge the bull view, but Friday we saw the bid disappear. It was brief and can be explained by many factors, but I feel more convinced that the bond market has less upside and more downside than most realize. CDS is actually more attractive from a value perspective, but will underperform if we get any meaningful risk off move. Weird, but that is the nature of the CDS market.

LQD did well, with spreads tightening. It was up marginally on the week, but given the move in treasury, the performance is more impressive and actually better than that of high yield. In fact, high yield seems to have had a lackluster week versus either its investment grade rival, or the leveraged loan market. Leveraged loans did pretty well.

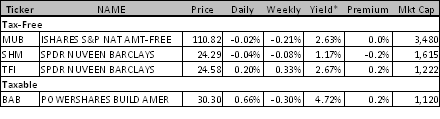

Muni’s A Lot to Like

I actually really liked how muni’s traded this week. The sell-off continued early in the week, but at least in line with treasuries as opposed to much worse. From there they bounced and stabilized. Given our growing view that treasuries are well supported here, the muni market is more interesting by the day.

EM

EM did well again. That is getting a bit repetitive, in fact too repetitive. With positive performance again this week, the outperformance is getting to be too much. Even the premium is getting excessive. EMB is not the most difficult index to replicate. It isn’t simple, but it is far less complex than the high yield ones for example. The top 10 bonds represent about 21% of EMB’s holdings, so I think the premium is a sign of getting excessive.

Greece, Spain, and Italy

On the bright side others started to notice what a great year Greek bonds had. For awhile I seemed like a voice in the wilderness. Another story that seems off most people’s radar screens is the resurgence of Irish debt. The Irish 10 year bond, with a nice 5% coupon, started the year at 80 and is finishing at 103.5. That is a very healthy 35% total return with surprisingly low volatility. Ireland didn’t swoon like others.

For now, I think much has already been priced in. I missed the past couple weeks in Spain and Italy debt. They have gone up, but I struggle to see how much more upside there is.

The stocks on the other hand, seem compelling. If the countries are getting fixed, the heavily bank weighted indices have immense room to run. If 2012 was the year too many focused on negative headlines and missed strong returns, then 2013 might be the year we overlook the negative headlines and focus on valuation and the potential for a rebound.

Don’t buy where good news is priced in, but where bad news is assumed.

Will have to look more closely at this, and think there is enough potential political noise in the next week or two that there is no need to chase returns here and would be out of all PIIGS debt here, including the Greek bonds.

Annaly Capital as an “Other”

A big week here as the market started to accept that the business isn’t as good as it was a few months ago, but the stock price has value. This isn’t a long term love affair for us, but one that has some more room to run in the near term.

Fixed Income Allocations

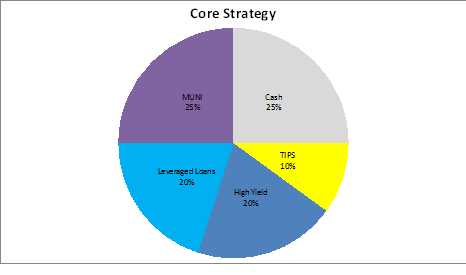

The “Core” strategy is meant to have limited number of trades. It would only be readjusted as longer term views change, or short term views become very large or very strong.

This strategy would have made 0.08% for the week bringing the 8 week return to 1.59%. Leveraged loans and high yield drove the return. TIPS and Munis were both drags and EM was helpful, but too small to make a big difference.

Although both high yield and leverage loans seem overdone and with risk to downside, we will leave the allocations unchanged in the view that this is meant to be a portfolio with less trading. We are making two switches. The first is to remove EM and to incease the allocation to Munis. We like how muni’s finished the week and that is supported in our view by treasuries.

The core strategy has moderate duration risk and medium high on the credit exposure.

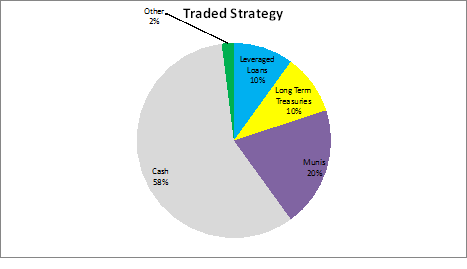

The “Traded Strategy” is meant to have more frequent rebalancing and to capture smaller moves in the market.

The traded strategy had a loss of -0.05% last week bringing the 8 week return to 1.31%. Both treasuries and munis hurt, while the other allocation to NLY made up for some of that.

We are adding to the muni allocation here. Other than that, we are looking to add to riskier assets in any sell-off.

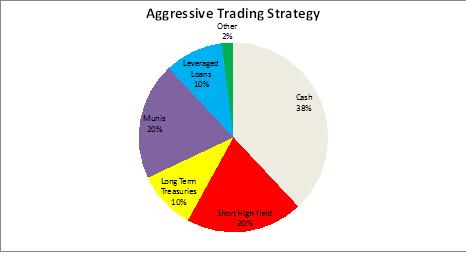

The “Aggressive Trading Strategy” is meant to be traded frequently and will expect to generate more from positioning than from yield.

The strategy should have lost -0.12% last week for a 8 week total of 1.59%.

The High Yield short was a big drag, as was the long position in munis and long term treasuries. Here we are going to add to munis as well as the only change.

Looking for an opportunity to cut the shorts, but are comfortable adding again now that we have seen real signs of potential weakness. EM is a potential short candidate here as well.

The portfolio is defensively positioned.

Disclaimer: The content provided is property of TF Market Advisors LLC and any views or opinions expressed herein are those solely of TF Market Advisors. This information is for educational and/or entertainment purposes only, so use this information at your own risk. TF Market Advisors is not a broker-dealer, legal advisor, tax advisor, accounting advisor or investment advisor of any kind, and does not recommend or advise on the suitability of any trade or investment, nor provide legal, tax or any other investment advice.