The T-Report: Long, Longer, Longest

WWF Adds Financial Market Bears to the Endangered Species List

It is almost impossible to find any bears. I consider myself bearish, but all I can muster is a mildly bear view. I got the courage to get more bearish on Fed day, but by Friday had cut back and took some profits. What longs I have liked recently, Spain, China, Greek Bonds, have been high beta plays. What shorts I’ve liked have limited capacity to move against (IG19 and HYG), though move against me they have.

So what to do? Mr. Tepper went on TV yesterday and gave what seems like a rousing endorsement for stocks, reminiscent to the 2010 post Jackson Hole commentary he gave. It is curious that he waited until now, but it does make sense. He focused on the commitment to ease until unemployment reaches 6.5%, a rate that is likely a long time from coming. That did seem like an aggressive move by the Fed, but the conference afterwards downplayed a lot, and there is some risk the inflation target brakes put a premature end to the easing.

In any case, people now seemed to be positioned long, longer, or longest. It is like the old style Ford days, you can have a car in any color so long as it’s black.

I am struggling with a couple of things here

- Crowded doesn’t necessarily mean wrong, but it often does

- The separation of financial asset risk and business risk

Positioning Matters the Most

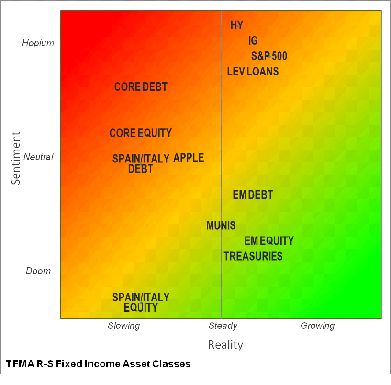

Yesterday morning, amidst the hoopla of Apple breaking $500 in pre-market we sent out our “Doomium/Hopium” chart on Apple. It showed that in our estimate, people had moved to the doom end from extremely hopeful. It bounced. It continues to bounce this morning. Can the market be that simple? Probably not, but can everyone be pretty fully committed to the market and have it keep going up?

Here is our latest chart of sentiment/positioning versus reality/valuation. Asset Classes in red would be ones we don’t like, yellow neutral, and green is ones we like (and yes, we are defining Apple as an asset class).

Separation of Financial Risk from Business Risk

The one problem with the bull case that I have the most trouble getting over is that the monetary policy, which is primarily what we are getting, doesn’t translate well into the real economy. The Fed can make credit spreads tighter, yields lower, and even push stocks higher, for awhile, but unless that combination encourages change in consumer behavior or the willingness of businesses to take risk, it doesn’t last.

There are all sorts of reasons why low rates, low credit spreads, high stock prices, should encourage the economy, but so far it hasn’t done much. These policies help over time, but after decades of excessive borrowing, overly optimistic assumptions about future earnings and retirement costs, society as a whole is deleveraging. This aids that process and will lead to a recovery sooner than otherwise, but how much and how soon is a big question.

The corollary of that question is what is priced in? We all know the roadmap the Fed is laying out. After the last FOMC meeting all the guesswork has been taken out (what exactly do Fed Watchers do now?). So we know the plan, and we know the theory behind it, what we don’t know is whether it will work now, and whether the market has already priced that in anyways.

I remain concerned that we won’t see a meaningful change in the real economy. We are in the midst of some massive seasonal adjustments to the data, so it may seem that we get it, but so far, I am not hearing a single business person say they are changing their plans because of the FOMC or frankly because of Washington. I hear lots using the Fiscal Cliff as an excuse, but haven’t heard a single one commit to growth once that is over and done with.

My Bark is Worse than my Bite

I am not as bearish as I might sound. Maybe I just feel the need to shout a little because I am not seeing enough others talk about the bear case. You can see from the chart what we like and what we don’t.

Friday I covered shorts, yesterday I was tempted to go completely long (apparently I should have) but we did actually like Apple. Now I have to decide whether to finally give up and join the party, or wait a bit and fight it harder from higher levels. That is why I am remaining very small, but frankly yesterday, when I was inclined to join the party, my inclination here is to fade this like last Wednesday.

Disclaimer: The content provided is property of TF Market Advisors LLC and any views or opinions expressed herein are those solely of TF Market Advisors. This information is for educational and/or entertainment purposes only, so use this information at your own risk. TF Market Advisors is not a broker-dealer, legal advisor, tax advisor, accounting advisor or investment advisor of any kind, and does not recommend or advise on the suitability of any trade or investment, nor provide legal, tax or any other investment advice.