Weekly Fixed Income Summary, Outlook, & Strategies

Crowded, Like 20 People in a VW Bug Crowded

Last week we focused on how crowded high yield was becoming. That people were treating it almost like AAA and that is not a good thing. Well, the week started strong, but ended poorly, and ultimately finished basically unchanged with the FOMC as the inflection point.

After the announcements of this weeks and the moves we have seen, the mix of what we like and dislike looks a lot different than just 6 weeks ago. Each market moved, and for once, not all of the moves were directly linked, so rather than giving a high level summary, let’s just jump straight into what happened in each market.

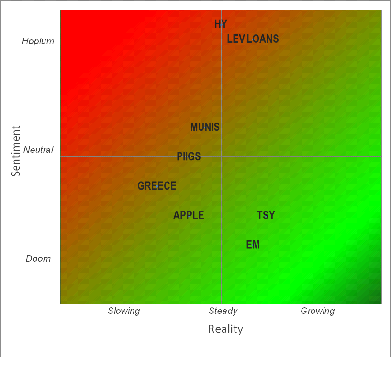

Sentiment versus Reality, or What is Priced In

I am still not sure exactly how to explain the above chart. Maybe it is the “contrarian” Rorschach test of the market, but it has been working as a pretty decent conceptual framework, focusing on what assets or asset classes seem to have too much hope or doom associated with their current valuation and potential.

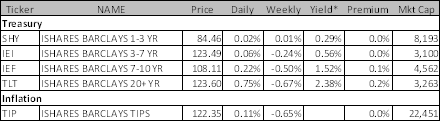

Treasuries, Risk-On, Risk-Off, or Fed?

This was one of the more interesting weeks for treasuries in recent memories. At one point the long bond was down 4 points. The initial reaction to the FOMC was for the long bond to rally, but then it sold off as it suffered from being at least partially anticipated and partially because the mix of buying was focused on a shorter part of the curve than recent twist operations.

I actually got bullish the long bond ahead of the auction. It was a disappointing auction, but in the end, that long bond is still up almost a point since Thursday morning.

In spite of the poor performance, I like treasuries here. I don’t think I have said that for a long time. I’m not buying it for the yield. I’m not even buying it for the flight to quality. I’m buying it primarily because the Fed is buying $45 billion a month. I’m not a momentum trader, but when Bennie and the inkjets decide to buy $45 billion of treasuries ad infinitum, I have to take notice.

So the main reason to be long is because I think the Fed will support them. Then, compared to investment grade, the miniscule yields don’t seem less tiny. Finally, there are too many “bulls” betting on a rotation out of fixed income into equities. I don’t think you need that rotation to happen for equities to do well, which is good, since I don’t see it happening.

I’m not expecting a big exodus out of fixed income into risky assets, so again, you have an asset class that many are underweight, that doesn’t seem ridiculous compared to other yield products, and you have a determined, price insensitive buyer. So I like these for a trade. And I do mean for a trade. I could be out of the long bond in another point or so, but while people with no experience in fixed income lament that you can’t make money in a 2.85% long bond yield environment, I think they are wrong. It is a matter of trading them well.

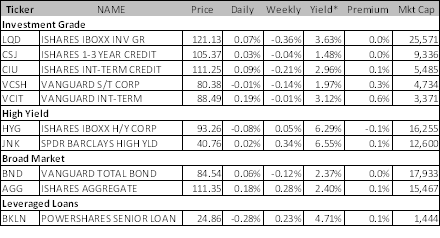

Crowded But Healthy

That is the best description I have for the credit markets. The story continues to be an okay economy, lack of supply, and Fed induced liquidity. My only argument against that, is CROWDED, CROWDED, CROWDED!

I depressingly watched my underweight in HY and particularly the ETF’s hurt the portfolio. On Thursday and Friday, that was largely reversed. I am really torn whether to admit defeat and join the crowd (the crowd isn’t always wrong), or hold off. I will hold off.

For the first time, I include leveraged loans in the overcrowded group. Here there is nothing wrong, it is just valuation. They had a steady nice week last week – exactly as they are supposed to.

Investment grade saw spreads tighten, but small declines in price, as the treasury market move was bigger than the credit spread move. I remain leery of investment grade bonds here, and do think many investors would be better served if there were more “spread” based products rather than “yield” based products.

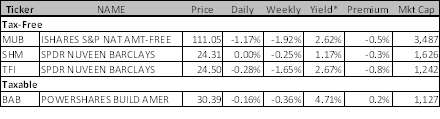

Muni’s Extend Last Week’s Weakness

As wrong as I felt about HY (which finally came back my way), I felt correct and vindicated with munis. They had outperformed by too much and for too long. Tax free munis took a pounding based on concern there would be limits placed on the tax benefit and the price action, primarily treasury driven, added to that fear.

That is an important thing to remember here. Treasuries had a bad week, particularly long dated treasuries. That impacts muni pricing. That weakness enhanced any fears of negative tax law changes. I am not quite there on liking munis (actually I am, I just want to see if the weakness can continue a bit longer). The relative performance of the BABs versus tax-free munis does confirm the fear of tax law changes.

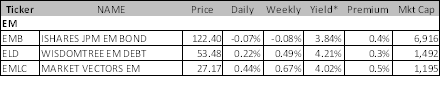

EM

EM did okay again. I think the EM story is getting old in the fixed income space. It is still under appreciated, so I remain near term bullish, but there potential for serious spread improvement seems minimal. I will be out soon, but do think the equities may be the place to play EM. In fact there seems to be a disconnect in how well the bonds are trading in many cases, relative to the equities.

Greece, Spain, and Italy

It is critical to be careful here. I think we are about to see the ECB finally step up and be more aggressive. While many are still focused on OMT (and I can’t be bothered to look up exactly what it stands for), but that isn’t the driver. While the ECB buying short dated bonds is good, I think the real crucial step that we are on the verge of taking, is the EFSF and maybe Eurogroup more generally, turning loans into 15 year loans, non pay 10. Term structure is important.

The IMF worries about 124.354% dept to GDP target in 2020, which is ludicrous when they can’t predict Q1 2013 GDP with any accuracy. What I can tell you, is that a company with 0 debt due in next 15 years, and zero coupon payments for 10, is far less likely to default than a similar company with less debt, but where it is all due next year as a bullet.

I can’t see any reason this doesn’t apply to countries and if they take that step in Greece, and then proceed the same way in other countries, those that have received aid, and those about to, then it is a game changer. It is as important as OMT and far less recognized.

But, with year-end coming up and enough noise coming out of various countries in regards to what they want, or what they are willing to do, I think there is room for a sell-off, and it is time to be on the sidelines in these markets.

More and more I am convinced that the biggest surprise in 2013 will be a turnaround in Europe.

Annaly Capital as an “Other”

Back to drifting lower on tax concerns and the Fed crowding out opportunities on their asset side. If anything, am looking to add here. Also think the Fed is now negatively impacting banks, which I need to think more about.

Fixed Income Allocations

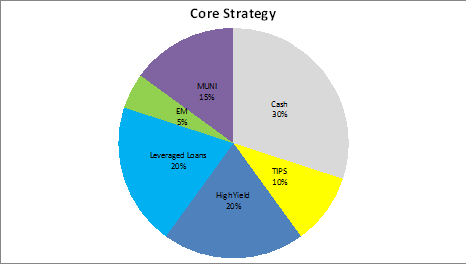

The “Core” strategy is meant to have limited number of trades. It would only be readjusted as longer term views change, or short term views become very large or very strong.

This strategy would have lost 0.02% for the week bringing the 7 week return to 1.51%. The allocation to leveraged loans made up for poor performance in other parts of the fixed income market – most noticeable in TIPS and BABS.

This portfolio is getting an overhaul. Early last week we reduced the exposure to Leveraged Loans to 20% from 25%. That change was a wash last week as the price dipped later, but only to cover the dividend. We would sell out of BABS and move into Munis (using MUB). There is finally some value there in our opinion and this isn’t about the tax rate (which is why BABS is often the preferred strategy). This is about the potential for total return as the market normalizes and gets through its cliff fears. Our comfort level with treasuries is also high, letting us be more aggressive in this space.

We will be looking to add to high yield and possibly long dated treasuries during the course of the week.

The core strategy has moderate duration risk and medium high on the credit exposure. The “target” yield on this portfolio is now about 2.9%.

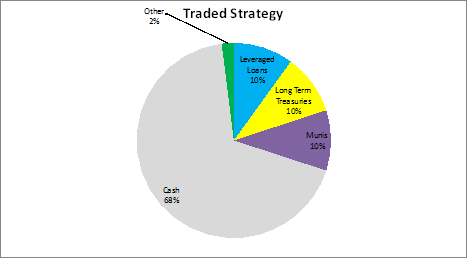

The “Traded Strategy” is meant to have more frequent rebalancing and to capture smaller moves in the market.

The traded strategy had returns of 0.14% last week bringing the 7 week return to 1.36%. The strategy was very conservatively positioned and that that was okay. Not great, and certainly a bit disappointing early in the week as credit performed well ahead of and just after the Fed. The decision to buy into long bond ahead of the auction generated a decent 1% return in a short period of time. We also have just added a muni allocation, focused less on the tax advantage, and more on the total return potential. Here again we will be looking to add to risk, or at least that is the current view.

The expected yield of this portfolio is barely above 1% since it is mostly cash. This portfolio runs the risk of being underinvested and having to catch up in the chase for yield, but the view is that there will be opportunity to add at better levels. That view was wrong last week, but the exposure to leveraged loans helped.

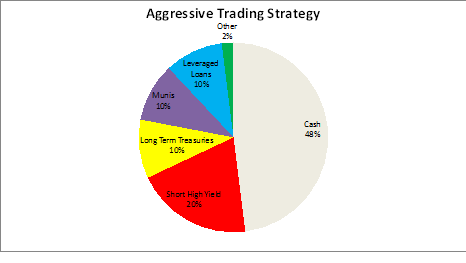

The “Aggressive Trading Strategy” is meant to be traded frequently and will expect to generate more from positioning than from yield.

The strategy should have made 0.14% last week for a 7 week total of 1.71%.

The decision to cut NLY from 4% to 2% on Monday morning made a big difference, as did the allocation to long dated treasuries on Thursday. Adding to the High Yield Short on Monday wound up causing that position to break even.

Along with the other portfolios we are adding a muni position. This portfolio has most potential to go either way, though leaning towards covering high yield and adding treasury exposure.

The portfolio is defensively positioned.

Disclaimer: The content provided is property of TF Market Advisors LLC and any views or opinions expressed herein are those solely of TF Market Advisors. This information is for educational and/or entertainment purposes only, so use this information at your own risk. TF Market Advisors is not a broker-dealer, legal advisor, tax advisor, accounting advisor or investment advisor of any kind, and does not recommend or advise on the suitability of any trade or investment, nor provide legal, tax or any other investment advice.