The T-Report: Lend Onto Others as You Would Have Them Lend Onto You

Lend Onto Others as You Would Have Them Lend On To You

We have moved fully into a world where lending decisions are based on who needs it and not who deserves it. I remember the days of deal roadshows where equity investors would come out excited, and the bond investors, more senior in the capital structure would come out with 20 unanswered questions.

At the individual level in the U.S. we have the HARP programs. Then whatever you want to call the various Fed purchases, they have nothing to do with credit review and analysis, they are just there to buy mortgages and treasuries. Then you have Europe where Greece, Ireland, and Portugal are already getting subsidized rates, and Italy and Spain will likely get them soon. Banks in Europe already survive on LTRO which has next to nothing to do with any actual lending criteria other than the meek shall inherit the earth.

So What to Do?

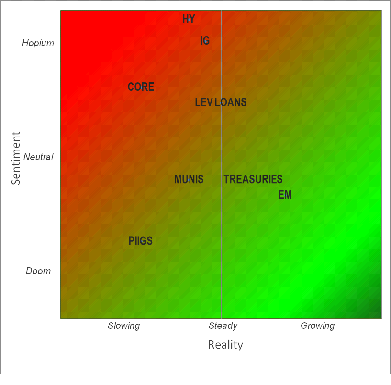

Right now everyone has decided that nothing can go wrong in the credit markets so everyone is moving out the maturity curve (extending duration), down the curve (investing in weaker credits), or adding complexity, or giving up liquidity. If everyone can get money, isn’t that the right trade?

It has been for the past few weeks. We were ahead of the curve near the Obottom when IG19 was up at 113 and felt like it was going to 125. We have been wrong for a week and seen IG19 drop from 99 to 94. Other credit products have had similar moves.

Time to join the herd?

The Worst Will be First

Greek PSI bonds cannot be ignored. We have liked them basically since they were issued and most recently re-itereated them as a “Best Idea” back on October 23rd. They were 33 at the time. They are 43 now. The case for Greece was more that so much bad had been built in and that the English law offered some comfort, and that the official sector would have to play nice. We have now had all of that.

What is scary about the Greek bond move is how bad the situation remains there. This big move in prices has virtually nothing to do with “fundamentals” and everything to do with the fact that government, or central banks, or the IMF, or the Troika, or some hidden power, has decided that it is better to subsidize Greek lending, than let reality, with a default and restructuring take place.

Portugal and Ireland have also done well. Spain and Italy have also had pretty good returns, and have done extremely well since July when the ECB promised to “do whatever it takes”. The Spanish 10 year bond has gone from 89 to 103 in that time.

In the U.S. the BofA ML HY index is up 13.8% year to date. What is interesting about high yield is that the returns have been well balanced. The BB index is up 13%. B’s are up 13.2% and the CCC index is up 17%. So while there has been some outperformance at the weaker end, it’s not as noticeable as in Europe. Maybe that is because until recently investors still felt HY companies needed decent businesses to raise money?

That is what concerns me. The fact that everyone is now only focused on how much liquidity there is and no one is focused on risk. The chorus cheering QE is growing louder by the day and is far louder than it was in September, and it was darn loud back then.

At the time we argued that it takes time for the QE money to work its way into the system. First it has to be created, and then it needs to be unleashed in a “risk on” environment. Well now we’ve had both, but the question is have we over anticipated the impact?

What Could Go Right?

The basis. That is one thing to look at. On a quick glance it looks like IBM 5 year bonds yield about 1.1% or a spread to treasuries of about 50 bps. CDS is at 40 bps, it was as low 23 back in March. Could CDS continue to grind tighter? That is a real possibility. It is one we have looked at repeatedly. Banks aren’t buying CDS (they need the interest income from loans) and non-traditional sellers of CDS are coming back into the market (part of investors moving out of their comfort zone to chase yield).

Structured products. While normal investors are running out of room to chase yield, particularly at the lower end of the credit spectrum, structured products are making a comeback. CLO’s have lead the way, creating cheap funding for investors looking to leverage their exposure to the leveraged loan markets. This search for yield will create the opportunity for structured products. That is about par for the course as some banks, who are notoriously bad at timing the markets, have just shifted to a “flow only” model in credit.

OMT. Although OMT, the ECB’s plan to buy bonds in the secondary market has helped spark the rally, at this stage it is still only a plan and it isn’t clear that it will be implemented.

What Could Go Wrong?

OMT. The ECB’s big plan might not work if the “conditionality” is too stringent. More importantly, Spanish 2 year bonds yield only 2.96% and Italy is at 2.24%, rates that might be below the level the ECB is willing to support. While OMT could help, it will have ongoing conditionality, and unlike the Fed’s program, is unlikely to give countries support much better than 3%.

Naked. The “naked” CDS ban in Europe helped Italian CDS move from 315 as recently in November to 230 a week ago. Then in just a couple days it blew out to 300. Any way you look at it, 230 to 300 in 3 days is a big move. There is no liquidity when something goes wrong, especially when there is no short base. While regulators have not banned buying CDS in the U.S., it seems as though the recent move tighter from 113 has accomplished that.

Retail. There seems to be this assumption that retail is a bunch of mindless muppets that are always the last to know and will continue certain behavior until it is too late. I don’t see that. I have seen retail time some of the fixed income moves pretty well. Their shifts into and out of various fixed income ETF’s have been logical, and generally well timed. If anything, I think the ability of “smart” money to misread “dumb” money has been a consistent occurrence.

FOMC. Ben is not going to be bearish. He will be accommodative, but I think that is fully priced in. If anything, I think there is a small chance that Ben disappoints the market. He may decide to be less aggressive just in case he needs some ammunition in case the cliff negotiations bog down. If it wasn’t for that possibility I would fully expect him to launch more QE this week, but with the potential for the market to be disrupted by the politicians I think he will hold back so he has more in reserve, just in case.

I Can’t Do It

I can bring myself to be long China (for now). I want to sell protection on HY19 (I think that can perform better than any other credit market), but for now I will remain patient with small bearish views on IG19 (which I want to grow if anything) and a negative view on HY cash in general (the ETFs in particular) because the bonds aren’t set up for meaningful upside – too much rate exposure for some, and trading too close to call prices for others.

Disclaimer: The content provided is property of TF Market Advisors LLC and any views or opinions expressed herein are those solely of TF Market Advisors. This information is for educational and/or entertainment purposes only, so use this information at your own risk. TF Market Advisors is not a broker-dealer, legal advisor, tax advisor, accounting advisor or investment advisor of any kind, and does not recommend or advise on the suitability of any trade or investment, nor provide legal, tax or any other investment advice.