Weekly FI Overview & Strategy: Is CCC the new AAA?

Is CCC the new AAA?

No, CCC isn’t the new AAA, but the market is starting to trade it that way.

It was a decent week for fixed income, but what stood out for me was the strength in the high yield market. I thought the demand for high yield debt would subside and that the market felt toppy. Well, I was wrong.

The argument for high yield is that QE is effectively working. Money is coming into the fixed income market via the Fed. Supply is low as corporations, particularly high yield companies, aren’t issuing right now. This money is chasing yield across the board. Investors are being pushed out of their comfort zones and buying riskier credit products, including high yield. With the view that nothing major happens on the supply side until the middle of January, investors are looking for price appreciation and a month’s worth of coupon.

That is the bull case in a nutshell. Some will argue the economy is improving, some will argue that the cliff will be avoided, but in a nutshell, it is about QE. I have made that argument myself.

So knowing what the argument is, and seeing that I underestimated demand, I have to re-evaluate my position that the risk/reward in high yield is skewed to the downside. After looking through a variety of bonds and at the ETFs in particular, I can’t convince myself to change my view. In fact, I am getting more nervous that downside isn’t just a 2% to 4% move, but could be worse. The risk of the downside move remains limited, but I can’t help but think this level of complacency is dangerous. This isn’t a “retail” phenomenon anymore this is full on aggressively bullish positioning at the institutional level.

With no new issue coming until the middle of January the market expects to earn one month’s coupon and get some addition price appreciation. What could go wrong?

CCC Doesn’t Kill Firms, AAA Does

Virtually every credit crisis and every institution that has been brought to their knees by bad credit exposure, were long AAA assets. Or at least assets that were formally AAA or deemed very low risk.

Firms don’t load up on junk bonds. They are scared of the default risk. That fear keeps the risk manageable.

No firm owned a lot of sub-prime debt. Sub-prime was risky. Apply some CDO methodology and create some AAA tranches and now there is virtually unlimited demand for sub-prime. First loss tranches for sub-prime deals were wiped out early, yet didn’t bring any firm down. Why not? Because those tranches were viewed as risky and were managed appropriately.

When you couldn’t see enough long dated AAA bonds, you create SIV’s that would issue shorter dated AAA paper so that they could buy longer AAA paper.

Would there be a Euro Debt Crisis if Spain hadn’t been rated AAA as late as 2010? Or if Italy wasn’t Aa2 or Greece A1? We probably wouldn’t have a Euro Debt Crisis because no one would have lent them so much money.

The only time I can really remember the high yield market being so aggressively bought was actually the leveraged loan market in 2007 and 2008. Leveraged loan spreads were going to zero. Credit Derivatives on loans (LCDS) started trading because there was massive demand to sell credit protection (and someone likely wanted to get really short the market). Loans didn’t default, and even if they did, the recovery was high. That was the argument. That trade got so crowded with leveraged buyers that there were times in 2008 that you could pick up senior secured debt at yields better than the unsecured debt. No one wanted to step in front of that freight train. The long LCDX, short HY trade, had to be unwound, and it was punishing.

I am not saying that we are anywhere near that, but worth thinking about. Remember Apple at 650 and how it was going to 800? How being short Apple seemed horribly dangerous (and it was briefly). That was only a couple of months ago, and I think there is far less liquidity for any crowded trade exit, than investors are currently pricing in. Not being alarmist, but after digging deeper, I remain just as convinced the downside risk is material, and while the grind higher may continue it isn’t worth the risk.

90% of High Yield Sell-Offs Have Little to do with High Yield

While that may seem insane, it is surprisingly accurate. While high yield can sell-off because of a specific credit or too much supply, more often than not high yield moves because of other markets. More often than not, EM has been the culprit, but recently PIIGS debt has been the driver. In the past we’ve seen the Turkish lira drive the market, the Brazilian real, sub-prime, so it isn’t enough to just get comfortable that the U.S. economy is fine. For high yield to remain bulletproof at these levels, it is now a pretty serious bet on everything in the world remaining stable or even improving. That is a harder bet to make, especially when it is unclear that our economy is headed in the right direction.

I am not as bearish as I sound, I’m even willing to concede that the next move is a grind higher, but I see the risk/reward picture here completely skewed with limited upside and surprising amounts of potential downside.

Sentiment versus Reality, or What is Priced In

Here is a quick look at how I see the market. How the fundamentals relate to the sentiment.

In general I think the economy is fragile and actually slipping a bit from Q3 which means fundamentals are a bit weak for U.S. corporate and a bit strong for treasuries (which rely on weakness to do well).

PIIGS in general remain weak and unloved, but not as unloved in the past and not enough given the weakness from me to be bullish on.

The debt of the European Core strikes me as rich as growth slows, tensions increase, and everyone seems to be long them, certainly relative to the PIIGS.

Treasuries, Risk-On, Risk-Off, or Fed?

Treasuries were tame ending the week virtually unchanged, TIPS finally did a little better, but the moves are leaving many investors confused.

Too many investors are relying on the treasury market to cue “risk on” or “risk off” or to confirm moves. Too often I see or hear or read that “the treasury market isn’t confirming stocks”. While not completely wrong, it is a misleading way to view the market right now.

Treasuries right now, first and foremost, and being driven by hopes that the Fed will announces unlimited operation Twist or just open ended rolls of their treasury positions. The market believes that the Fed will be very accommodative at this week’s meeting and announce continued participation in the treasury market.

I tend to agree with that view, so treasuries are well bid, not out of economic fear, but out of hopes for Fed action. Misreading that can be costly.

Then there is a “carry” element. As silly as it may sound, but some investors getting forced out of mortgage bonds by QE and who don’t have the stomach (or mandate) for corporate credit may be adding to treasuries.

I am still neutral here, and if anything, it seems like the grind to higher prices/lower yields is likely as too many people remain bearish treasuries.

Credit – Bottom Feeding

This was a good week for credit products with high yield and leveraged loans leading the way.

I clearly missed how strong high yield and even leverage loans could remain. Monday was really the big day for the HY ETFs. HYG paid a dividend of almost 50 cents and finished the day unchanged. That is the bulk of the move.

The strength in leveraged loans is a bit surprising since they are callable, but on the other hand, they are largely just catching back up to recent highs; whereas, high yield has surpassed those.

In CDS land, the market felt more “squeezy” than it was. I’m not sure exactly how to explain it, but credit derivatives felt like they were much tighter on the week, but IG19 only went from 98.5 to 96.75. That is clearly tighter, but I think the fear about a squeeze heavily outweighed the actual squeeze, telling me once again investors are not hedged.

The HY CDS index, HY19, went from 100 to 100 5/8 during the week. A little less upside than the junk ETFs had. That makes little sense given the mix of portfolios and convexity that make up the CDS index versus the ETFs. I think the world is aggressively long high yield, and even the “prudent” bulls are long high yield and short the index. I think this will be a pain trade, with either the CDS massively outperforming, or both selling off.

One area that surprises me, and pleasantly so as a bear, is that closed end funds didn’t seem to catch the same level of interest as some other parts of the market. To me, that says retail isn’t chasing this rally as much as institutional money is, and institutional money, particularly hedge fund money, is notoriously fickle and subject to stop losses on any signs of weakness.

Muni’s and All Good Things Must Come to an End – Or at least a Pause

Munis finally suffered a minor setback. After several weeks of great performance they succumbed to some profit taking and concerns that the tax hits to other asset classes might be less than originally thought. Munis benefitted more than any other asset from Obama’s victory and cliff fears. In many ways they remain attractive to me, but will largely remain on the sidelines a little longer to see if the recent weakness can continue.

EM

EM did okay again. My perception is that EM is not well liked, but the price moves don’t reflect that, so I have to re-evaluate that. I have liked EM in part because I thought no one else did, so I have to think that one through a bit more.

Greece – This Chart is Important

I realize that Greek bonds aren’t for many of you, but I think this chart is worth a very close look.

Greek bonds have been one of the best performing asset classes of the year. This shows the PSI bonds from the post-election lows in August, but even from inception when the bonds traded at 26, the returns have been great.

Think about how many positive things have been said about Greece? About Greek bonds? Then look at the returns. This is “crowded” trade syndrome in reverse, and I think it is important in terms of guessing what is priced in, and how illiquid credit can be – both directions.

Annaly Capital as an “Other”

Another blah week for this, but I view the stability as a sign the worst is over, and as the yield chase pushes high yield debt to tight levels, some adventurous investors will start buying the dividend stocks with closed connections to the fixed income market.

Fixed Income Allocations

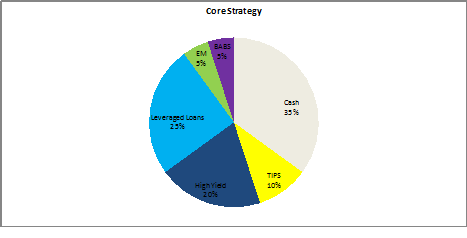

The “Core” strategy is meant to have limited number of trades. It would only be readjusted as longer term views change, or short term views become very large or very strong.

This strategy would have been up 0.40% for the week bringing the 6 week return to 1.53%. The medium allocation to high yield and leveraged loans generated the bulk of the returns.

This portfolio remains unchanged, but will likely see cuts in the high yield and leveraged loan allocations with possible increases elsewhere. The core strategy has moderate duration risk and medium high on the credit exposure. The “target” yield on this portfolio is now down to 3.0%. But I think this highlights how crucial it is to think in terms of total return. A portfolio with an annual target yield can generate 0.4% in a week.

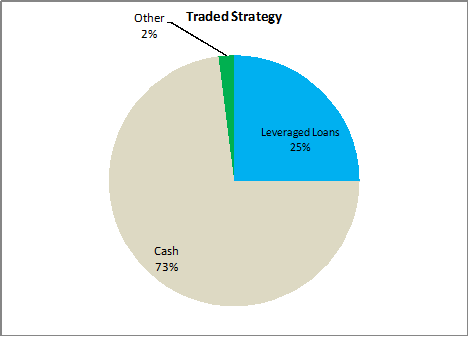

The “Traded Strategy” is meant to have more frequent rebalancing and to capture smaller moves in the market.

The traded strategy had returns of 0.15% last week bringing the 6 week return to 1.22%. The strategy was very conservatively positioned and that hurt. Rather than chasing here, we remain cautious. We will look for opportunities to add risk, but right now will remain cautious and look for better entry points.

The expected yield of this portfolio is barely above 1% since it is mostly cash. This portfolio runs the risk of being underinvested and having to catch up in the chase for yield, but the view is that there will be opportunity to add at better levels. That view was wrong last week, but the exposure to leveraged loans helped.

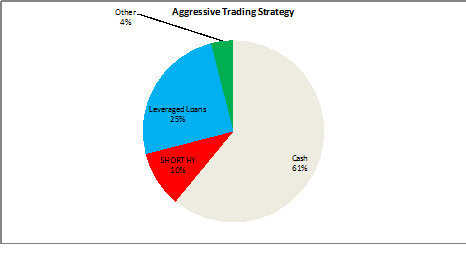

The “Aggressive Trading Strategy” is meant to be traded frequently and will expect to generate more from positioning than from yield.

The strategy should have made a dull 0.11% last week for a 6 week total of 1.57%.

Underweighting risky assets hurt as high yield surged. Had we kept the very risk oriented weighting from two weeks ago, the returns would be stellar, but we didn’t. The exposure to NLY hurt.

We are now adding a short high yield position. How can you be short high yield in a “fixed income” strategy? Well, we have looked at the market, and the ETFs in particular and this is the right trade here. The goal is to generate as much return as possible from fixed income, while balancing the risk and reward, and that trade suites the view best right now.

The portfolio is defensively positioned.

Disclaimer: The content provided is property of TF Market Advisors LLC and any views or opinions expressed herein are those solely of TF Market Advisors. This information is for educational and/or entertainment purposes only, so use this information at your own risk. TF Market Advisors is not a broker-dealer, legal advisor, tax advisor, accounting advisor or investment advisor of any kind, and does not recommend or advise on the suitability of any trade or investment, nor provide legal, tax or any other investment advice.