Greek Bond Trading Strategy from Last Week

One of the Best Performing Bonds

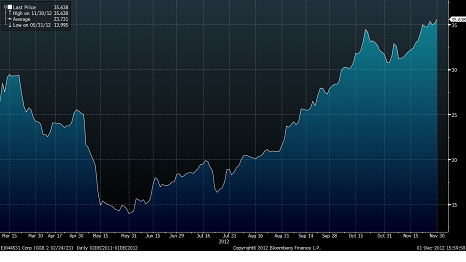

With all that is going on, it is hard to remember, that Greek PSI bonds have actually had a good year.

This is the 2023 maturity PSI bond. Is started out around 26.5 then dropped to below 15 after the elections that took the world into a summer of risk off, but now are at about 35. If you add in 1 point of accrued since these bonds were priced, you’ve made about 10 points. Off a cost of 26.5 that isn’t too bad.

Obviously the story is more complex like that, as you cannot ignore the sell-off, not the impact of FX, but before figuring out what this new deal out of Greece might mean, it is worth at least recognizing that no matter what has happened to the country since the March restructuring, these bonds haven’t been a bad investment.

No Rules on Distressed Sovereign Debt

The other thing to consider is that there really aren’t rules when it comes to sovereign distressed debt. Unlike U.S. bankruptcy law, it is very uncertain what you can get, how you can make the claim, and more importantly how you can enforce it. In some sense it is a bare knuckle brawl, but that is too fair. The sovereign has serious advantages in the entire process that makes this a little more like “bear baiting” than any other investment arena. But sometimes the bear wins.

Start by Saying No

This week Greece is expected to announce the buyback scenario. It will likely be at prices that existed on Friday November 23rd which are below today’s prices.

So you can quickly agree, book a loss from last mark and move on. But why would you do that? Asides from the fact that it is a boring scenario, let’s see what some of the other outcomes are.

If you say no, what happens next?

Europe, in their infinite wisdom, made bond buyback “success” a precondition to other steps to help Greece. The IMF is hung up on this 2020 debt to GDP calculation – it is comical how fixated they are on something that is a complete and total random guess and could be anywhere between 100 and 150 just as easily as the 124 they predict.

So with so much on the line, they will want to make it a “success”. The most obvious and least painful way for everyone involved is to sweeten the tender offer. Pay a higher price. They want to get this done, and one way is to raise the tender price. Maybe 35 isn’t exciting, but 40 whets the appetite, and 50 is absolutely amazing.

This is a negotiation and at some price it is worth the Troika thinking of other ideas. They don’t get the debt reduction they want or claim they need if they pay too much. As greedy as a holder I might be, this is for a quick profit, so what is fair? Also, if the negotiations turn out badly where do the bonds trade?

The Absolute Best Outcome

In the best case scenario, you say no, but 60% or so of others say yes. Not enough to use CACs, so you get to keep your bonds, and Greece gets about a €23 billion debt reduction (60 billion * 60% acceptance * 65% savings). Then lets say that the EFSF goes ahead and changes all of their loans to 15 years with 10 year PIK. Now you are near the front of the term structure. The 2023 bonds would be getting paid back before a lot of the European debt (not sure how much as haven’t seen details). Then let’s say the ECB does the debt forgiveness deal, or at least stops getting coupon and only gets repaid purchase price rather than par.

That is all good. Maybe even a few privatizations people get bullish on Greece. But you are still a long way from getting paid, there will be some debt ahead of you, and you will not be getting any invites to the Troika holiday party, so they will not be happy with you.

If the bonds traded to an 8% yield in this scenario, I’d be shocked. That seems way too much, and that only gives a price of 65. A 10% yield is 56.

Nothing that happens now with Greece will make these bonds trade at par anytime soon, and I laid out a pretty amazingly optimistic case.

If they are smart, and put all the EFSF debt ahead of you (ie, only 10 years not 15, then you will not see the price appreciation and will be likely starting down the barrel of future subordination, and earning a 2% coupon in the meantime).

So don’t get too greedy.

What is the Worst Outcome?

My first thought is that the worst scenario is you refuse to the tender and they don’t get the money from the Troika and certainly don’t get all the other sweeteners mentioned as possibilities in the press release.

Then Greece threatens to default. To some extent, you have to ask yourself, so what? That may be cavalier, but it is worth a look.

Post PSI, these bonds are documented under English law, not Greek law. That was one of the concessions made/demanded. So unlike the first restructuring, you have at least reduced the ability for Greece to retroactively change the law on you. How enforceable anything is, I don’t know, but that is better off than you were heading into PSI 1.

It is going to be a lot harder for Greece to default on your bonds and keep paying other entities. It took the ECB over a year to reach the logical conclusion that getting paid purchase price was a reasonable agreement for a country they are trying to help, you really think they want to face a Greek default?

Okay, maybe the ECB manages to get some sweet deal, but you do have better law on your side.

Maybe the IMF keeps getting paid, at least they did seem to build seniority into their documentation.

But what about the EFSF? How can Greece pay the EFSF but not PSI bondholders? I think that is far harder. And if you think more bailouts is a tough sell in Germany now, wait until the EFSF takes a massive hit. Remember, so far Germany, and every other country has made a PROFIT from their bailouts.

I think the entire Eurogroup will be scared to death of taking a hit at the EFSF. No matter what they say, they are not prepared for losses yet. Maturity extensions? Maybe. Lower coupons? Maybe. Actual monetized losses? No way.

Then there is a question of how you default on bonds that don’t have anything due until March 2013. That is the first coupon date on the PSI bonds. Until that point, no money is paid to the PSI bonds, so why rush the decision. Even then, it is only €1.2 billion or so in coupon payment.

If you delay, and the “sweeteners” get implemented, your bonds go up. If you delay and the sweeteners don’t come in, more likely that Greece deteriorates and that would like drag Spain and Italy down with it. Terms like the “unlimited” bond buying of OMT lose their effectiveness when it is clear for all to see there is no real will to buy bonds and take risk. As negotiations drag, long Greece, short Spain, would make some sense.

To avert that obvious contagion, maybe they will implement OMT. I don’t see how that would hurt your Greek bond position. It would add to the outrage against the Troika that they are treating Greece unfairly and encourage them to provide the sweeteners, or to pay up.

So maybe the worst case is they make the March payment and try to come up with some other way around the problem they face – how to wipe out PSI bonds but not hurt other investors?

So What to Do?

You are clearly making a bet that Greece can’t find a way to default or wipe out PSI bonds while paying everyone else. In the corporate world you would know the answer to that possibility. Here it is tricky. You cannot rely on courts in the way you could normally and enforcing any judgments may be just as difficult. But at these prices, I think that downside is minimal. You have better documentation this time around. You also have the fact that these bonds were created in a restructuring that left official sector alone so maybe bondholders won’t be viewed quite so much as “evil speculators” this time. Not that there is any legal value to that, but much of this negotiation will be held in the court of public opinion, and double whacking bondholders while continuing to let inept governments get par might not play out as well.

That is all guess work. I could try and refine the arguments, but in the end it is guesswork, and you have to make a bet of how low these can go in default. I think the market overstates that risk.

The other question is how much latitude does the Greek government have to pay more for these bonds? The trade here is more about getting 45 than it is about owning these bonds in 2 years, but there are many ways for your bonds to get to 45. Asides from the easy way, of Greece capitulating and upping the tender offer, you would see another pop if the sweeteners get implemented in the meantime.

I think the 2024 bonds seem the most interesting. The 2023 trade a couple of points higher, and I’m not sure I see the justification for that. I wouldn’t own longer than 2026. If the EFSF really pushes their lending to 15 years, that would be great, but you wouldn’t want to own longer than that. If you are going to play the holdout game, you don’t want longer than 2026. If I was EFSF I wouldn’t let myself be extended past the 2022, but weirder things have happened in Europe.

So I like these bonds. I can’t classify it as a “best idea” or anything, because it has so much risk, but I think it is certainly worth thinking about.

If you get a chance, you can also read what I wrote about the Greek conference from the other day. I’m too cynical to be that excited by what was said, but I do think things may be getting portrayed worse than they are.

E-mail: tchir@tfmarketadvisors.com

Twitter: @TFMkts