The T Report: Bulls are from Mars, Bears are from Venus

One Market – Two Tapes

Is this the start of the Santa Rally? I can’t believe how many times I heard that yesterday. Clearly the bulls were not allowed to look at Apple or the Nasdaq. Even the S&P couldn’t get back to Monday’s close and is down on the week? I thought my Traffic Jam rant might have been out there, but at least that is relevant.

The bullish talk just didn’t match with what the markets have actually been doing. I hadn’t been particularly bearish, but I am getting there, mostly because the bulls seem to be ignoring facts at this stage which is often a sign of desperately clinging to an investment thesis that is falling apart at the seams.

Apple Dropped a Starbucks

Apple has dropped $45 billion this week (though that number could be $10 billion different within the next half hour). Starbucks has a market cap of $38 billion. Something about that seems wrong. How many years and how many stores and Apple can lose that much in 48 hours? Only 64 companies in the S&P 500 have market caps greater than that. Apple has morphed into something more than a stock and is approaching an asset class of its own.

Not one single analyst mentioned that long Apple, short the market has been a favorite hedge fund trade. Last time it closed at $537 was November 14th and the S&P closed at 1,355. This time the S&P closed at 1,409, winning. This is a real trade many had on and it caused extreme pain yesterday. It wasn’t working and I am assuming some of the price action we saw were investors getting stopped on that.

The best hope for Apple here seems to be some sort of cash disbursement. The cash large cash position they hold actually inflates the P/E they trade at. They haven’t had to worry about that, but maybe they should.

In the end we need to think about the real growth prospects of a company that has become so big that dropping the entire market cap of Target, or Time Warner, or Starbucks, looks like a drop in the bucket.

Can the 99% Be Right?

It is almost impossible to find anyone bearish corporate credit. I understand the reasons. In fact I have analyzed many of those reasons and in some cases was early to see them. I am less scared about the market because of any reasons and more scared about it because no one is scared. All we have to fear is a lack of fear itself.

Denial and Hopium

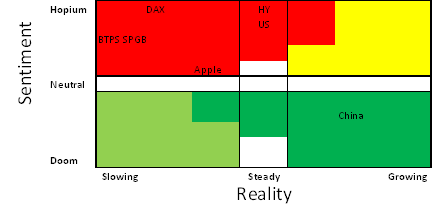

I am getting bearish. More and more the market seems to be reacting “inappropriately” to news in my opinion. Whether it is the cliff that won’t be named or Europe, the market seems to only want to react to good news and ignore bad news. I am becoming more bearish by the day.

Here is my quick view of the world. China is turning the corner and is not liked at all. DAX is acting as though any Euro outcome is good, which isn’t the case. Spain and Italy have priced in OMT and don’t yet have it. HY and the US seem okay from an economic standpoint, but too much faith is being put in the ability to do better. Finally Apple had a nice fall and is moving back into reality territory.

Disclaimer: The content provided is property of TF Market Advisors LLC and any views or opinions expressed herein are those solely of TF Market Advisors. This information is for educational and/or entertainment purposes only, so use this information at your own risk. TF Market Advisors is not a broker-dealer, legal advisor, tax advisor, accounting advisor or investment advisor of any kind, and does not recommend or advise on the suitability of any trade or investment, nor provide legal, tax or any other investment advice.