Weekly Fixed Income Overview and Strategies – Chase for Yield is On

The Year End Yield Chase

Closed end fixed income funds continued their bounce, high yield ETF’s had inflows, and much of what we discussed last week came true.

The move the prior week was rational. We saw steep declines in closed end funds on a combination of big premiums, leveraged assets, and dividend tax confusion. This helped push all credit markets lower. Credit moved not just with the other “risk off” trades but with fear and confusion that retail in particular was having a mass exodus from fixed income.

That wasn’t true and isn’t likely to be true anytime soon.

I am the most bullish I have been. I think we will see continued strength in credit into year end at this point. I am making a key assumption here that the fiscal cliff will be dealt with in a way that benefits the markets. I expect a deal that has minimal impact in the next 6 months to a year. At the Ben Bernanke luncheon this week, it seemed clear to me that is what he is telling congress. So congress is being told not to raise taxes and not to cut spending in the near term but by the Chairman of the Federal Reserve. That seems to be a policy that congress can get on board with, as can kicking seems to be their specialty.

The other thing that was made clear to me at his speech was just how long he is willing to leave rates at zero and how willing he is to continue to flood the market with money. I somehow clung to the belief that a decent payroll report or two would have him pulling back. That view is just wrong. He is determined to get the economy moving along and won’t risk pulling back too soon. He wants to ensure that the economy gets over that hump and stays over. No rolling back this time. I’m not sure his policies can really do that, but for now I have to assume that we will get low rates for awhile and we are far more likely to see new purchase programs announced, than we are to see programs cut.

Where has all the QE gone?

This is a serious question. In September it was impossible not open a paper and avoid reading about how QE would ensure the markets would keep going higher. I argued against that view. I had argued the markets had gotten ahead of themselves and that QE couldn’t force people into “risk on” mode, especially when risk trades had already done so well. I argued that much of what people took to be QE inspired rallies in the past were a combination of many factors, of which QE was only a part.

I also mentioned that much of the early QE was going to help reduce balance sheets at Fannie and Freddie and possibly European banks looking to scale back their U.S. operations. I also mentioned that the money tends to build up. It is like a dam that collects the money and right now, I think that dam is about to burst.

So, since September the Fed has being buying assets. They continue to buy assets. That money has not been allocated to risk trades, but I think it is about to. I think we are going to see that money put to work and that is very positive for risk assets, and credit products will be immediate beneficiaries.

No Calendar and ETF Premiums

I’m not sure whether it was hurricane Sandy or the election, but Thanksgiving seemed to sneak up on people this year. That includes the fixed income markets. We weren’t bombarded with the usual lament that the new issue calendar dries up after Thanksgiving and that there won’t be any supply. Analysts were far too excited about the sell-off to pause and wonder about trivial things like “no supply” in a market that kicks off immense amounts of interest payments that need to be re-invested. So look for that dynamic to continue to help credit.

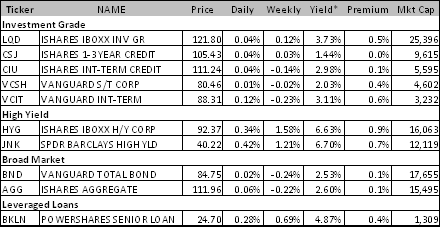

In a note I sent to clients on Friday, I highlighted the fact that the high yield ETF’s are trading at a nice premium to NAV (so is LQD). In thin markets where dealers and fast money took off positions lower, or got short at lower prices, that can cause the market to go higher. The premium is likely to be persistent right now and will push prices higher as ETF “arbitrage” accounts buy bonds, allowing the “virtuous” circle to play itself out where rising bond prices cause the ETF’s to rise, causing the premium to remain high, causing more people to buy bonds.

That will end in tears as ETF’s and hedge funds will all wind up owning the most “liquid” bonds and the most insane prices, but I think we are at least 2% away from that happening, so risk-on remains the trade, and this is coming from someone who is typically contrarian and far more comfortable booking profits than adding to winning positions.

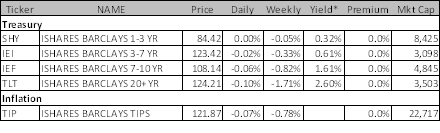

I Missed Shorting Treasuries

Last week I mentioned I was close to being short treasuries. I should have gone with that. Treasuries did poorly across the board, with the long end taking a beating. What is noticeable is just how poorly TIPS did. That was off my radar screen but bears some further scrutiny. The CRB index was actually up last week, so commodity prices continue to go higher. It may be worth adding some TIPS exposure.

I am pretty much back to neutral on treasuries. I missed the sell-off, and am not convinced they go that much lower, not with the Fed potentially prepared to buy more. At the same time, I want to keep limited (or no) exposure to bonds with a lot of yield risk. The potential for continued pressure in the treasury market remains and that is dangerous for unhedged municipal bonds and investment grade bonds.

Credit Spreads – I Can’t Wait to Look

Last week I was scared to look, but this week after adding aggressively last week and even during the week, I can’t wait to open my credit market gift.

High yield did very well, with returns of about 1.5%. The HY CDS index, HY19, did even better, going from 97.3 to 99.6. That is a good indication that “fast money” got caught short and had to chase up the most liquid instrument to take some risk off. It was hard to get a great feel last week with so many people on vacation and short trading days, but I have to believe there is a lot of “whipsaw’ out there. Investors who didn’t sell bonds, but bought protection, experienced some real P&L pain last week. I don’t think that is over.

Investment grade CDS was even more “heinous” to be caught short. It peaked at 113 last Thursday morning, closed the week at 109.5 and finished this week at 99, and I think that 99 close was more of a mercy rule (like the Jet’s needed) than real trading. Anyone stuck short didn’t feel like playing the game Friday, so I suspect that unless something bad happens between now and the open on Monday, we will be trading at 97 or so pretty quickly.

This move highlights one of my frustrations for many investors – they can’t get investment grade bonds on a yield basis. LQD and the other investment grade funds broke even for the week. That’s it. So while spreads did very well (though cash bonds underperformed CDS) the move in treasuries (rates) offset most of those gains for yield investors. Investment grade corporate bond investors who invest on a spread basis had a fun week, outright investors missed the “risk on” fun.

Then finally we had a very nice move in bank debt. The leveraged loan ETF’s did well and I feel somewhere between vindicated and just happy I wasn’t losing my mind. Loans sold off last week and seemed inexplicably weak. We saw that as an opportunity and increased our allocation to that space dramatically in the more aggressive strategies and were rewarded. I think they still offer a nice balance of protection from downside risk, with some upside. The loans themselves are callable, so that upside is limited, and we will be taking some profits soon, but not yet.

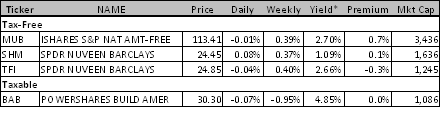

Muni’s Getting Frothy

Municipal bonds did well again. They outperformed investment grade bonds and given the move in treasuries they did extremely well to have gains. The less liquid BABS market didn’t fare as well. This isn’t a market I want to short, but I don’t see adding risk here. Too much rate exposure and too many investors front running year-end tax code changes for my comfort. This has the feel of a market that is getting “priced in”. I could make a case for a quick trade down here, but also see reasons for the market to grind higher.

EM

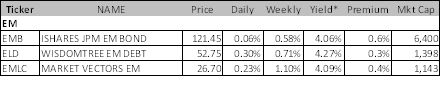

EM turned in a very solid performance. Not quite as good as high yield, but it managed to ignore the move in treasuries, outperform investment grade, and that is on the back of news in Argentina that certainly spooked that market. Argentina was ordered to pay some holdouts from prior debt defaults, yet the markets managed to largely ignore that. I like the Emerging markets space, though I think it is more of an equity play here rather than ideal for fixed income.

Spain – Better Lucky than Smart

On Tuesday morning I came out positive on Spanish bonds. I recommended the 3.75% of 2015 because they have a maturity that should be bought by any ECB program. At the time, those bonds were trading at 99.5 and they finished the week at 100.5, to yield 3.56% down from 3.93%. I have a target of 3.25% yield on these bonds, though I think they could get to 3%. Longer dated bonds did even better, but I remain a little uncomfortable with them due to potential subordination issues down the road, but with my overall “risk on” view in credit, I might be too conservative and am considering moving into the longer dated bonds as the recommended choice. The 10 year bond moved 2.25 points in the time the 2015 bonds moved 1 point, so that extra duration and wider spread to start is attractive, and I really think I’m being too conservative.

The rationale for buying Spain here is that progress is being made and the EU is realizing (in part through its ongoing efforts in Greece) that they need comprehensive plans sooner than later, and Spain is the likely beneficiary of that change in attitude. I also believe that France being downgraded is yet another reason for Europe to decide to be more aggressive, rather than less aggressive. As we talk about on Is it time to get bullish on Europe the ETF’s are a good way to play Spain and Italy as they are financial heavy and will benefit from any resolution in the current round of bailout negotiations.

Annaly Capital as an “Other”

This stock and sector was stable this week. After the fear the previous week, that is a good resolution. While I don’t think this stock can get back anywhere close to its highs, I think it will benefit very nicely from any renewed “chase for yield” that I expect to see into year end.

Closed End Funds

I’m back out of the closed end fund space. Nice bounces across the board and back to what seems like reasonable premiums. I don’t have a problem with the CEF’s here, I just don’t see them offering that much better value than other ways to trade the market. If anything, the leveraged loan funds appeal to me the most here. We are working on better ways to dig deeper into the closed end funds and have better trade ideas, but while working on that more systematic approach, it is time to take the gains and run, at least for our recommended list, but as a whole, I can see why people would want to own them here.

Fixed Income Allocations

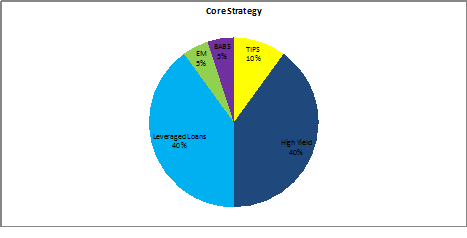

The “Core” strategy is meant to have limited number of trades. It would only be readjusted as longer term views change, or short term views become very large or very strong.

This strategy would have been up 0.68% for the week bringing the 4 week return to 0.60%. Returns are nicely back on track for this strategy. I am looking at adding exposure to Spain or Italy for the core. I am also tempted to sell some leveraged loans and add that money to either the muni space or to TIPS (which hurt this week).

During the course of this week we added 5% to high yield on Tuesday and then again on Friday. That is more trading than would like to do in the “core” strategy but I feel very strongly about the chase for yield into year end. The core strategy has very moderate duration risk but is now high on the credit exposure. The “target” yield on this portfolio is now up to 5.1%.

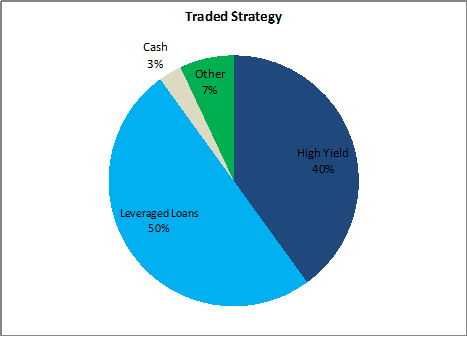

The “Traded Strategy” is meant to have more frequent rebalancing and to capture smaller moves in the market.

The traded strategy had returns of 0.90% last week bringing the 4 week return to 0.85%. The strategy was aggressively positioned coming into the week and is even more aggressively positioned now. Incremental 5% positions in HY were recommended on Tuesday and Friday morning. An allocation of 5% to Spain came on Tuesday, and finally on Friday added a small 2% recommendation for NLY. The sliver that had been allocated to IG has been removed to allow for the aggressive positions in high yield and “other” which is Spain and NLY. This portfolio is at the limits of how aggressive I would be, and will look to take some profits this week and shed some risk.

The expected yield of this portfolio is up to almost 5.5% and while duration risk is very low, credit risk is extremely high.

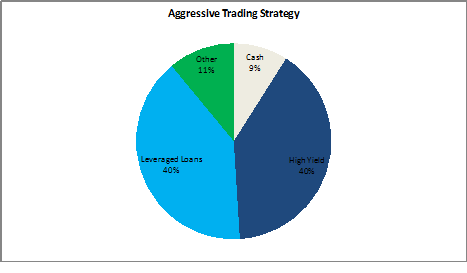

The “Aggressive Trading Strategy” is meant to be traded frequently and will expect to generate more from positioning than from yield.

The strategy should have made 0.86% last week for a 4 week total of 1.30%. The portfolio actually underperformed the “traded” account as it wasn’t as aggressively long.

In addition to adding 5% allocations to High Yield on Tuesday and Friday Morning, and 5% to Spain on Tuesday, the strategy sold its MHY on Tuesday, and added NLY on Friday to bring that recommended weighting up to 4%. We are also adding a 2% allocation into EWI as of Friday (the Italian stock market). While not a pure yield play, this funds will do extremely well if our expectations on Europe are met.

The portfolio has is aggressively positioned. If anything, will likely be looking to take some profits, particularly in the leveraged loan area, but may add some more small, but high beta bets, with most likely being more dividend stocks, and longer dated Spanish bonds, and also possibly long a rated hedged investment grade position.