TFMkts Weekly Fixed Income Summary and Strategies

Closed End Funds

I can’t remember the last time I look at the fixed income closed end fund space this closely. It was probably in 2008 when many were trading at great discounts and offered a great opportunity to get long the market.

This week, while Pimco executives were busy writing Op-Eds and telling Europe what to do we saw a complete collapse in the Pimco High Income Fund (PHK). To be fair, it wasn’t just this fund, but it is the poster child for what went wrong and at one point was down more than 16% on the week and 30% from its October 5th high. Pretty ugly for an “income” fund.

Not only is PHK large by closed end standards, but it was trading at the most egregious premium to fair value as Barron’s pointed out over a month ago. The calculation of premium does seem fuzzy. I have tried to look at it in the past and got bogged down. In a simple world, the funds would own bonds and the issue some preferred debt to get leverage. You could quickly calculate total value of assets and subtract the preferred debt and voila, have fair value and determine how rich or cheap these funds are.

But nothing seems that simple. The Pimco website doesn’t allow you to download the portfolio, in fact the last portfolio I could find was from September month end. From that report, you can quickly see that there are interest rate swaps and what looks like some FX trades. I have heard these affect the NAV calculation, I will try and dig deeper, but it does seem reasonable that accounting wouldn’t be good for derivative or futures trades.

So, while I try and determine a better way to look at these funds, I would say that of the 8 page position report, more than 3 pages are ALLY smart notes. I am not sure I would pay a premium to own a bunch of callable notes from one issuer, but that is another story. Another large holding for this fund is AIG. From the data I have, the AIG INC JR SUB 8 1/8% bonds of 2068 are one of the largest individual holding in the portfolio (but not the only AIG sub debt holding). I cannot verify the accuracy of the prices I see on this bond, but it looks like they trade at 122 to give a 6.13% yield to call (these bonds are confusing as they switch from fixed to floating in the distant future but are also callable). Anyways, with purported leverage of less than 30% (from the Pimco site), It is not clear how you get a sustainable dividend yield of 13%. In fact any premium bond, should be seeing NAV declines as the coupon is paid out (like on these bonds with an 8.125% coupon but only 6% yield). I will try and dig deeper into this, but on a quick glance, it seem the dividend here is unsustainable, which leads to the question of why it was kept so high?

Outflows

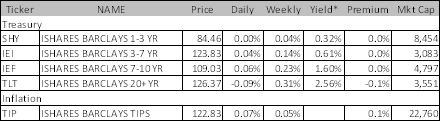

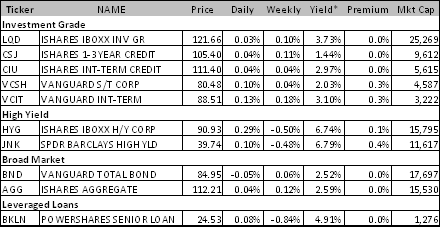

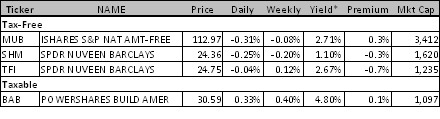

HYG had outflows of at least $600 million last week. JNK was similar in magnitude. LQD wasn’t as bad. BKLN (on the leverage loan side) seemed okay, and TLT and MUB had inflows. Even BOND (the Pimco Managed ETF) had inflows. It also looks like we saw some net buying on Friday. As far as I can tell mutual funds experienced similar results.

So What Does This All Mean?

I think a general “risk off” trade went through the market. I was surprised just how long people were and how many allegedly thought Obama wouldn’t win. Anyways, the leverage on the closed end funds didn’t help. The premium to NAV makes investors nervous. Confusion over dividend taxes (which shouldn’t affect these funds since they aren’t “qualified” anyways) added to the selling pressure. The moves were so big and so dramatic that they fed other markets. There were some old school high yield bond traders who think ETF is a four letter word and don’t even know how to spell CEF who were suddenly talking about what was going on. The big moves in the CEF’s sparked with redemptions led to the fear that “retail was exiting fixed income” en masse. That just isn’t the case. Yes, some position reductions along with rest of the market, but the chase for yield is still there. Inflows into treasury ETF’s might signal only fear, but munis saw inflows too. That is healthier. It is also incredibly hard to decipher how much of the ETF redemption is retail versus institutional. The success ETF’s have had in penetrating the institutional market, particularly high yield, means that not all flows are retail, and some early flows are likely fast money seeing more liquidity in ETF’s than bonds, and the ETF arbitrage crew.

I cannot promise that the selling is over, but I think there was a lot of confusion that helped drag us down and that with some time to think, markets will behave well. PHK was up over 10% on Friday.

Someone Forgot to Tell The Treasury Market that it was “Risk Off”

Treasuries were surprisingly well behaved. I would have expected much bigger gains given the tone of the market. They hype and headlines were implying carnage on a wholesale scale for the markets, yet the reality was pretty muted reactions. I’m not there yet, but I am looking at shifting from neutral on treasuries to bearish. I think in any risk-on trade they will sell off, and we are really starting to hit levels of resistance on the “flight to safety” trade. It is hard to flee to U.S. Treasuries when the U.S. government is what you are fleeing from.

Credit Spreads – I’m Scared to Look

Wait, that wasn’t so bad. Certainly not a good week, but with investment grade bonds breaking even and high yield only down 0.5%, that just doesn’t seem as bad as it could be. I have some

IG19 had another rough week. It was once again performing worse than almost anything else, blowing out from 107.5 all the way to 113. I think we have now managed to get a lot of people caught offsides the other direction. Bulls turned to bears, and people underweight.

If you can do CDS, I like selling that here better than long IG bonds. Investors are once again hedged and wedged. We see this time and again. Investors don’t want to sell their “precious” bonds knowing that they are illiquid and the cost to buying them back may be high, so they use the more liquid CDS index as a hedge. The problem tends to be that the bond prices don’t fully reflect reality, and the CDS is now ripe for a squeeze, so I think a lot of managers will be going home at lunch Wednesday complaining what a bad product CDS is because it is going tighter while their bonds are barely moving. If you hear someone complaining on the commute about why CDS is outperforming, suggest to them they should read this report.

At the bad end of the world was the leverage loan market. We have liked this market and it got crushed. It was the worst performing segment of credit. I was wrong, but we have actually increased exposure. The selling in leveraged loan CEF’s wasn’t as extreme as it was in some other sectors, but it was bad enough. Those CEF’s are almost all now trading at NAV so I think the selling pressure ends. CLO’s continue to print. That will create demand for loans. More and more non-traditional investors are stepping up to fill voids left by Yankee banks exiting the middle market and project finance market. U.S. banks are under pressure to get earnings up, and in a low yield environment, where regulators and the public have deemed that making loans is not only risk-free but serves the public good, expect big banks to extend their lending business and keep more on balance sheet. I have spent a lot of time this week questioning those ideas and remain convinced they are in place. So I am comfortable adding to loans here in spite of having been wrong.

Muni’s Do Well – Again

I reduced exposure to muni a bit early. Actually, really only to build America bonds which did well. Straight muni’s came out about flat. I remain neutral/mildly bullish over the medium term, but I expect these bonds will do poorly over the next week or so as everyone has now priced in the tax related buying, and no one is pricing in a decent Fiscal Cliff resolution coupled with a risk-on trade pushing treasuries wider. The rate risk here is my big concern here, I am much more comfortable with the credit element.

EM

Argentina had a lot going on, that frankly got lost in the shuffle, and I am working on getting caught up. The market as a whole moved about as expected given everything else going on. It was hit by a risk-off sentiment, and with concerns about an ongoing global recession, underperformed U.S. credit spreads across the board.

Spain – Continued, if not Growing Weakness

Same header as I used last week. Why not? Bonds did weaken again in Europe, but I am now looking for an entry point. Reading between the lines in Europe, you can read anything you want. There are so many headlines and so many people saying different things, often at odds with each other, that is hard to get a good story. I continue to believe that I am interpreting things correctly and that we are getting closer to another round of intervention that helps the markets. Draghi, in particular, seems to like doing things when markets are thin. He may believe that he gets more bang for the euro if he does things when traders aren’t around and are very protective of year end performance (LTRO I was late last year). Still flat, but getting very itchy to pull the trigger here on long.

Annaly Capital as an “Other”

I am just thankful I didn’t have to do the weekly summary on Wednesday. NLY has bounced back to almost the purchase price from last Friday. I would have been tempted to add to dividend stocks last week, but was far too afraid to. Being a small bit out of comfort zone and wrong made me too cautious.

Closed End Funds

We added a small position on Friday to the aggressive strategy. I used MHY. It was unscientific as I couldn’t do the work I would like, but have traded it before, and this really was a quick strategy trying to capture oversold. I am looking for other ideas where the managers are good and the portfolios make sense.

Fixed Income Allocations

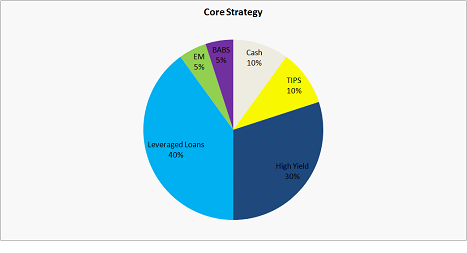

The “Core” strategy is meant to have limited number of trades. It would only be readjusted as longer term views change, or short term views become very large or very strong.

This strategy would have been down about 0.39% for the week bringing the 3 week return to -0.08%. Disappointing 3 week performance, and was hurt by the exposure to leverage loans more than anything as that performed far worse than expected.

We are increasing the allocation on leverage loans from 30% to 40%. The yield is now close ot 5%, and as mentioned earlier, the supply/demand equation remains skewed in favor of these loans, and the seniority should kick in if we see further weakness. We will reduce the BAB position to only 5% as we are growing increasingly concerned about the duration exposure, and just how much the credit spread have outperformed. The core strategy has very moderate duration risk but is medium to high on the credit exposure. The “target” yield on this portfolio should be about 4.53%.

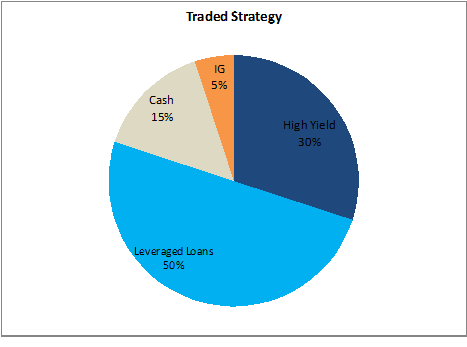

The “Traded Strategy” is meant to have more frequent rebalancing and to capture smaller moves in the market.

The traded strategy had returns of -0.40% last week dragging the 3 week return to -0.05%. Leveraged loans were the primary culprit. We are adding 20% to the leveraged loan allocation. Also looking at adding either to EM or to the “other” section, which is likely to be Spain, Dividend Stocks, Closed End Funds, or some form of all of the above.

The expected yield of this portfolio is up to 4.6% and the duration risk is low. Credit exposure those is now above moderate and is the key driver.

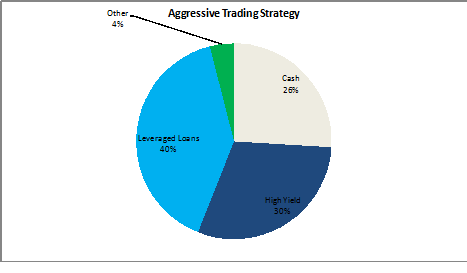

The “Aggressive Trading Strategy” is meant to be traded frequently and will expect to generate more from positioning than from yield.

The strategy should have lost 0.14% last week but would still have a 3 week total of 0.44%. The portfolio benefitted from large cash position and from the investment grade and other allocations. We are taking up both the High Yield Allocation and Leveraged Loan allocations to 30% and 40% respectively. We are removing the IG allocation completely.

The portfolio has low duration risk and a moderate to high amount of credit exposure. The other allocations may grow if we take it up with the Traded Strategy, but also happy to take profits in the closed end fund if we get another day like Friday.