The T Report: Choking on Debt

Many Names for the Same Problem

In the U.S. we talk about Fiscal Cliff and Debt Ceiling. In Greece it has come down to Grexit. Spain still goes by Spanish Bailout or Spanish Unbailout as the case may be. Italy is in denial and hasn’t made up a word. Belgium calls their debt problem Dexia. Ireland, where it is hard to understand the brogue describes it as Thieving Bankers. Japan has had it for so long it now is known as Normal. England has QE, austerity, and party called Labour that seems to have nothing to do with labor. Portugal’s debt problem is known as the Rodney Dangerfield as they get no respect in spite of putting the P in PIIGS.

Too Much Debt

Everywhere you look, countries have too much debt and are struggling with it. Countries without Central Banks that can buy their own debt might have to worry about it. Those countries that can buy their own debt, do. Remember when “Quantitative Easing” was an “unconventional” policy? It is now the norm. QE to the left of you, QE to the right of you, everywhere you look there is QE. Savings and balanced budgets have shifted to unconventional policy, and are on the cusp of being relegated to the status of myth or urban legend. Our children will have heard there was a time when investors bought bonds and governments tried to run prudent policy, but never having seen it, they will just humor us and pretend like it was true.

The Problem Is Too Much Debt, Which is Why We Will Get More Debt

I think Keynesian economists have done more damage than good. I’m not even convinced Keynes would be happy with the policies that have been pursued in his name, but that doesn’t matter. We have gone so far down this hill, that stopping and turning around isn’t an option. Or at least not an option politicians or policy makers are willing to try.

So we will see more debt. We will get some lip service about a responsible future and then will spend more. The only two lessons the world has learned in the past decade is that Lehman shouldn’t have defaulted, and austerity is bad. No one wants to talk about the symptoms that led to Lehman or the conditions that were in place at the time of Lehman that let it be such a catalyst. That is hard. It might lead to blame for many people. Much easier to close your eyes, click your heels, and blame it all on Lehman. So we will never see a big bank default again. It doesn’t matter what you think, or what the politicians say, or what would even be good, too big to fail is more entrenched in policy now than before the crisis. Any country that can print its own money will never embrace balanced budgets (in the current year) in favor of an attempt to sustain the unsustainable. Countries that can’t just print their own money may be forced to accept some form of austerity, but away from that, countries will do everything they can to avoid it.

We Won’t Die the Death of a Rock Star

We will not choke on our own debt. No early death in a hotel bathroom under strange circumstances. We will do everything possible to cling to life. The quality of life may be low, we might even be in a coma and not realize it, but the outcome seems clear to me.

Countries will get money. The weakest countries will get money from other countries. Central banks will become more aggressive rather than less aggressive in their policies. At some point we will see OSI or official sector debt forgiveness on a massive scale. The fact that debt forgiveness is never mentioned as an option for the Fed might be the best indication that it is the likely outcome.

As the Fed owns an ever greater amount of treasuries, that option seems as likely as any. Especially once policy makers find new ways to avoid cuts now with plans for cuts in the future. We know the animal we are dealing with. We know what they think. It makes sense to be a bit scared that they will deviate from their norms, but I think the sad truth is that the politicians and central bankers will never try a course that leads to potential near term pain if they can avoid it, so they will perpetuate the game.

Smile, Be Happy

I don’t want to be complacent. I’m not happy with the course of actions. I remain convinced that back in 2010, a Greek default would have put Greece on a better path, would have led to some immediate contagion that could have been contained. We would have culled the weakest banks in Europe, Real programs to fix AND fund the economies of Spain and Italy would have been created and implemented and we would be in a better place now. We didn’t and have created such a convoluted mess it is has to visualize a Greek default now that doesn’t spread contagion. Two and a half years of policy and all they have done is make things worse, at least in terms of real structural change that can work. Instead they have kept markets happy. I just find it hard to believe we won’t see more of the same.

A couple of weeks ago, it seemed like Europe might let Greece go. Now there are more headlines to the contrary. That makes sense, because some smart people who understand how interlinked the system is, grabbed some of the politicians and scared them into playing the game.

I wish I had more to say. Wish I had detailed knowledge of how it will play out, but I really can’t help but think in spite of all the noise, threats, and cajoling, politicians and central banks will never make a hard decision and keep extending the situation as long as possible. Looking at Japan, it seems like it can go on for awhile.

The Markets Tell Politicians their ONLY Mandate is Bipartisan Solutions

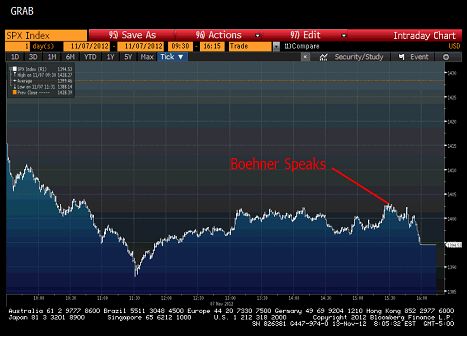

Wednesday was ugly for the markets, but Boehner crushed any hope of a late day bounce.

If that wasn’t bad enough, Obama went out and destroyed what was looking like a credible rebound. The best line I heard about his speech was that every round of applause was worth 1 point on the S&P 500.