TFMkts Weekly Fixed Income Summary and Portfolio Allocation Strategies

Risk Off

This was clearly a “risk off week”. Unlike equities which started the week well, credit markets didn’t even start the week well. They did join equities in the post election and post ECB sell-off. The decision to switch from a more aggressive risk taking position to a more neutral position made sense. Treasuries and some “duration” products like muni’s did well. Corporate credit sold-off in spite of that, with the exception of leveraged loans, which held their own last week.

I am not sure it has ever been so clear that one stock drove the market as it was this week. It was all about Apple. The intensity and magnitude of the sell-off surprised me. For the first time I actually really started to think Apple was worth a shot at $575. I was wrong. Hard to believe it was only a month ago when being short at $675 seemed like an insane call.

Anyways this week the market is looking for signals on fiscal cliff. Any sense that we can break out of partisan politics and move into something where the leaders negotiate a compromise would be seen as positive.

Europe continues to show signs of letting Greece default and not being as ready to support Spain and Italy as many would like. As bad as that sounds, this has been the stage where they have surprised us in the past. I think it would be an incredibly dumb decision to let Greece default while so much uncertainty remains around Spain and Italy. The hardest thing for me is telling whether Draghi was pleading with Germany this week, or making excuses for actions he is about to take. A huge difference and it is easy to see almost all of the comments being made making sense under either path.

China now has every incentive to look good. The new leadership has been announced, and if you were a politically motivated country that was happy to publish data that might not be totally accurate or wanted to save stimulus for the “new guys” then we could start seeing signs of a turnaround there. Personally I wouldn’t believe them, but with markets beaten up enough, it could produce a spark of hope.

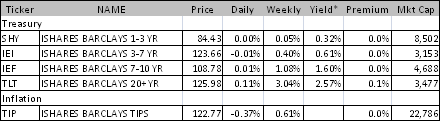

Interesting Moves in the Long Bond

Treasuries had a typical flight to safety reaction. The performance at the long end of the curve was impressive, especially given the weakness there last week. I think more hedge funds have lost money shorting Japanese Government Bonds over the years than any other trade. It is a trade that everyone is tempted by, but never seems to work. Shorting U.S. treasuries isn’t quite at that level of pain yet, but it is approaching that. So long as the Fed is buying treasuries, which I don’t expect to end any time soon, we just can’t see a big sell-off. Maybe inflation will pick up, but I remain doubtful that we will see strong growth, so I don’t think that will happen. I continue to generally avoid treasuries and prefer taking duration risk in other assets, but after these moves, I too am tempted to join the short camp, or would be taking profits.

Credit Spread Widening

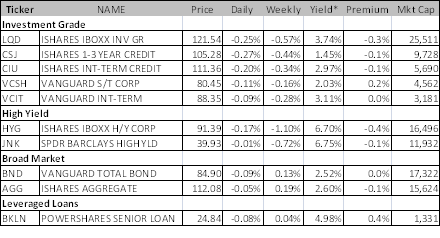

This was a bad week for corporate credit. The high yield market was down close to 1%. Investment grade bonds were generally lower, which given the move in treasuries means there was significant spread widening.

IG19, the CDX index reference 125 U.S. investment grade issuers, jumped from 97.5 last Friday to 107 this week. That is a big move. It underperformed the cash bond markets and even the equity markets. That is the widest this index has been since the summer, when Europe looked in trouble. This market is very “fast money” and is reflective that many were too complacent. Now it seems a bit stretched, so either that will bounce, or we will see more bond selling.

I had taken off most of our HY risk and all of our investment grade risk coming into this week. We have been adding back as I think we will see some return to the “chase for yield” as governments and central banks offer another round of market placebos – the placebos don’t solve anything, but make the market feel good for a bit.

After last week’s underperformance of leveraged loans, they stood out like “champs” this week, actually managing a small gain (largely carry).

The sell-off here feels a bit overdone. Nothing has really changed about the state of earnings for corporations, and unlike stocks and dividends, the likely change to taxes on interest income is minimal. The knee jerk reaction is to sell credit risk along with equities, but to the extend there was a lot of tax related selling in equities, that shouldn’t impact fixed income in the same way.

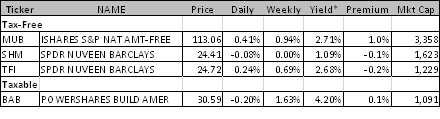

Muni’s Do Well – Again – Maybe Too Well

This is beginning to sound like a broken record, but municipal bonds did very well relative to other risky asset classes. While underperforming treasuries, they significantly outperformed investment grade or high yield. To some extent, the tax concerns should have helped munis, so that makes sense. BABs on the other hand are taxable, and the outperformance was striking, and has encouraged us to reduce positions here.

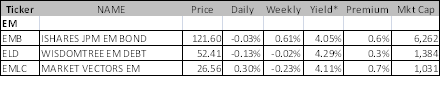

Ho Hum on EM

EM did okay. Spreads widened a little, but the EMBI held its own on a yield basis. The bonds benefited enough from the move in treasuries to perform “ok”. I don’t like EM here yet as it has too much European risk, and the combination of spread/yield just doesn’t resonate with me.

Spain – Continued, if not Growing Weakness

Spanish bonds sold off again last week. The 5 year bonds were out 14 bps to yield 4.57% and the 10 year bond was down a point. Italy held in surprisingly well.

The Spanish 3.75% of October 2015 are worth watching again. When we recommended getting out on Nov 1, the price was 100.52 and the Euro was 1.294. The bonds recovered a bit on Friday from their Thursday lows, maybe a sign that the ECB will do something. Anyways at a price of 100 with the Euro back at 1.272 they are becoming interesting again, especially as I believe Europe has to launch a program or risk seeing an escalated across the globe sell-off in risk assets.

Annaly Capital as an “Other”

In the very aggressive trading portfolio we have added a small, albeit 2% weighting to NLY. While understanding many of the reasons for last week’s sell-off, and how they apply to this company and how mortgage QE isn’t great for them, there seems to be some value here, and the high current income (not sustainable, but still likely to remain high) is worth a look, especially in more active accounts. It is some high beta for us in what is an otherwise only moderately bullish outlook.

Fixed Income Allocations

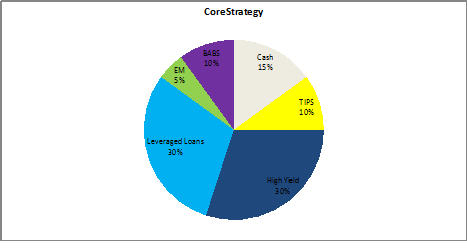

The “Core” strategy is meant to have limited number of trades. It would only be readjusted as longer term views change, or short term views become very large or very strong.

This strategy should have returned about 0.21% for the week and 0.31% for the past two weeks, which is a bit better than the approximately 4.00% annual yield on the portfolio.

This week we recommended cutting BABs to only 10% and increading HY to 30%. The outperfromance of BABs, given their taxable nature is too high. The allocation to high yield is on the aggressive side, but we like it here. Thought about allocating some to investment grade and selling the EM, but held off for now. The core strategy remains at medium levels of duration and credit risk. The “target” yield on this portfolio should be about 4.23%, but so far the portfolio has performed better than the yield.

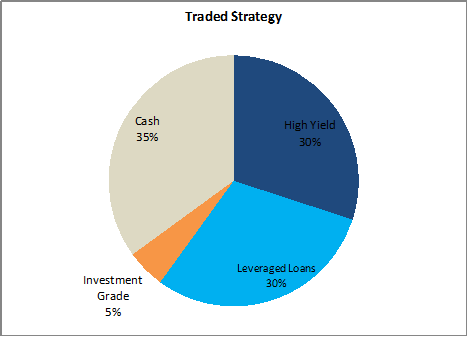

The “Traded Strategy” is meant to have more frequent rebalancing and to capture smaller moves in the market.

The traded strategy had returns of only 0.15% last week. It underperformed the core as we left the high yield exposure relatively high, but had cut EM which actually performed okay. The two week total return is 0.35%, so still running at a good pace. The duration exposure is coming from investment grade, and we have taken the high yield component back to an aggressive level, but asides from some fast money, particularly in the CDS indices, we think these bonds should remain attractive through year end.

The expected yield of this portfolio is back up to 3.7% and the duration risk is low, while even the credit risk has been pushed back up to moderate.

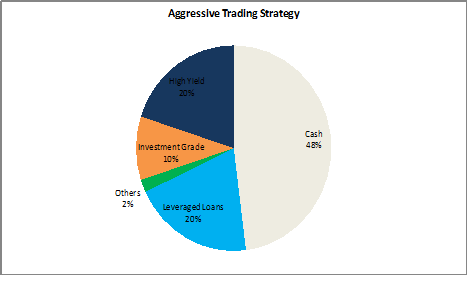

The “Aggressive Trading Strategy” is meant to be traded frequently and will expect to generate more from positioning than from yield.

The strategy should have generated just under 0.39% last week and a 2 week total of 0.6%. The portfolio outperformed with over half in cash, and the bulk in BABS which did very well and the rest in leveraged loans which were about flat on the week. We allocated back a little HY early in week, and have a more aggressive positioning coming into this week.

The portfolio has low duration risk and a moderate to low amount of credit exposure. The small allocation to a high dividend paying stock is risky, but we think warranted, given what seemed like a dramatic over reaction by the market last week.