The T Report: Just Another Manic Thursday

What Next?

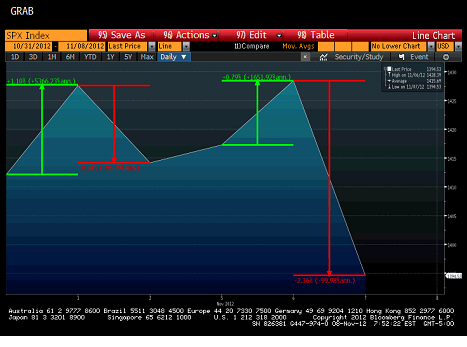

There is a lot of concern about yesterday’s move. I think they are wrong. We have had several large moves in the past week (greater than 0.75%) and have had reversals the next day. In most cases, the reversals themselves were large moves.

It is hard to get extremely bullish here with everything going on in Europe, but I am not particularly scared by yesterday’s move. I was looking for S&P to hit 1,375 to 1,400. I wasn’t expecting it to happen in one day, but it did. So now what?

I wrote a lot about that yesterday in Afternoon T Report. Nothing has changed my mind since then. We did get the Greek approval as was expected, but it was a very close vote.

Now the real key is to figure out what Mr. Draghi is up to. He is clearly cajoling or even threatening Germany. The question is whether he is doing this to soften the blow when he acts preemptively, or is he desperate to get them on board with the program so that he can move forward? The former is encouraging for risk assets while the latter is potentially a disaster.

If we get a decent unemployment claim today, we will know it wasn’t all just about supporting Obama. If the number is ugly, expect some people to go berserk with conspiracy theories. I’m kind of hoping for a bad number just to watch that.

I remain neutral to slightly bullish U.S. risk here. Have the capacity to add on weakness if it is on nothing specific. I actually like Apple here, though that was a bad decision yesterday afternoon. Fixed Income I think is only okay. It isn’t going to run away from you here, so I think being patient to add in case of weakness is prudent. The market is extremely thin. I am just neutral Europe. If the ECB acts there will be time to get in, and if the ECB doesn’t act, there won’t be time to get out.