TFMkts Fixed Income Overview and Allocation Strategies

Pop and then Gravity

The week started positively. In spite of fears related to hurricane Sandy, risk assets started the week on a positive note. Wednesday, when U.S. markets finally opened, the rally was a bit tentative, but then it gained strength on Thursday. We had remained positive that morning on risk, in a large part because of The Visible Hand of central banks. But as the day wore on, we became concerned that news out of Europe was not good. We recommended getting out of risk-on trades and ultimately on Friday morning became bearish over fears that the European “Maniacs” would finally do it and let Greece implode, causing problems for Spain and Italy.

Apple certainly helped the bear case as it broke its 200 day moving average and triggered an avalanche of selling – I’m assuming a lot of algorithms were set up to push on that once it broke.

With the election looming, some allegedly good numbers out of China and the speed of the correction, so clearly led by one stock, I wouldn’t be surprised to see some stability early in the week, and even a bounce, particularly if some people get caught short Apple here and the algorithms decide to sweep it the other way.

In spite of the potential to bounce, and in spite of lingering thoughts on Spanish OMT (the thoughts are fears when short, and hopes when long) we are in mild “risk off” mode. I’m not expecting a big sell-off, but events in Greece and comments from various Troika representatives send a chill down my spine. After 2.5 years of trouble, they still don’t seem to understand credit.

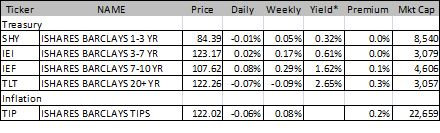

Interesting Moves in the Long Bond

Treasuries had a strange week. The long bond underperformed a bit. That may be in part due to the auction, but it was still interesting to see it struggle to do well, while other parts of the curve seemed fine. Maybe it was the image of people in America lined up waiting for gas that spooked it, maybe it was just the auction, maybe it was a skeleton crew of traders, but I thought it was interesting to see it struggle. Especially as consensus grows that the Fed will continue to buy treasuries after the conclusion of Operation Twist.

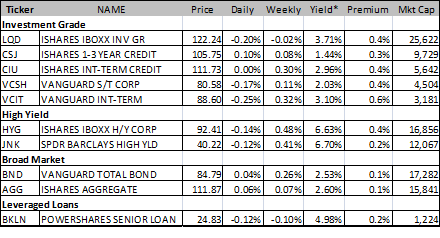

Corporate Credit outperformed on Friday, but….

Corporate credit did well. The investment grade sector struggled by the end of the week. The LQD ETF did worst amongst the corporate credit ETF’s, but that is largely a function of how many long dated bonds it holds, and those were dragged down by the weakness in long dated treasuries.

The CDS indices were the best way to watch credit this week, as the bond market was less liquid than usual – a combination of the effects of the hurricane, thinly traded stock markets, no real new issue calendar, and a general lack of interest. IG19 was 101 bid on Monday morning. That was about 3 bps wider than where it had closed, and seemed like a great opportunity to sell protection (as I wrote to our institutional clients at the time). It got to 97 by Thursday afternoon which seemed like a good time to turn neutral and finally time to get short at 95 when the markets were better overnight and with a post NFP pop. IG19 ended the week at 97.5. It is still a reasonable short here.

Leveraged loans were a bit disappointing. They sold off a little, so while the underperformance versus high yield in a strong overall week makes sense, the actual losses are perturbing if not outright annoying. We still like this sector, think it is defensive and has strong demand from CLO’s and banks, so will live with what has turned out to be a bad allocation decision, at least this week.

If stocks don’t stabilize, expect credit to worsen as it outperformed going into the close. Europe again will remain a key here, but the real wildcard is if any junk company hits at problems that the market may not have anticipated. The market is still trading with minimal overall default risk priced in. Yes, specific issues are recognizing their specific problems, but as a whole the market has shrugged off corporate earnings weakness surprisingly well – perhaps too well.

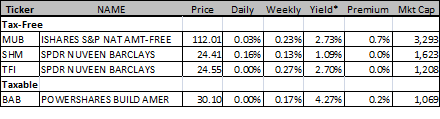

Muni’s Do Well – Again

Municipal bonds were the best performing market out there. Both tax-free and taxable munis did well, even the long end, they managed to avoid getting dragged down with treasuries. We continue to like this segment and they still look “cheap” relative to investment grade bonds, but the outperformance will take a breather soon.

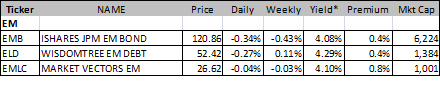

EM Takes A Beating

EM did poorly right from the start. While other fixed income asset classes opened the week okay, EM never really got going and the swoon accelerated. With Greece getting trickier by the day, and growing doubt that any serious solution for Spain will be found, the EM markets look poised to see further outflows. I remain neutral these bonds. There is a chance we will see a pop on Monday with China Non-Manufacturing PMI coming in fairly strong, but I expect that will be short lived, and it may actually turn us to bearish these bonds in our aggressive strategies.

Spain – Will They or Won’t They?

This is the same question as last week and the only our answer has changed. We still follow the Spanish 3.75% October 31, 2015 bond. We had liked it on the long side. At this stage we are neutral. These bonds moved from 100.3 last Friday to 100.5 on Thursday, only to finish the week at 100.2 and earned about 0.1 point of interest. We took these bonds off all of our strategies on Thursday as we came out with our revised view on Europe. The move in the EUR/USD FX rate also bears scrutiny. It hit a weekly high of 1.296 on Wednesday, slide back to about unchanged on the week by Thursday, and sold off significantly on Friday, ending the week at 1.2835.

While OMT may come, we think the risk that it doesn’t come has grown, and that it will come in a diluted format when and if it finally comes. We haven’t switched by to bearish Spanish debt, but if we do, we will target the 5 to 10 year part of the curve as they are overconfident about the impacts of OMT. We are fairly certain that contrary to the promises that the ECB won’t be senior in priority to other bondholders, they will be if the problem gets worse. Just look at what is going on around Greece and you can only come up with one logical conclusion – the ECB will say what it needs to at a time to help the market, but when push comes to shove, they will fight losses tooth and nail.

Fixed Income Allocations

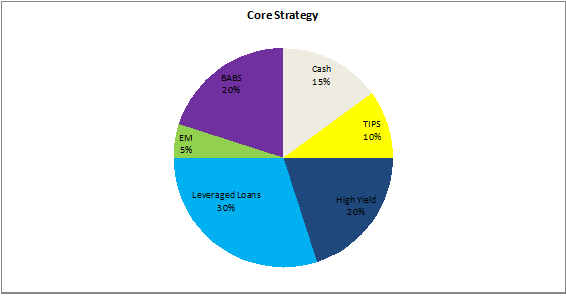

The “Core” strategy is meant to have limited number of trades. It would only be readjusted as longer term views change, or short term views become very large or very strong.

This strategy should have returned about 0.1% for the week, which is a bit better than the approximately 4.10% annual yield on the portfolio.

The only change this week to the core strategy was to sell out of the “other” category, which were Spanish government bonds, and leave that in cash. The strategy is a bit more “risk on” than we currently like, but as a core strategy, not meant to be overly traded, it makes sense still to us. It is unusual to go from fairly bullish Spain to negative, but as we wrote earlier, the tone just seems awful. The core strategy remains at medium levels of duration and credit risk.

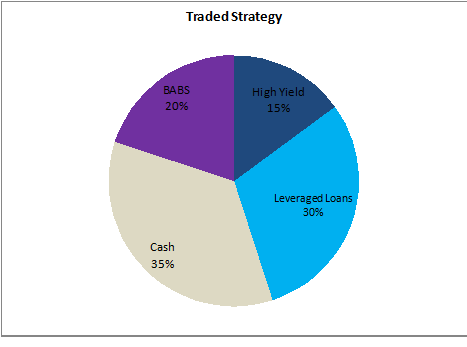

The “Traded Strategy” is meant to have more frequent rebalancing and to capture smaller moves in the market.

The traded strategy had returns of just under 0.2% last week. On Thursday, we took out the allocations to other and EM, and cut the high yield allocation from 30% to 15%. That is in line with our mild risk-off call. Spain should drive it, and that will impact EM and then high yield the most. It is tempting to ad TIPS here, but so far haven’t since in spite of pressures caused by hurricane Sandy and some enthusiasm over a potential recovery in China, we just don’t see a global economic rebound. The next move here would be to either take down more high yield if the situation looks to get worse, or there are some earnings problems, though I could see a case where we put the cash component back to work in the markets.

With the shift to cash, the expected yield of this portfolio has dropped to only 3.35% and the duration risk is low, while even the credit risk has dropped to medium low.

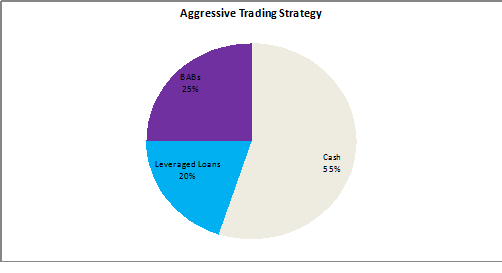

The “Aggressive Trading Strategy” is meant to be traded frequently and will expect to generate more from positioning than from yield.

The strategy should have generated more than 0.2% last week as long high yield worked and investment grade hedged with treasuries worked well. The leveraged loan trade and EM exposure both dragged down returns for the week.

The portfolio is now positioned very conservatively, with an expected yield of just over 2% and low duration and low credit exposure. The bias here is to continue to reduce risk and possibly add some short positions with shorts in high yield or un-hedged corporate bonds being the most likely.