TFMkts Fixed Income Overview

From Risk Off to Risk Neutral

Until Friday of last week, we had been in a risk off stance. We had believed that the market was too optimistic about what immediate impact QE would have and that too many had over-estimated how eager Europe was to proceed with new and bigger bailouts. Those all helped our view, but in the end, earnings turned out far worse than most were expecting. The earnings story has been a drag on the market for the first time in recent memory. Even Apple struggled. The outlooks were even gloomier than the actual results.

So why are we switching from Risk Off to Risk Neutral or even Risk On?

First, S&P 1,400 helps. We believe the range on this downside move had been 1,375 to 1,400 so there is still some room lower, but we hit levels that make sense for us to look for a reversal. Then there is Apple. For the first time in a long time, I can see some strength building for Apple. Maybe we will get more profit taking, but given their earnings, the cash on hand, and the magic of round numbers, right around $600 seems like we could see some support and new investors who missed the surge to $700, step in and take a shot. Apple is so large in the Nasdaq, the Nasdaq 100 (QQQ) that it alone can drive the indices. Even the S&P is affected directly and indirectly by Apple.

But the real reason is OMT. The market is a little spooked this morning by the Troika finally admitting that the “Official Sector” would have to take some losses on their Greek exposure. It really shouldn’t have taken 10’s of millions of dollars of taxpayer funded money to pay for the people and their trips to reach such an obvious conclusion, but it did. In any case, that is another reason to be legitimately fearful that the EU is tiring of bailouts. It is this feeling that Europe is getting sick of bailouts that makes me believe we see OMT very soon.

Spain and Italy ultimately need the support of OMT (ECB) and the ESM. Playing a waiting game has become too dangerous. If Spain and Italy aren’t nicely nestled into a program soon, they may not get one. Spain, the most stubborn of all potential recipients may finally be aware of this and will act. It does them no good to delay for better terms, when the most likely outcome of further delays is “no terms”.

I don’t think the ensuing rally will be large or last long, but that is how we see the market playing out over the near term.

A Dull Weak in Treasuries

Treasuries had small gains across the board last week. The moves in treasuries tracked equities reasonably well as the “risk on” and “risk off” mentality was clearly evident. TIIPS actually eked out a gain last week in spite of a decline in the CRB index.

|

|

NAME |

Price |

Daily Chg |

Weekly |

Yield* |

Premium |

Mkt Cap |

|

Treasury |

|

||||||

|

SHY |

ISHARES BARCLAYS 1-3 YR |

84.37 |

0.02% |

-0.01% |

0.31% |

0.0% |

8,488 |

|

IEI |

ISHARES BARCLAYS 3-7 YR |

123.03 |

0.24% |

0.02% |

0.62% |

0.0% |

2,165 |

|

IEF |

ISHARES BARCLAYS 7-10 YR |

107.45 |

0.63% |

0.20% |

1.58% |

0.0% |

4,631 |

|

TLT |

ISHARES BARCLAYS 20+ YR |

122.64 |

1.45% |

0.73% |

2.54% |

0.4% |

3,103 |

|

Inflation |

|

||||||

|

TIP |

ISHARES BARCLAYS TIPS |

121.82 |

0.49% |

0.09% |

|

0.2% |

22,573 |

Weakness in Corporate Credit

High Yield was the weakest, being down about 0.5% on the weak. High Yield cash actually outperformed the CDS market, but we finally saw some concerns that earnings could impact the high yield market. High Yield should perform well if we get another “risk on” move, and so far we have not seen significant outflows, but if earnings continue to be weak, we will see some shift out of high yield bonds. The catalyst could be a large miss on earnings from a highly leveraged, widely owned name. Names like CHK, HCA, would certainly fit the bill. I’m not expecting that yet, but it is time to remain vigilant.

Investment grade was down a little on the week on an outright basis, and significantly down on a spread basis as treasuries, particularly the longer end managed gains. On the CDS side, the index struggled as investors started to put on hedges and some active money started trading form the short side. The fact that LQD is trading at a reasonable premium in spite of market weakness is either a very good sign, that there is still underlying demand or just a delayed reaction as investors still covet bonds relative to CDS. That has been a warning sign in past. Bond investors don’t want to sell bond “they won’t be able to buy back” and instead hedge with CDS. Given my current “risk on” view, I’m not particularly concerned, but it yet another thing that bears watching.

I like leveraged loans the best. The closed end ETF’s have seen their discount shrink, so any “cheap way” to play the market is gone. CLO’s continue to price and do well, so there is demand on that front. Banks are once again becoming lenders, which further reduces selling pressure on the market. I am a bit concerned that many of the loans are less secure than I would like, but at this stage in the game, I think they offer better protection than high yield still, and the yield differential is relatively small. Leveraged loans are currently our favorite “carry” trade with high yield offering the most near term upside.

|

Ticker |

NAME |

Price |

Daily Chg |

Weekly |

Yield* |

Premium |

Mkt Cap |

|

Investment Grade |

|

||||||

|

LQD |

ISHARES IBOXX INV GR |

122.64 |

0.49% |

-0.13% |

3.76% |

0.8% |

25,534 |

|

CSJ |

ISHARES 1-3 YEAR CREDIT |

105.79 |

0.04% |

-0.05% |

1.51% |

0.2% |

9,690 |

|

CIU |

ISHARES INT-TERM CREDIT |

111.67 |

0.16% |

-0.19% |

3.02% |

0.2% |

5,584 |

|

VCSH |

VANGUARD S/T CORP |

80.62 |

0.07% |

0.04% |

2.07% |

0.4% |

4,450 |

|

VCIT |

VANGUARD INT-TERM |

88.55 |

0.28% |

-0.05% |

3.21% |

0.5% |

3,126 |

|

High Yield |

|

||||||

|

HYG |

ISHARES IBOXX H/Y CORP |

92.48 |

-0.24% |

-0.52% |

6.29% |

0.0% |

16,952 |

|

JNK |

SPDR BARCLAYS HIGH YLD |

40.28 |

-0.15% |

-0.35% |

6.61% |

0.0% |

12,069 |

|

Broad Market |

|

||||||

|

BND |

VANGUARD TOTAL BOND |

84.75 |

0.21% |

0.08% |

2.47% |

0.0% |

17,273 |

|

AGG |

ISHARES AGGREGATE |

112.03 |

0.27% |

0.07% |

2.22% |

0.1% |

15,908 |

|

Leveraged Loans |

|

||||||

|

BKLN |

POWERSHARES SNR LOAN |

24.86 |

-0.10% |

-0.30% |

4.98% |

0.3% |

1,200 |

Muni’s Do Well

Muni’s had a decent week, with MUB only widening a little bit, while BABS performed in line with treasuries. The yield on BABS with their lack of supply should continue to be supportive. While government spending has to come down, we expect municipal bonds to continue to do well, though we focus more on the relative value of BABS versus corporate.

|

Ticker |

NAME |

Price |

Daily Chg |

Weekly |

Yield* |

Premium |

Mkt Cap |

|

Tax-Free |

|

||||||

|

MUB |

ISHARES S&P NAT AMT-FREE |

112.00 |

0.13% |

0.27% |

2.89% |

0.5% |

3,270 |

|

SHM |

SPDR NUVEEN BARCLAYS |

24.40 |

0.00% |

-0.20% |

1.21% |

-0.2% |

1,623 |

|

TFI |

SPDR NUVEEN BARCLAYS |

24.54 |

0.16% |

0.00% |

2.79% |

-0.2% |

1,207 |

|

Taxable |

|

||||||

|

BAB |

POWERSHARES BUILD AMRICA |

30.05 |

0.43% |

0.77% |

4.27% |

0.2% |

1,064 |

EM Slides with Risk Off

EM did poorly underperforming even high yield bonds. These bonds got caught in the overall risk-off mentality and deserve to be. They represent real risk if we face a global slowdown. I was somewhat encouraged by the fact the local currency debt actually did reasonably well. This sector has been a big beneficiary of “yield chasing recently”. It makes me nervous, but I do think we get another round of risk on, and these bonds will do very well under those circumstances. In any case, as so many domestic assets have hit yields that seem hard to chase further, we should see continued interest outside of the U.S. That may explain why local currency debt, at least as represented by LEMB did so well relative to dollar denominated debt.

|

Ticker |

NAME |

Price |

Daily Chg |

Weekly |

Yield* |

Premium |

Mkt Cap |

|

EM |

|

||||||

|

EMB |

ISHARES JP MORGAN EM BOND |

121.80 |

-0.27% |

-0.76% |

3.94% |

0.7% |

6,224 |

|

ELD |

WISDOMTREE EMRG MKTS DEBT |

52.36 |

0.06% |

-0.59% |

4.30% |

0.1% |

1,377 |

|

EMLC |

MARKET VECTOR EMERGING MKT |

26.72 |

-0.04% |

-0.22% |

4.09% |

0.9% |

935 |

Spain – Will They or Won’t They?

For now, our “other” category is really Spanish debt. You can look at Italian debt, but it is just a lower beta Spain, or you can look at Greek debt, which we like, but is very high beta.

The 3 year Spanish bond continued to be weak. The 3.75% October 31, 2015 maturity bond dropped about a point last week, from 101 to 100. The yield has moved back to 3.72% from a low of 3.3% on October 18th. There is growing concern that Spain will not ask for a bailout in a timely manner or that the conditions will be harsh.

We were against these bonds at the peak, because it seemed the market was pricing in more than might be delivered. I do not believe that the ECB will support Spanish 3 year bonds below 3%. The ECB and the ESM are there to help Spain (if they ask) but not to be too generous. We believe that late last week we saw more signs that Spain was heading to the bailout arena. In that case, these bonds should do well, and the Euro should do well. We don’t like longer dated bonds because in all likelihood, they will eventually get subordinated. The ECB can say they won’t subordinate holders, but if Spain continues its downward spiral, that is the inevitable conclusion. Those longer bonds would likely do better on any immediate announcement, but I think for a balance of risk/reward these bonds make sense.

Fixed Income Allocations

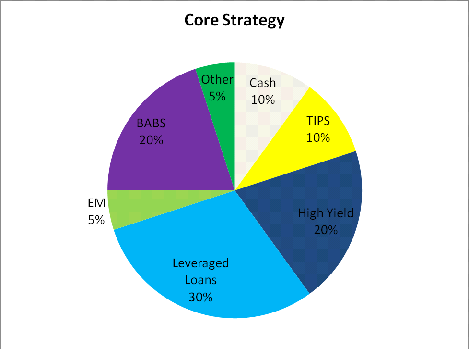

The “Core” strategy is meant to have limited number of trades. It would only be readjusted as longer term views change, or short term views become very large or very strong.

The current core strategy should be able to produce a current yield of about 4% and has rought “medium” risk in terms of credit exposure and duration risk. The focus here is clearly high yield with 50% of the portfolio held in non investment grade assets. There is a strong bias towards leveraged loans, because we see continued demand for the underlying, and the yield give up seems low relative to the additional safety. The longer term nature of the “core” portfolio lends itself well to allocations to managed mutual funds.

The “Traded Strategy” is meant to have more frequent rebalancing and to capture smaller moves in the market.

The current traded strategy should provide current yields of about 5% with a medium duration risk, but a medium high credit risk. The exposure to high yield, EM, Other, and BABS is all increased relative to the core portfolio. This is in response to the belief that the near term weakness in risk markets is nearly over and we should see a return to risk on mentality. That would be good for credit spreads, but bad for “risk free yields” so we have kept the duration reasonably low.

|

Aggressive Strategy |

|||

|

Long Positions |

Short Positions |

||

|

Investment Grade |

20% |

Long Term Treasury |

-20% |

|

High Yield |

20% |

|

|

|

Leveraged Loans |

30% |

|

|

|

EM |

10% |

|

|

|

BABS |

25% |

|

|

|

Others |

15% |

|

|

The “Aggressive Strategy” is meant to be traded frequently and will expect to generate more from positioning than from yield.

The current aggressive strategy should yield close to 5% but has the most aggressive credit risk exposure, and in spite of the interest rate hedge, has a duration similar to the other strategies. This is a bet on spreads performing well and has included investment grade (on a rate hedged basis) in the mix. It will need bank spreads to perform well, which they should if OMT comes through.