The Weekly T Report: PIIGS Bonds, HY Bonds, Bank Bonds, and Recoupling

Spanish, Italian, and Irish 4 year Bonds This Year

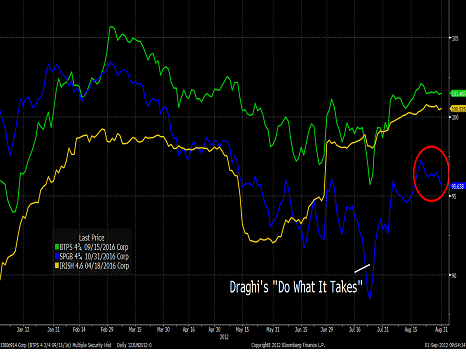

Don’t Ignore the Irish Comeback

This chart is important for a couple of reasons. The story in Ireland doesn’t get much attention, but what a comeback. The Irish 2016 bonds started the year yielding 7.5% and are now down to 4.43%. So while we are inundated with reports about “Italy is not Greece” we rarely see anything about the improvement in Ireland. Or for that matter, Portugal, where the 5 year bond started the year at 15.6%, peaked at almost 22% and is down to 7.6%. That is still in the danger zone, but a stunning turnaround.

So while it is easy, and even fun to point out how nothing worked in Greece, the situation in Ireland has turned around and even Portugal seems to be coming around. Heck, even the much maligned Greek PSI bonds are getting back to their CDS auction level from March. The “front-end” bonds (which are 2023 maturities) have clawed their way back to 22 from a low of 14, and have actually managed to accrue more than 1% of interest. I’m not making light of the situation there either and think it remains precarious unless the Troika does some form of debt extension (or better yet forgiveness), but there have been signs of slight improvements.

Patience is Running out in Spain and Delays are Costly

Over the past week or so, the market is starting to question whether anything will happen in Spain. The 2016 bond hit a low yield of 4.99% on August 21st and has drifted back to 5.45%. The move in the 10 year is more pronounced as it went from 6.18% to 6.83%.

One encouraging sign is that the 2 year has been pretty stable, moving from 3.42% to 3.59% and the yield here actually declined.

|

Eurozone |

||

|

PMI |

Unemployemt |

|

|

Jan |

48.80 |

10.80% |

|

Feb |

49.00 |

10.90% |

|

Mar |

47.70 |

11.00% |

|

Apr |

45.90 |

11.10% |

|

May |

45.10 |

11.20% |

|

Jun |

45.10 |

11.30% |

|

Jul |

44.00 |

11.30% |

|

Aug |

45.30 |

|

The problem is that while words and promises of action may be supporting the markets, they aren’t helping the real economy. It is one thing to buy a stock based on some hope of support but it is an entirely different thing to hire a few more workers. Those workers can be hired once the programs are announced. All these delays, whether on the banking recap side, or sovereign debt funding cap side, mean that the economies continue to struggle.

The unemployment rate is heading the wrong direction, and the PMI data is quite horrible. These are diffusion indices, so each month is worse than the last. So as bad as July had gotten, August was worse again (below 50).

The politicians and central bankers have to do something that impacts the real economy. It is relatively easy to make the markets happy, for at least a short time, but without actually getting money into the system and flowing into the economy and improvements will be fleeting, and we are seeing signs that the markets are losing patience. Without action the markets will sell-off. I expect action this week, and will be very bearish if we don’t get it.

Expect a Limited ECB Program

I think any ECB program will be limited to the front end of the curve. They might be willing to go out to 5 years (LTRO or direct purchases, or some form of EFSF/ECB lending), but not beyond. Defending the entire curve can become very expensive, and currently has no real impact for the country. It might look nice to have 4% 10 year bond, but it is actually far more important, and easier to achieve a 2% 2 year bond.

Look at the ECB’s purchases in Greece. They were skewed towards the front end. They did buy along the curve, but the weighting was heavily 3 years and in. This is the point in the curve “old style” bankers like. It is easier to convince politicians to lend short term. As a risk taker, I am typically biased towards the longest dated, lowest price bond in a stressed situation, but I think the policy makers will act differently. They will focus on the front end. Longer dated bonds have a much higher likelihood of becoming subordinated over time. Even if the ECB or EFSF start out “pari passu” if the crisis doesn’t turn around, it is reasonable to expect they will take steps to enhance their seniority.

So some of the continued curve steepening may be reaction to what the program will actually look like, and not be a sign that no program is coming. I still believe that the ECB will launch something as early as this week and we will see pressure taken off Spanish and Italian markets.

Retail Isn’t Playing the Corporate Bond Market like Institutions Think They Are

Retail isn’t getting bearish high yield or corporate bonds, nor are they even turning their back on the product, but they are getting to the point of being fully allocated. There seems to be a perception that the flood of retail money into the corporate bond space and high yield in particular is limitless.

Well, HYG had 176.4 million shares outstanding as of Friday, up from 176.2 million shares on August 3rd. Expect another bump when the dividend is paid, but this isn’t a sign that retail is chasing the market. I also see HYG currently trading at a discount of 0.02%, hardly a sign of froth or great demand.

JNK, which has a smaller market cap, went from 290.4 million shares to 299.4 million over the same period. So inflows, but less than the 15 million shares created in July.

The story is about the same with LQD representing investment grade. The EM ETF’s had been flat but did attract some money late last week on the back of QE hopes globally.

So I’m just not sure we are going to get the continued flood of retail money, and it seems investors may be positioned on the hopes of that. With HYG now at its highest price of the year, the potential for a pullback seems pretty high. With an indicated yield of only 6.6% there isn’t much room for error.

That is the problem for many of the high yield investors. To generate double digit returns, you are now either stretching down the credit curve and buying some bonds you would normally shun, or leveraging up on the names you like. That is the dilemma facing many credit hedge funds. Generating 10% returns in a 6.6% world isn’t easy, especially when generic shorts haven’t worked.

I’m not expecting a major pullback, but could see a 2% to 3% move down. I think HY ETF’s are the best way to play the short, because they really are getting capped on the upside, don’t get to play new issues at par, and have liquidity. HY CDS isn’t a bad option, but there remains a decent short base, so the weakness will not be as pronounced, and the possibility for a squeeze is much higher. The equal weighted, fixed duration, roll approaching, HY CDS has more upside potential than HYG here, on our quick look at the names in the bond market.

Bonds will be the worst way to play it, because by the time you hit a bid, you will have missed the first 1%, and by the time you try and buy back the bonds, the offer will have been jacked. I’m not seeing a major correction, just some supply induced overhand, coupled with fast money being too long, and no one wanting to tolerate much mark to market risk.

CDS and TBTF CDS

I continue to think bank CDS remains attractive. JPM at 120 with a 141 billion market cap just seems wrong. This name traded below 50 back in 2010. The stock was higher back then too, but the ratio seems off to me. BAC and C at 225 scare me a bit, but even there, the TBTF is likely to play out.

Some of this is a legacy of the past few years. Some of it is concerns over Europe. Some is related to LIBOR. Some is a function of the anti bank rhetoric. Some is legitimate hedging needs, but as a whole, I think the bank CDS risk is cheap. I don’t think bank stocks are cheap. All of the above reasons will weigh on shares, and the low volumes will hurt revenues, so I don’t like US bank stocks here as much as I like their CDS.

Wouldn’t load the boat on it as it is volatile, but I have to say I like it, and even IG18 remains in my good risk bucket.

I think we can leak wider a bit here, as IG18 continues to trade rich, but I don’t see a big move, and assuming Europe can gets its act together, think the CDS indices will outperform coming into the roll.

Re-Coupling

I guess my overall theme is re-coupling. Spain and Italy catching up to Germany. Europe catching up to the US. Apple falling back to earth. CDS catching up to bonds.

I’m slightly negatively biased here, but the things I like trading from the long side are generally high beta (or insane) and the shorts seem to be viewed as safe to be long by most.

We had been long and had like banks and Spain, but also the US. That has worked. We have been cutting risk and fluctuating between a long and short bias here, and it has been okay. Timing remains critical. I’m worried about being a bit short over the weekend as Europe could surprise, but their tendency all too often seems to be to get a little contentious ahead of decision time, which is really the September 6th ECB announcement.