LIBOR: Non-linearity in a world that struggles with basic arithmetic

How 5 Liar Banks Could Get Away with it.

Let’s say you could prove, beyond a shadow of a doubt that 5 banks all lied by 20 bps on Libor on a particular day, what is the lowest impact on LIBOR? ZERO.

How could 5 liars have zero impact? It is possible for 5 banks to have lied by 20 bps, and individually be able to demonstrate that they their lie didn’t impact LIBOR. If 11 banks submitted 400 and 5 banks submitted 410, then LIBOR would have been the average of (7 banks at 400 and 1 bank at 410). Individually, each lying bank had no impact. You need to be able to look at all the submissions at once.

Using all submissions LIBOR would have been off by the bare minimum of 2.5 bps. If you can argue that LIBOR would have been 11 banks at 400 and 5 banks at 430, then LIBOR would have been the average of (7 banks at 400 and 1 at 430).

Whether it is “collusion” or just multiple banks doing the same thing in their own best interest, any key to a successful LIBOR lawsuit will be to show what LIBOR would have been had all lying banks put in the real rate. Going one by one could lead to miniscule settlements.

In LIBOR Liebility we go through a more complex example, but the conclusion is the same, the lawsuits need to be able to look at the simultaneous impact of lies and not just one by one.

Which Banks to Focus On

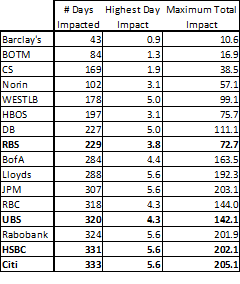

From August 1, 2007 until January 30th 2009 (crisis period and before SocGen started submitting on Feb 9, 2009), I took a look at all the submissions. Then I recalculated LIBOR as if one bank was now the highest. So I would ensure that Barclay’s was now the highest contributor for every day during that entire 18 months and calculate what LIBOR would have moved based on them alone. I did this for each bank. Here are the results for US 3 month LIBOR.

This table is flawed in I don’t look at “combinations” of potential lies which is key because of how LIBOR is calculated.

On a quick looks, it is clear that even if Barclay’s was a liar (which they seem to have admitted), their impact, as a standalone basis was minimal. They were so high, that even if they were lying (by themselves) it wouldn’t have made a difference to the setting of LIBOR. Playing with the math, I also think it protects them if other banks “lied” since their original submissions were already so low. Bank of Tokyo Mitsubishi, CS, and Norinchukin have less to worry about.

RBS is a little strange, in that they stand out as having the potential to impact LIBOR on many days, but the maximum possible total impact would have been relatively low. This indicates that they were typically at the high end of submissions, but low enough to be counted.

There are a few banks that would have big impact if they were proven to be liars, but a few of them, like Rabobank and JPM and RBC seemed to do reasonably well throughout the crisis, so it isn’t that surprising that they would generally be at the low end of submissions.

I find UBS, HSBC, and Citi more interesting as they were clearly at the low end fairly often, and that just doesn’t tie out well to my perception or to some CDS and stock price data.

There is a wealth of data

For once, there is no lack of data. The question will ultimately be does the data prove that LIBOR was a lie? And can the data be used to determine the overall impact all liars on a given day had to LIBOR or will each bank be looked at in isolation.