LIBOR Liability, A Framework for Liebor Liebility

Pre-Crisis – Expect Fines but no Successful Lawsuits

My focus has been primarily on the US LIBOR rates as it is the biggest market and comes up repeatedly in the FSA’s letter regarding Barclay’s. The e-mails and phone conversations are despicable. There is clear intent to manipulate markets for the benefit of themselves and some customers. Given the size of their books, it probably even added up to some decent amount of money over the course of the years, but it isn’t adding up to billions in the pre crisis years.

Without collusion, there was no ability for any 1 dealer to move LIBOR by very much. The markets were calm, and credit was freely available to banks, so they all posted very similar and consistent rates. There is no real evidence of persistent lying in any one direction during this period. The rates make sense when looking at the “TED” spread.

So the banks should be punished by regulators. Fines should be imposed, and employees should be treated as having attempted to commit fraud. Those fines will be significant, but in terms of big lawsuits, they just won’t come from this period.

There wasn’t enough ability for any one bank to move LIBOR, and there is no consistent pattern of being too high or too low (even the FSA didn’t allege that during this period) so finding damages will be extremely hard if not impossible. Again, if the regulators find collusion, they should punish those banks even more severely, but during this period, even collusion is unlikely to have moved LIBOR by more than a basis point.

The Data Doesn’t Lie

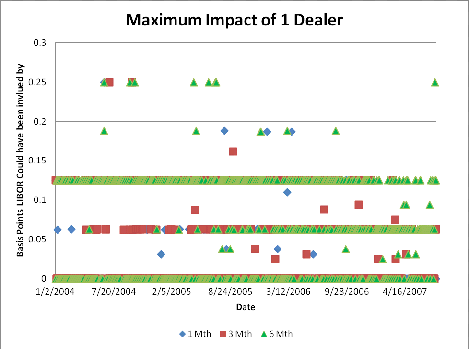

The banks may have lied, but the data doesn’t. From January 1, 2004, until July 31st, 2007, there just isn’t the ability for 1 dealer to move the market. There isn’t an obvious pattern of LIBOR being mispriced as the TED spread moved, but seemed in a reasonable range given the general lack of credit concerns during much of that period.

So I’ve looked at 1 month, 3 month, and 6 month USD LIBOR. That would cover the bulk of USD contracts linked to LIBOR. I looked at maximum possible manipulation. I looked at the case where a dealer at the edge of being excluded for being too high or too low, moved to the other extreme. That is the maximum possible influence a dealer could have.

It was rare for a single dealer to be able to influence LIBOR by more than 0.125 bps. Being able to move LIBOR by 0.125 bps means the range of dealers from just excluded to just included, was 1 basis point. That is the problem with looking for damages from this period. Although there seems to be little doubt that dealers were gaming the system or committing fraud, they were running positions where the scale of their business made it worth trying for that 1/8 of a bp (or more with some collusion). To find damages will be extremely difficult since the manipulation was allegedly up and down in addition to being small.

Even on the days with the biggest possible variation, it would have impacted LIBOR by 0.25 bps.

If you had a $1,000,000,000 exposure to the LIBOR fixing (that is a substantial size), then 1/8th of a bp would mean you were out about $6,250 if you referenced 6 month LIBOR. If you had monthly LIBOR, the cost to you would have been about $1,050.

Post crisis, the variation picks up and gets far more interesting. We have started to highlight some of the issues during this period and are attempting to quantify the range of potential damage.

Who Bears the Liability?

I have seen a hodge podge of articles looking at potential damages. Only a couple of the articles seem to have thought it through.

I believe that banks that lied will be sued for their lies. I do not think you can sue an “honest” bank just because you have a contract on with them that was affected by other banks’ lies.

So looking at potential liability by market share doesn’t make sense. The regulators fines might be based on that, but ultimately big lawsuits are unlikely to be won based on market share. If a particular bank was honest and did not commit “fraud” or didn’t manipulate LIBOR, why would you be able to sue them for damages?

I may be wrong, and there is definitely disagreement, but the lawsuits will ultimately have to be against the liar banks. If a bank lied and affected LIBOR than it seems plausible that anyone affected could sue the lying bank even if their contract wasn’t with them. That seems fair since it is the “criminal” who would be paying for the crime.

So focus on which banks look like they lied the most, not at the size of their books.

Suing Banks as a Group is Key

Finding collusion and being able to sue multiple banks at once would be helpful and may even be necessary for big damages. That is because the LIBOR calculation itself is the second line of defense for any bank (the first line of defense will be wrangling over what LIBOR is meant to be in a market that isn’t trading, etc.).

Suing banks individually leads to the risk that banks use the “exclusion” process to show that relatively little of their “lie” flowed through.

Let’s say 4 banks submitted 395, 8 banks submitted 415, and 4 submitted 420. LIBOR would have been set at 415. Let’s say each bank lied by 20 bps (I don’t think every bank lied, this is purely for illustrative purposes only).

So if every bank lied by 20 bps, then LIBOR should have been 435, so a 20 basis point difference.

But if you sue the banks individually, the 4 that submitted 420 should have put in 440, would argue that they were excluded, so still would have been excluded, so although they lied, individually they would say their lie didn’t impact LIBOR. Yes, we put in 420 when we should have been 440, but run the numbers and you will see that had we put in 440 [and everyone else was the same], LIBOR still would have set at 415.

So no money from the 4 banks that put in 420.

Each bank that put in 415 but should have put in 435 will have a similar argument. Had they alone changed their submission, they would have been excluded and one of the 420’s would have counted causing LIBOR to have been 415.625. So that bank would be on the hook for 0.625 bps. All 8 of the banks would be on the hook for 0.625 bps, adding up to a total of 5 bps.

Then the banks that submitted 395, would point out, that if they alone changed their submission to 415, it would have impacted LIBOR since it still would have been 415.

So in this case, what was 20 bps if looked at together, turns out to only 5 bps if the banks can be looked at individually rather than a group. Getting the most damage will come from being able to demonstrate the cost of not just one bank moving in isolation, but the impact it had on the setting if they moved as a group.

Damages and Offsetting Trades

Let’s start with a CLO as it is pretty straightforward. The CLO buys loans that pay a floating rate based on LIBOR. They also issue debt to fund their capital structure. Some of that debt is floating rate as well as they want to match floating rate assets with liabilities.

I think the banks will have a decent argument showing that “damages” from LIBOR have to be offset by “benefits” if you were both paying and receiving. It seems reasonable that the argument that a counterparty can’t just sue where they lost if they also benefitted. I don’t know enough to be certain about that, but it seems reasonable. That quickly drops the potential amount of lawsuits from the $500 trillion to $800 trillion talked about very quickly. There are lots of back to back swaps. Banks themselves hold lots of loans paying based on LIBOR while they also have funding based on LIBOR. If, and yes it is a big if, you can only claim for damages on your “net” LIBOR exposure, the risk of big damages again drops.

Can LIBOR Be Restated?

This is far more extreme, but if lots of banks consistently lied by a large amount, could they push for a restatement of LIBOR?

By doing that, would they be able to limit themselves to their direct exposure and to the fines given by regulators.

If in the example above, LIBOR which was set at 415 should have been 435 could it be retroactively restated? That would seem strange, but not out of the realm of possibility. The banks would want that because then anyone with a LIBOR contract would have to go after their counterparty for the “corrected” payment amount.

This seem highly unlikely, but I figured it is worth throwing out there as it changes the dynamics a lot. Politically it would get ugly, because without a doubt, the average American directly benefitted from low LIBOR. The average American is far more likely to have loans where they pay based on LIBOR rather than assets where they receive on LIBOR.