The T Report: Bears are Tired if not ready for Hibernation

The Only Thing Wrong with the Bear Argument is that it has been Wrong

The bear argument is persuasive. It is well reasoned, makes sense, is supported by fact, yet it hasn’t been working. I was bearish early this year. Too early, but eventually the market did break down from 1,400. Near the end, many bears had capitulated. Many of the most bearish pundits put out “eventually” or “we are right, but maybe not yet” sort of capitulation letters. We haven’t seen that yet, but I think we are getting close. Bearishness seemed to hit its peak (as is typical) after the S&P broker 1,280. Too often we let price action dictate views, and this was a perfect example. Yes, some people were bearish all the way down to 1,280 (I had cut shorts and turned bullish higher than that) but by and large the bear mantra grew after that.

More people jumped on the bandwagon. Some “perma-bears” spent more time trying to recant their prior capitulations than analyzing the market. In any case the bear trade has been painful. We have seen a series of cycles where markets rally on short covering. We hit new levels where the data continues to be weak and shorts get reset as the market stumbles. The bears are nervous but gradually we see some bigger down moves and the shorts fully reset. Then, for whatever reason, something happens that spurs the market to yet another short covering high.

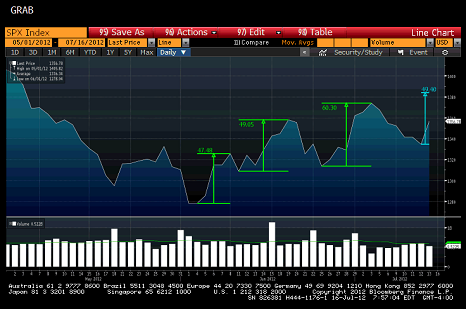

We hit a high on June 8th, followed by a period of consolidation until we took off for a new high on June 19th. We sold off until June 25th, but that low wasn’t as low as the post June 8th low (higher lows). From there, the market sprinted to another new high of 1,374 on July 3rd. Then we entered into another pullback lasting until July 12th. That sell-off ended well above the June 25th level. So it looks to me like we are seeing higher highs and higher lows since the market bottomed on fears of economic malaise and political fears in Europe.

This wouldn’t be so frustrating for bears if the data wasn’t supporting them. Economic data has been week, globally. Chinese data continues to weaken, Europe is a mess with nothing improving while all the focus is on summits and bailouts, and there is relatively little encouraging about the U.S. data other than it is better than anywhere else.

The bailouts have seemed “blah” and have done little for bond yields in Spain or Italy.

JPM had a loss in the CIO book and the LIBOR scandal creates awful headlines, yet JPM showed they can produce whatever number they want (at least for a period of time), and the LIBOR scandal hasn’t turned into something bigger yet, because the largest discrepancies, with biggest potential losses to LIBOR based contracts, occurred at a time when the Fed seemed to turn a blind eye to the issue, if not actually condoning it.

Growth Slowing, Europe Doesn’t Work, Gridlock…..

While typing the morning memo, I have already seen a few pieces of research focusing on those issues. I haven’t read them, but based on who sent them, they are likely well thought out and make sense. But they are also likely to be, to a large degree, a variation of what has been sent out over and over for the past 2 months.

Bears are caught short once again. Bears are getting tighter. Somehow, earnings haven’t yet sparked the next wave of sell-offs. Earnings at least are a new weapon in the bear arsenal, but again, so far they haven’t done much, and JPM’s earnings seemed to spark a wave of buying.

Where I disagree with the Bears

I have two issues with the bear argument. The main one is that the analysis of Europe has become overly pessimistic. If Draghi put on a Santa suit, got in his helicopter, and started dropping money in Europe, the reactions would be:

- Does he have the proper flight path clearance

- Is a Santa outfit correct for all of Europe

- If the money is coins people will get concerned falling money hurts people

- If the money is paper, the argument will be that it is blow away on the wind

My point is that every action Europe takes is now met with a chorus of groans. That is not completely undeserved. I view the Spanish bailout as a C-/B+ type of program in terms of usefulness, but that is far better than the F- the market seems to want to give it. Rumors that the EU will provide low coupon, long dated money to Spain are met with sneers, when that is in fact very meaningful.

There is talk that the weakest banks will not have their existing equity holders bailed out, and that losses might even hit senior unsecured lenders to the weakest of the caja’s. Suddenly that is bad? That seems fair, is a good step because it saves taxpayers money in the bailout and makes future taxpayer losses less likely as the banks are truly restructured. That seems to fit what Germany wants. Will there be some fear in the credit markets for weak banks? Yes, but there already is.

I’m not saying anything is fixed, far from it, but the market is failing to interpret what is done and is only starting to digest the new “incremental” approach of Europe. Europe isn’t trying for the “bazooka”, they are announcing plan after plan. Small announcement after small announcement, and generally, in the aftermath of each, has done more to address market concerns than to amplify them.

My other main disagreement is that the economic data here is signaling recession or further slowing. In terms of economic data, we seem far too willing to extrapolate trend lines. Yes the data is weak, but that does not mean it will be weak going forward. There is some correlation where more jobs can create more jobs and vice versa, but if that were true, we would never hit turning points in economic cycles. The Q1 data would have continued and we would all be billionaires, or the Q2 data will continue and we will all be destitute. Too much has been made of the trend, and too little attention paid to how much is driven by Europe and China. If either of those areas manage to arrest their decline, and even improve, we should see a quick turnaround in some U.S. data. Housing does seem to have bottomed. Banks are experiencing lower loss rates on loans in this country. Be careful extrapolating the latest data, especially when the “adjustments” are actually larger than the actual measured number.