LIBOR Litigation in 3 Easy Charts

LIBOR Manipulation in 3 Easy Charts

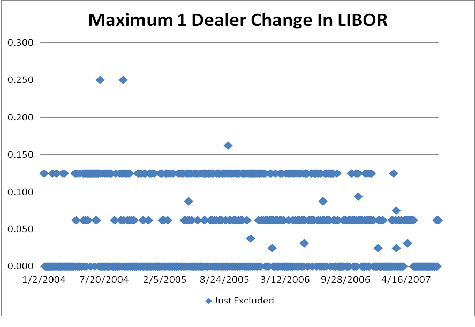

I looked at the maximum possible influence 1 dealer could have on LIBOR on one day. I took the worst scenario. That is where a LIBOR that was excluded for being too high or too low, got “lied” all the way to be excluded for the other reason.

From the entire period of January 2004, until the end of July 2007, there were only 3 dealers a single dealer could have moved the USD 3 month LIBOR setting by more than 1/8th of a basis point. That is 0.00125%. Since it is 3 month LIBOR, only 3 times could a single dealer have affected a $1,000,000,000 trade by more than $3,160.

The average a single dealer, who was somehow able to affect LIBOR by the maximum each and every day, could have moved it, was 0.043 bps. Under 1/20th of a bp. Attempting to manipulate LIBOR is bad, and should likely constitute some form of fraud, but from 2004 until mid 2007 it had limited impact on the outside world.

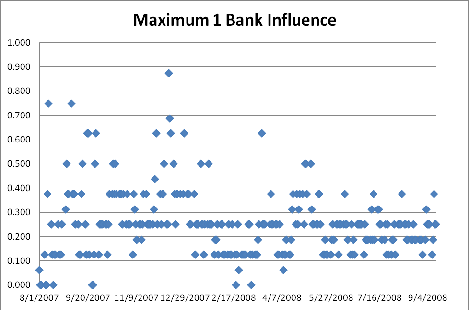

Starting in August 2007, something changed. The financial crisis started having a real impact.

Now suddenly it gets interesting. Every day LIBOR could have been moved a lot by 1 bank. Whether the e-mails the FSA released about Barclay’s are reprehinsible or not, isn’t the question. The question is are these variations in rates real or was their constand manipulation?

These numbers are still relatively small, as 1 bp on a LIBOR setting doesn’t have a huge impact, but suddenly at least it is apparent that there was room to move LIBOR around.

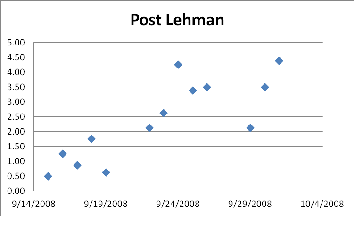

Then, post Lehman, the divergence grows.

This is a very short timeframe, but now you are talking about some serious potential moves. The range was large. There was a wide variation within the quotes that were used. We have highlighted many of the concerns and most obvious questions, but if you want to find real potential litigation, it is certainly after July 2007 and the aftermath of Lehman also offers a lot of intriguing possibilities about who did what.

E-mail: tchir@tfmarketadvisors.com

Twitter: @TFMkts