More Fun Facts with Crisis Period LIBOR

Some “Crisis” Period Libor

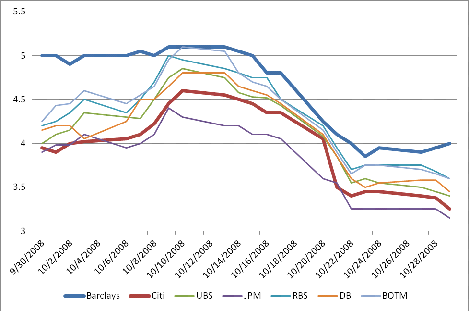

I figured it was worth looking at some more LIBOR data. I picked on 7 banks: Barclays, Citi, UBS, JPM, RBS, DB and BOTM, largely to get a cross section from different countries.

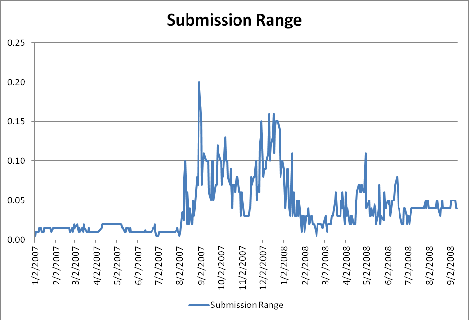

The first thing I did was look at the range of submissions for 3 month LIBOR. I took the difference between the higher and lowest submission from these 7 banks.

The range was miniscule for the first part of 2007, but by the summer, there started to be noticeable differences between the best and worst bank, but as the Fed started cutting rates and creating various funding programs and encouraging the use of others the range settled down. After the Bear Stearns bailout, the range moved lower and was reasonably stable right until Lehman.

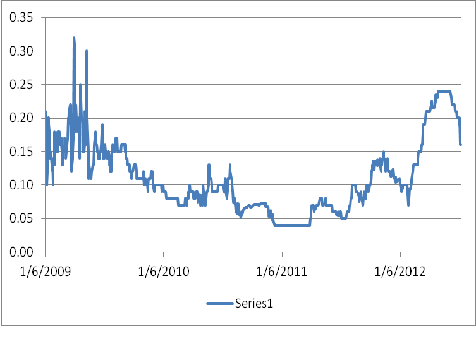

Since early 2009, the range has been larger than the 2007 range, but still mostly under 20 bps. But it is the time immediately after Lehman that is the most interesting.

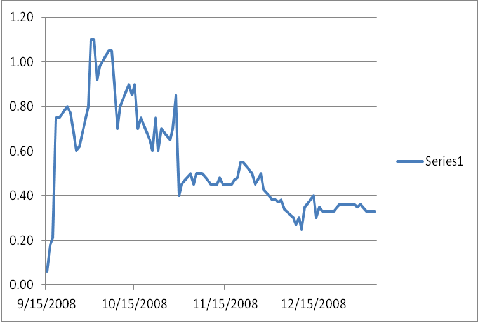

It took a couple of days for the bank to react. For the first few days, LIBOR barely moved higher and the range remained contained. Then on the 18th of September we got the first real “shock”. Barclay submitted 3.75% while JPM was only at 3%. The first really big change.

The range appeared to stabilize until the 30th as all the banks increased rates on a daily basis. Then suddenly the range popped to 110 bps. Barclay’s was all the way to 5% now while JPM was only at 3.9%.

On October the 1st the range was still 1.1% but somehow now Citi was the lowest rate. Citi posted a 3.9% rate on October the 1st. That, I have to admit, makes me laugh.

|

|

Barclays |

RBS |

DB |

UBS |

JPM |

Citi |

BOTM |

|

LIBOR |

5.00 |

4.25 |

4.20 |

4.10 |

3.98 |

3.90 |

4.43 |

|

1 Year CDS |

2.05 |

2.55 |

0.95 |

1.73 |

0.98 |

3.45 |

0.53 |

|

Difference |

2.95 |

1.70 |

3.25 |

2.37 |

3.00 |

0.45 |

3.90 |

So those are the rates submitted by various banks on October 1st. I have also included CDS spreads, though it is important to remember that Barclays, RBS, DB, and UBS CDS all trade in Euros while Bank of Tokyo Mitsubishi trades in yen, so they aren’t directly comparable to Citi and JPM which trade in dollars.

So, assuming anyone was telling the truth about where they could borrow for 3 months in the interbank market, Barclay’s seems relatively honest, despite the settlement with the FSA.

Outliers seem to be Citi, RBS, and to a less extent UBS. I am going by memory now, but my perception was that RBS was viewed as a worse credit than Barclay’s. CDS seems to confirm that, yet they are posting LIBOR significantly tighter. UBS always seemed to have some decent government support, so while maybe a stretch that they were quoting LIBOR close to JPM and DB, it isn’t totally unreasonable. DB if anything looks conservative relative to other prices.

Citi just seems ridiculous. The CDS market was trading it as the worst of the credits, yet here they are with the best LIBOR. That looks consistent throughout the entire the period. Maybe there is something I’m missing and just don’t remember, but it does seem surprising that Citi thought they could fund at the same level as JPM at the time in the unsecured interbank market.

At this point it is all just speculation where the information Barclay’s has provided the FSA leads, but so many people have been talking about LIBOR so long, that I would be shocked if it ends at Barclay’s and there is enough data, in my mind, to warrant some much deeper investigation.

The big question is what will the lawsuits look like and what chances they have of winning anything.