Some Quick LIBOR Facts and Potential Implications

LIBOR is getting “Streakier”

LIBOR if anything is becoming less volatile. Part of that is the fact that the Fed is at ZIRP and all banks are supported, but it is interesting to look at these streaks. It is the number of days in a row that LIBOR changed by less than 1 basis point in either direction. We are currently in a streak that has lasted almost 2 YEARS! Yes, for 2 years now, we have not had a daily change in LIBOR of more than 1 bp.

|

Streak of <=1 bp Daily Changes |

|

||

|

Start |

End |

Length |

Break |

|

10/20/2003 |

1/6/2004 |

78 |

|

|

9/25/2006 |

12/1/2006 |

67 |

993 |

|

12/5/2006 |

2/27/2007 |

84 |

4 |

|

3/13/2007 |

8/7/2007 |

147 |

14 |

|

6/16/2008 |

9/15/2008 |

91 |

314 |

|

9/2/2009 |

4/27/2010 |

237 |

352 |

|

5/26/2010 |

7/29/2010 |

64 |

29 |

|

8/25/2010 |

7/9/2012 |

684 |

27 |

Basically since the end of the financial crisis, LIBOR has been very “stable”. Prior to 2009 it was unusual for LIBOR to be so stable. I find the summer of 2008 particularly interesting. I remember issues with the energy markets, with concerns over Fannie and Freddie, the fact that Bear Stearns had gotten to the point of needing to be bought, yet LIBOR remained very stable that entire summer.

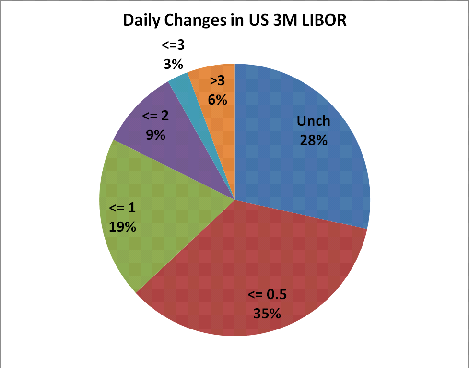

Small Changes are the “norm”

Whatever “manipulation” was going on, in most cases LIBOR barely moves. In fact on more than 82% of the days, LIBOR moved by 1 bp or less and almost 92% of the time, the move was 2 bps or less. 2 bps on 3 month LIBOR is 0.005% of notional. On a $1 billion exposure, a change of 2 bps on the setting would mean the difference of about $50,000. Not chump change, but worth keeping in mind.

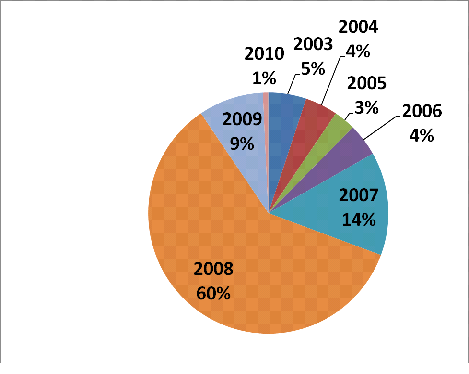

The “BIG” Moves in LIBOR are concentrated around the Financial Crisis

The period of 2008 was particularly volatile. But that was also true of all markets. Massive swings in stocks and fixed income were the norm. Policy after policy was put in place to calm credit markets and let’s be honest, to control LIBOR. The Fed was working hard to make the bank funding problem go away.

The big moves in 2007 started in August when problems at the big banks became brutally apparent, but continued throughout the fall as the Fed aggressively pushed Fed Funds down and removed the “taint” from using the discount window. By May of 2009, the crisis had subsided and the big moves in LIBOR were largely reactions to that.

Off-hand, I’m not sure what drove the bigger moves in 2003 to 2006, but I suspect that there are reasonable answers to those based on world events and central bank activity.

The next chart looks at when those moves of 3 bps or greater occurred. 2008 sticks out like a sore thumb.

2 Distinct Periods

I think the problems with LIBOR will break down into 2 distinct phases.

The “Pre-Financial Crisis” period had consistent but small amounts of volatility. I think this period will pose problems for “investors” trying to get money, but be easy for “legislators” to go after the banks. Most of the damaging e-mails from the Barclay’s transcript seem to focus on the pre-crisis period. Dealers (and accounts) trying to push LIBOR either way for a basis point or two. We don’t know the details yet, but I suspect that we will find out other banks were doing the same as Barclay’s. The nature of the LIBOR calculation almost necessitates collusion as 1 bank alone has a trivial impact. My guess is we will find that there is no particular pattern to the “manipulation”. That some days the attempt was to push it higher and some days it was to go lower and that there may have even been competing “coalitions” on certain days. It will revolve around the specific roll risk on a particular day for any given institution.

The big banks are far more likely to have big “roll” positions on any given day where moving it up and down a couple bps for those days makes a meaningful difference. It looks bad and is bad and people will lose jobs and it will change how LIBOR is produced over time, but I still think the ability to win significant lawsuits against banks during this period will be difficult. More on that as we finish our more detailed analysis.

The “Financial Crisis” period had the most volatility. It started in 2007 and didn’t really finish until 2009. That was basically the time frame during which fears of bank credit risk was high. There were times when the only source of short term money for banks was depositors and the central banks. This period of time may be problematic for everyone. In short, it looks as though a big effort was made to “pretend”‘ LIBOR was low in spite of the fact that banks weren’t willing to actually lend money to each other anywhere near those levels (trying to find out what interbank trading was occurring, if any, as that would be highly useful for determining how valid LIBOR is). The entire market was watching LIBOR for signs that a bank was in deep trouble. “Bear raids” were the norm, and there was no better way to attract one as a bank than submitting a very high LIBOR rate. The push to get LIBOR down was all about trying to calm markets. Banks themselves may have been losing money because of low settings, but wanted low settings in any case, because the alternative was potential nationalization.

This is what makes 2008 potentially more difficult. Banks may not have profited. There was no real lending. The central banks and politicians (at least those with any sense who weren’t short the market) were happy to see LIBOR come down. If the pattern was consistent, it helped all borrowers. It didn’t help lenders. What happens if all banks lied? What happens if banks themselves were hurt on lots of trades? Can LIBOR be restated? The construction of LIBOR is an issue. The question is potentially vague, and the BBA relies on bank regulators to regulate the submissions, yet it is the BBA that publishes them. I think this is where we might see all non-bank floating rate lenders suit. They were receiving less income than they otherwise would have. That problem is potential massive and dwarfs (in my opinion) the claims around derivatives since it is far easier to prove and will be owned by some investors the jury would sympathize with.

Who Does a Lender Suit?

Say you lent $1 billion to various companies, and it turns out that LIBOR was off by 50 bps. To be off by 50 bps, you would need to sue all of the contributors. Each contributor is only worth a fraction of the total, since it is an average. I’m not sure how the fact that some get kicked out and don’t count in the average would play into it. In any case, I think all contributors would have to be sued as a group rather than individually to get an effective result.

But the banks didn’t benefit. If LIBOR should have been 2% but was only 1.5% it is the company that benefitted. The lender is suing the bank for setting the wrong rate, but it is the borrower who benefitted. Can the banks use that as a defense? Can they go and suit the company to get them to pay the higher rate? I highly doubt that. That to me is the key, if the banks can be made to pay the lenders this gets really ugly. The argument would be that the banks set the rate low so are responsible. The borrowers would claim innocence so couldn’t be sued.

Can LIBOR be systematically restated? What if LIBOR was restated, would lenders then have to sue the borrowers individually?

I think the pre-crisis period is relatively tame. Small moves in both directions will likely be hard to find anyone who was consistently harmed, or harmed enough to justify the legal costs. Especially since you cannot really sue just one bank and the size of any potential manipulation seems look in the pre-crisis era.

The post crisis era seems more likely that a consistent pattern was in existence, though it is unclear whether the definition of LIBOR is weak enough that a bank could defend their actions by showing an absence of trading and their own “rationale” for why their LIBOR met the definition.

Why You have to Sue them All

Again, I haven’t looked closely at bank by bank submissions, but it looks like in the pre-crisis era, banks attempted to get small moves in their favor in either direction as they needed. Here is why even finding one bank isn’t enough.

Currently US LIBOR is set by 18 banks. Each bank provides a “submission”. The 4 lowest and 4 highest are thrown out and LIBOR is the average of the other 10 (the number of contributors and who contributed has changed over time).

For now let’s assume that there is a way to verify what the “real” rate for any bank is. Remember, the question is where they “think” someone would lend to them. If they are busy borrowing money from their friendly central bank and are too scared to even ask another bank, it is possible that it will be very hard to prove they are “lying” or by how much they are “lying” by. That is another separate question, and for now we will just assume, the amount of the “lie” is known.

We will look at a hypothetical effort to move rates lower (the same would be true for moving rates higher).

There are 4 basic scenarios if 1 bank is “lying”:

- The “real” level would already put them in the group being discarded. Then the lie had no impact as their “real” level would not have been included in the setting.

- The “real” level would have put them in the calc, but the lie kicked them out. The impact would be the difference between their “real” rate, and the rate submitted by the 4th lowest dealer (divided by 10). The 4th lowest dealer would be included since the “lie” rate was lower. Depending on the “real” rate vs 4th lowest rate, the impact would be between 0 and the full “lie” (divided by 10).

- Both the “real” and “lie” level would be included. The full differential (divided by 10) would have impacted the LIBOR setting. Since they would have been included with their real rate, and were still included with their lie rate, the full differential would have impacted.

- The “real” rate would have been excluded, but the “lie” rate was included. Here the impact is the difference between the “lie” rate and the rate the 14th highest rate submitted (divided by 10), since that dealer was no longer going to be counted. So again, the impact could be between 0 and the full differential (divided by 10) dependent on what the 14th highest fair submission would have been.

So on any given day, the impact would depend on what the other 17 dealers submitted. All, none, or only a portion of the “differential” might impact the calculation. So even if you can quickly prove that a bank was “lying” on the submission (which may not be easy to do), you still need to determine if that lie had an impact based on what other dealers submitted that day.

Here is an example from a few days ago. This is purely for illustrative purposes. I am assuming every one of these rates is a “real” rate. The point is to show what impact a “lie” would have.

|

Low |

Used |

High |

|||

|

HSBC |

0.260% |

DEUTSCHE |

0.410% |

R.B.SCOT |

0.540% |

|

BARCLAYS |

0.340% |

UBS AG |

0.411% |

CA-CIB |

0.548% |

|

RABOBANK |

0.405% |

JPMCHASE |

0.430% |

BNPP |

0.560% |

|

CR SUISS |

0.410% |

CITIBANK |

0.450% |

SOC GEN |

0.598% |

|

|

|

BTMU |

0.460% |

|

|

|

|

|

BOA |

0.470% |

|

|

|

|

|

RYL CAN |

0.475% |

|

|

|

|

|

SMBCE |

0.490% |

|

|

|

|

|

LLOYDS |

0.500% |

|

|

|

|

|

NORIN BK |

0.510% |

|

|

|

Average |

0.354% |

|

0.4606% |

|

0.561% |

|

3 Month USD LIBOR Fixing |

0.4606% |

|

|

||

If HSBC, Barclay’s, Rabobank, or Credit Suisse decided to “lie” and push rates lower, they would have no impact. They have already been excluded from the calc, so if CS said 20 bps, it wouldn’t make a difference to the determination.

In this case, that is true for DB as well. If DB submitted a lower “lie” rate, then CS, also at 41 bps “real” rate, would be included in the calculation. In fact Norinchukin would have the best “potential” to move rates. They could make LIBOR lower by 1 bp. If they submitted a rate of 0.41% or lower, the average would drop by 1 bp. If Norin dropped their submission by 5 bps, LIBOR would have moved by .005%. A 20 bps drop would have only made LIBOR go down by 0.01% since CS would have become included.

At the other end, say BNP wanted to lower rates. They could drop their rate by 20 bps say to 0.36%. Yet LIBOR would drop only by 0.01% because BNP would jump to the excluded list for being too tight, Norinchukin would fall out of the calculation since it is now one of the 4 highest, and CS would be included.

So the impact of any “lie” is affected by all of the other submissions. It is not enough to say a bank “lied” by 20 bps to determine it had an impact. Hence the need to find collusion and sue multiple banks.

The complexity of what LIBOR is, who to sue, how to prove loss, is enormous. I think derivative cases and pre crisis cases will have a tougher time finding damages that are easily attributable but the investigations and lawsuits are going to shed light on a cozy corner of Wall Street that may have had the best of intentions but has morphed into something the public will despise.

Regulators, Start Your Engines.

I’m not sure the best term for LIBOR. Is it a “setting” scam or another example of “two tier” markets. All “two tier” markets should be investigated. Why do HFT’s need to be able to trade in sub-penny increments but retail can’t? Why are their markets for specific customers or to specific groups of market participants that isn’t widely disseminated? Why has all fiduciary responsibility been taken away? Huddles get a mere wrist slap? Opening and closing of ETF’s especially on thinly traded slices of the market?

So many wonder when retail will come back. Is 1,400 the magic number on the S&P? Maybe they won’t come back until they are convinced the bully will no longer give them a wedgie every chance he gets. The movies are cool, where the weakling buffs up and comes back and beats up the bully to everyone’s delighted surprise. The reality is that doesn’t happen and the weak need the authorities to step in.

LIBOR, so prevalent, became the plaything of a few. When people get upset about the 1%, I think they don’t meant those that built something, that figured out creative and moral ways to make money, but they do mean people collecting central bank liquidity hand over fist who game the system at every chance they get.

This will be big wake up call, and maybe even the SEC will stop with their “no admittance of guilt or wrongdoing” settlements. The nature of LIBOR means the e-mail trail is likely only beginning. Many will be out of context or sound worse than they are, but it won’t help the situation.

More to come, but this is just a broad and “fascinating” topic, it should keep us busy for awhile.