EFSF and ESM Funding Explained in Detail – Why Italy is Ok with it

There is so much confusion about the ESM or EFSF funding costs. How it works, how it affects countries, etc. Here is how it works.

€1 Billion of EFSF Borrowing

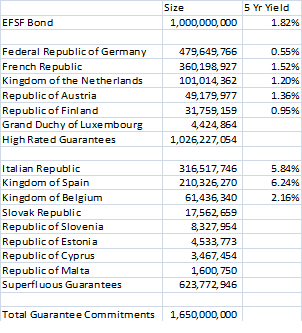

The EFSF sells bonds to the market. They have already issued €109 billion of bonds, so they are a meaningful issuer and buyers at this stage understand how it works. The bonds are backed by “guarantees” from member countries with an “overcollateralization factor”.

The key is that for every €1 billion of bonds issued, you get a billion of guarantees from useful countries. Yes, Spain and Italy are included. Yes, technically if Spain or Italy receive money it is circular, but ultimately they are pretty irrelevant. Investors buy EFSF bonds and are getting paid more than if they invested in France directly – the weakest of the high quality guarantors. If you invested €1 billion split among the 5 best issuers in this ratio, you would expect to earn 1.01%. By investing in EFSF you get 1.82% and yet your risk is more than covered by those top 5. Yes, there is a risk that they don’t come in on their guarantees, but at same time you are getting almost double the spread of investing in countries outright and pick up the throwaway guarantees for free.

So now you can see how EFSF funds, how irrelevant Spain and Italy are too it, and that it is likely sustainable when it is so much cheaper than direct investments in the top countries (especially if people don’t think there will be an FX event in Europe).

€1 Billion of ESM Funding

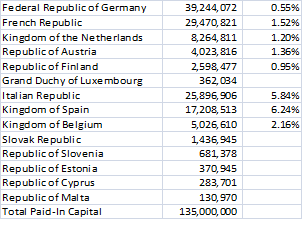

The ESM is trickier than the EFSF. There is “paid-in” capital, but it is important to note, that the ESM limits how much it can borrow in a way, that the paid-in capital has to equal at least 15% of the amount borrowed.

So to raise €1 billion of money to lend, the ESM could use €135 million of paid-in capital, and €865 million of bonds backed by overcollateralized guarantees (just like EFSF does). That would produce a ratio of 15.6% so would be in compliance with the rules of ESM.

So now both Italy and Spain have to contribute capital. We will ignore Spain for now, since it is clearly a beneficiary in the program, and will examine how Italy can afford to do this.

The answer is surprisingly simple. To get €1 billion to the FROB, Italy only contributes €26 million.

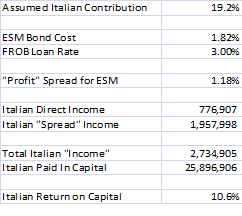

Now let’s assume that the ESM borrows at the same rate as EFSF on its €865 million of borrowings. There is no reason the cost should be significantly different since the mechanism is identical to EFSF. If anything, costs should be lower because in theory, ESM is lending at a more senior level than EFSF.

I have assumed Italy is in for 19.2% for all of the calculations. That may not be exactly right, but is latest data I had with the 3 “stepping out countries”.

This is where it does get a bit tricky. Italy is entitled to 19.2% of all the “profits” of ESM. It contributes 19.2% of the paid in capital, and provides 19.2% of the overcollateralized guarantees. The fact that Italy’s guarantees are largely useless, doesn’t affect its claim of 19.2% of the “profits” of ESM. So if ESM borrows at 1.82% and lends at 3% the profit margin on the borrowed money is 1.18% and the earnings on paid-in capital are 3%.

So Italy would actually make a profit on their paid-in capital net of cost.