Spanish Bond Subordination: Some Possibilities Analyzed

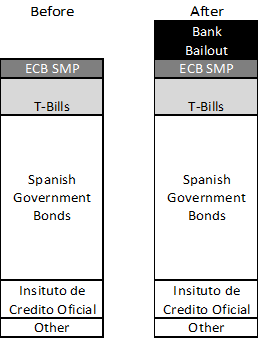

This is a rough approximation of the Kingdom of Spain’s €730 billion of sovereign debt as it currently stands.

The ECB’s SMP holdings have no legal standing to be senior, yet as we saw in Greece were treated as senior. I assume the number is around €50 billion and is all in government bonds. T-Bills, which again don’t seem to have any legal requirement to be senior, have been treated as such. Even in Greece, while GGB bonds were being negotiated down to 20% of par, they were issuing new T-bills at 4% yields.

Pari passu with the government bonds are other entities which are guaranteed by the kingdom of Spain including the now well know FROB.

Range of Possibilities

How much is actually borrowed remains a question. Who will do the lending also remains an open question, as ESM is mentioned yet for any immediate needs it will have to be EFSF. There is a range of possible ways for the deal to be structured, some resulting in significant subordination, and some not having much impact on holders of existing Spanish Government bonds (SPGB’s).

Worst Case

The absolute worst case of subordination is if the EU lends to Spain as a general unsecured creditor and is senior to any existing creditor. That doesn’t seem to be the current plan, but is definitely the worst case, and results in decent amounts of subordination

As a Spanish bondholder you would have had €100 billion jammed ahead of you. That would be a significant cram and effectively assumes all of the bank bailout money is squandered and yet those loans get paid out ahead of you. Possible, but worst case, and doesn’t seem like the likely case from what we’ve seen so far.

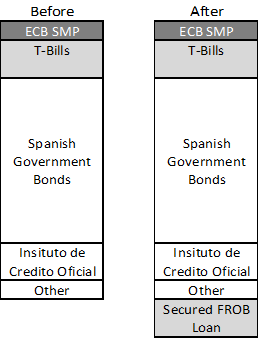

Best Case

In this case, the EU would lend to FROB. The EU would demand priority over all of the FROB assets, which will be the equity, coco, and preferred bond investments the FROB makes. This would subordinate the existing €14 billion of FROB debt, as the EU would have a senior interest in all the assets of FROB.

Any shortfall from FROB would be a senior unsecured claim against the Kingdom of Spain. That claim would rank pari passu with existing debt. Assuming not everything the FROB invests in goes to zero, this means the amount claimed against Spain would be less than the full amount lent, and it would only be equal in priority. That could qualify because the EU lent on a senior basis to FROB, just not senior to all other Kingdom of Spain lenders. Probably a stretch, but so is viewing it as being completely senior to existing bonds.

If all of the FROB assets turn out to be worthless, then SPGB’s will be subordinated, but honestly, if all of the FROB or even a significant amount of FROB purchases turn out to be worthless, people have a much bigger problem than worrying about being subordinated on their Spanish bond holdings.

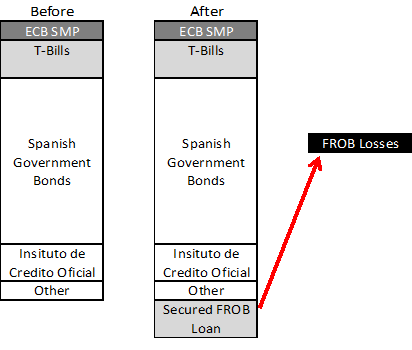

Reasonable Case

Ignoring whether it is EFSF or ESM lending (EFSF is better as an existing bondholder), a reasonable scenario is that the EU lends to FROB as a senior lender to FROB. But then they negotiate a senior claim against Spain on any shortfall. That would require changes to the FROB documentation. It would make the Spanish guarantee of FROB higher than senior unsecured. Something like that is more likely than the best case, but still not bad, unless of course all the FROB purchases turn out to be worthless – U.S. TARP did not have a recovery rate or zero. Spain may do worse than the U.S., possibly far worse, but worrying about subordination will again be least of the concerns. If any rebound in the economy occurs, and the FROB assets look like they have value, the impact on Spanish sovereign yields will be minimal. IMF involvement in the disbursement of proceeds is one good reason to believe not all the FROB money will be squandered.

Not enough detail to know yet. It might turn out they only use €50 billion, all from the EFSF which has less, if any right to expect senior priority. Like everything else in this situation, the details will matter. Reacting to overly positive or overly negative headlines will lead to unnecessary losses.

It still remains uncertain how the market will react initially, but I continue to believe that either the Spanish program will mark a turning point as the EU adopts a variety of new policies and tries to drive a strong rally, or this will turn out to be another hasty announcement with no real commitment and the sell-off will resume. Please see market view from this morning.

E-mail: tchir@tfmarketadvisors.com

Twitter: @TFMkts