What the TF? Greek Debt, Then and Now

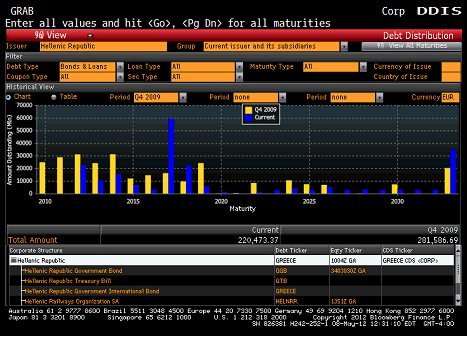

So here we take a look at Greek Debt outstanding in Q4 2009 versus today. I chose Q4 because that seems to have been prior to their being a “crisis” which first really became noise in Q1 2010.

The most striking thing, is according to this, Greece’s €220 billion of current debt is less than the €281 billion it owed back then. On the surface that seems strange, but I don’t think it includes whatever agreement they put in place with the EFSF as part of PSI. Remember, in theory Greece owes the EFSF money for the bonds the EFS issued. Those are likely to disappear in the fuzzy world of sovereign accounting but that was about €30 billion. Where is the rest of the debt? Greece had €350 billion of debt in Q4, so did it really all get taken care of? No.

What we are missing is the loans the Troika is supposed to make to Greece in the future. The big addition will be the amount of money being lent to Greece to recapitalize their banks. Yes, Greece is going to borrow money to recap their banks, and make bank lenders whole, even though lenders to the country took a massive loss. Try not to think about it much, it will either make you angry or your head will explode.

Although a lot of future loans are to pay back the ECB and EIB for their holdings, some is actually allocated for the Greek budget deficit and to fund Greece over the coming years. Anyways, by most estimates, by the time Greece is getting done with the “bailout” they will owe about the €350 billion they owed before, they will just owe it to different people.

There are some really interesting difference between the debt then and now. Back in 2009, 100% of the debt was bonds and was owed to traditional investors. Now the debt includes a lot of loans from the IMF, and traditional lenders only have about €100 billion of exposure to Greece and that is roughly valued at €22 billion.

So the lenders have changed dramatically. The “private” sector has very limited exposure to Greece, and since at this stage the bulk of it is carried at market value, those holders have very little incentive or ability to do much.

The IMF and their loans are tough to touch. Want to watch how quickly a firewall disappears? Let the IMF renegotiate one cent of their loans and see how quickly countries back out of their firewall commitments.

So the only way to get any serious debt forgiveness is from the ECB, and from demanding more from the banks for their recapitalization.

With so much debt in the hands of the Troika, I find it hard to believe that any new Greek government will default in May. They might be tempted to, and might do it later in the year, but I believe that after a couple of “you’re in the club now” and some “super secret handshake” meetings, the new leaders will be scared and cajoled into playing along for now and not risk the “fire and brimstone” Draghi and crew will say they are destined for if they don’t stick to the current program.