The T Report: Garbage In, Garbage Adjustments, Garbage Out

It is hard to ignore the fact that this year is shaping up a lot like 2011 and 2010. I’m not a big fan of seasonal patterns, so what else could it be. Could it just be that all of our adjustments are a total mess?

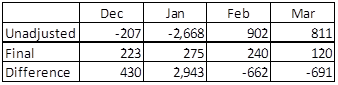

I understand why we attempt to “seasonally” and otherwise adjust numbers. We crave smooth data. It makes charts look better. It puts a number into context, but what if the adjustments are just horribly wrong? The magnitude of the adjustments is large, so even a small mistake could have a huge impact.

Did the plunge in the economy in the months following Lehman cause adjustments that consistently make the Dec-Feb period look better than it should. Did the rebound, which really started in March 2009 affect those adjustments so that they reduce the jobs by too much? We have gone through some violent shifts in the economy since at least 2008. Industries like homebuilding, which had a huge seasonal component, are far less important in today’s economies. So much has gone on, and so much has changed, are the adjustments overwhelming the data and giving us bad reads? I have only picked on payroll, but I am becoming convinced that much of what we see as growth, followed by decline, is just bad data in the first place, further messed up by bad adjustments. We pretend like 50,000 difference in a month is meaningful (when even BLS says that is in their confidence error), when the data shows that probably anything within 250,000 of the real job growth would be a lucky guess.

As you get ready for next week’s deluge of data, it is worth keeping in mind. Expect bad data.

One last rant, I find it interesting that every American has to basically fill in the same forms, in the same way for their taxes, and yet the half a dozen money center banks, thriving on Fed support, each report basically everything in their own way, making it very hard to compare bank to bank or quarter to quarter. Couldn’t the SEC, Fed, OOC, or FDIC insist on a consistent summary format for reporting earnings?

Markets are a little better on the back of German confidence. Those rallies rarely last.

I would be shocked though if we don’t get some commitment to commit out of the G20 and IMF this weekend, so although I think we will fade a little from here, we should see some strength into the European close as everyone gets ready for more “firewall” money. This meeting highlights the ascent of China and the decline of the U.S. as it is Chinese money “coming to the rescue”.

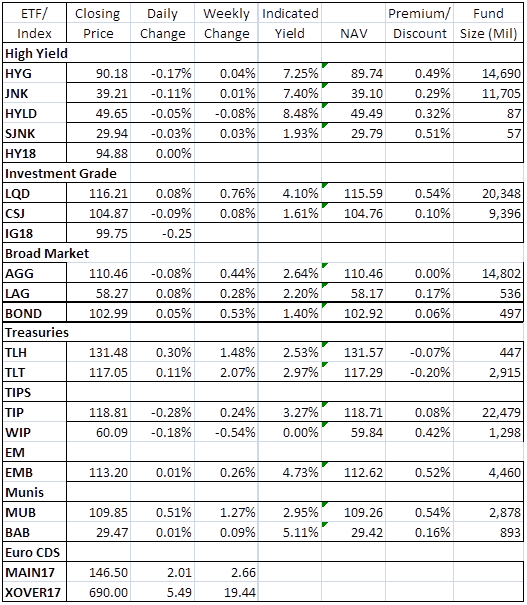

Credit is very quiet this morning. IG, MAIN, XOVER, and HY are virtually unchanged. High Yield bonds remain well bid, HYG and JNK remain strong, but HY18 continues to struggle. TIPS have continued to do very well in spite of how “transitory” inflation is.