The T-Report: T-Bill Day in Europe

Stock futures have had another interesting overnight session. They hit a 4 day low, breaking 1,360 but once again failed to break 1,358 which seems to be a pretty strong resistance level. Stocks then managed to climb as high as 1,373 and are trading off a little now. So another large move and we haven’t even seen the pre-opening economic releases. Volatility is back. The market feels good, but so far, it was not able to breach yesterday’s highs, and the overnight low, was lower than the prior day. It doesn’t seem healthy to me, and the primary drivers for the change in sentiment seem highly suspect.

A wave of treasury bill auctions and German confidence sparked the turnaround. Sentiment numbers are never particularly convincing data points for me, in either direction. The market is happy that the EFSF, Belgium, Hellenic Republic, and Spain were all able to issue treasury bills. That is definitely good, as it indicates the continued availability of short term funding, but it isn’t great news and shouldn’t be surprising. European sovereign treasury bills seem to have their own set of rules, I still haven’t found the specific rules, but my understanding is that they are protected in some way. Greece was able to (and did) issue bills throughout the entire crisis. Even while PSI was being negotiated and bonds were trading at 20% of face, they were able to issue bills with yields of about 4%. The bills were not part of PSI, and they continue to issue them at 4% while the new PSI bonds languish at 20% of par. If Greece could issue treasury bills and still had to crush bond holders and still can’t make ends meet, why so much excitement over Spain’s treasury bill issuance? It is marginal news at best.

I am a little surprised that the market is reacting negatively to Goldman’s news. On the surface earnings seemed good, and the stock is well off its March highs. I’m not complaining, it just seems weird, and seems to be another signal that all is not right with this market.

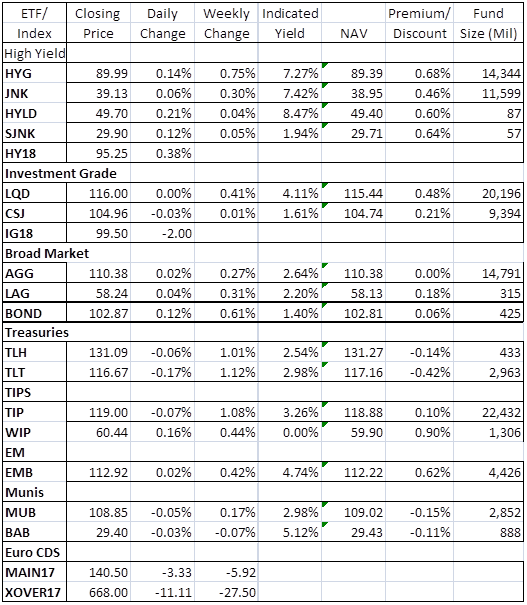

Fixed Income ETF’s were largely unchanged yesterday and although most are trading at a slight premium to NAV, nothing really jumps out as particularly rich. CDS indices are outperforming this morning, with Europe leading the way. I continue to thing HY18 offers value, but am not ready to commit to it yet as the auction led rally seems to simplistic to last. So far it doesn’t look like there has been any new technical pressure unleashed on the market from all the “whale” stories. I continue to look for that, and if it occurs, it is likely to be bad for IG9 and good for HY17 and HY18.