The T Report: Yellen, Italy, and Volcker

A dull, but positive start to the day. Stock futures are above yesterday’s highs and credit is performing very well. The IG18 index is trading at 100.5 which tighter than it got at any time yesterday and seems to be the big outperformer so far.

The Italian bond auctions seemed okay, at best, yet the market seems quite pleased with the result. Once again, sovereign CDS seems less enthusiastic, with Spanish and Italian CDS only a bp or two tighter. That has been a sign that intervention by the ECB is driving bond prices more than any real change in sentiment.

The main reason for the strength seems to be that Yellen was extremely dovish and has put QE back on the table and hinted that ZIRP could go on even longer than 2014. That basically flies in the face of most other recent Fed comments where they seem to be taking great pains to dissuade the market of the notion that more QE is imminent.

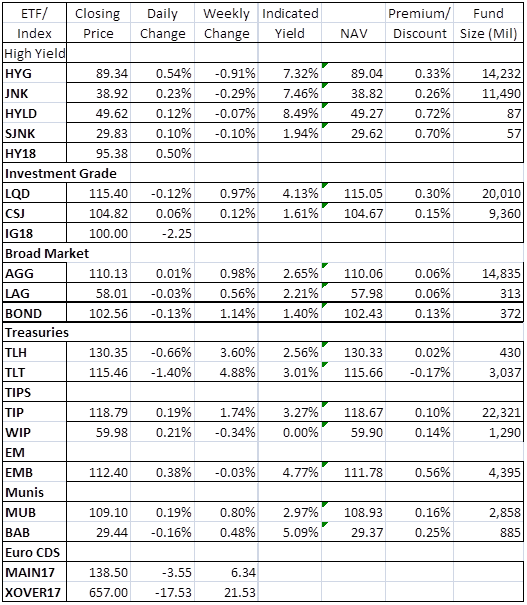

HYG and JNK both reverted to trading at a premium. That is helpful as the discount was concerning. Both funds saw outflows yesterday, we can argue whether that was investors pulling out, or arbs putting on the trade in the morning, but in any case we need to see if the trend of inflows is finally broken.

Blackrock announced a new corporate bond trading program. Bloomberg already has ALLQ for CDS indices. I continue to believe that the Volcker rule will be the best thing that happened to credit trading, it just won’t be a great thing for all of the existing players. Credit trading desks still rely on basically the same technology that was around in Bonfire of the Vanities and Michael Lewis, and now some new places and methods are being created to get some of those “crumbs”.

I remain short. Too short this morning, though it had been looking good overnight. With what seems like low volumes and no new news driving today’s strength I will watch for bit before deciding to cut.