The T Report: “Rate” Products and “Credit” Products

Clearly Spain is the story of the day. The auction was weak in every possible way. They sold less than the maximum, at yields worse than last time, and with much lower bid to cover ratios. That accelerated the sell-off that was started after the Fed came out with a less dovish statement than the market had been hoping for.

I had an interesting discussion yesterday about the difference between “rate” and “credit” products.

To me, “rate” products are bonds where no one believes there is a risk of default. These would include German, French, and U.S. bonds. Everyone expects to be paid on those. These products tend to trade in large blocks where investors (speculators) are often attempting to capture moves of just a few basis points. Duration and yield are what matters when trading these bonds. Greed for a few bps rules the trading of “rate” products.

As you shift to “credit” products, like Greece, Portugal, Ireland, and Hungary, yield and duration become less important and the focus becomes on maturity, price, and notional. The risk of default is real and investors pay careful attention to notional. The trading size and usually the liquidity decrease, forcing investors to be even more careful. Although jump to default risk is relatively low, the tendency for major gaps down in price is to real to be ignored, even by the most die hard bulls. Fear over full notional loss rules the trading of “credit” products.

Spain and Italy are right on the cusp. Just over two weeks ago, first Spain, and then Italy started to break away from the “rate” countries. Not by much, by noticeably different trading pattern. That has accelerated. Some rumors of direct ECB interventions and hopes of easy money across the globe provided support the last couple of times that these countries threatened to resume trading as “credit” products. This is a real concern. I can only assume that the ECB is debating once again wading in and buying some bonds or directing the EFSF to spend some of its “firewall” money. That would help the situation, but I don’t think would be long lasting. If the ECB fails to say anything very supportive during the press conference, expect the sell-off to resume. Too many people had become complacent, and had viewed LTRO as accomplishing more than it was actually capable of.

The mark to market collateral provisions of the LTRO could become important. I don’t believe banks actually used it much to purchase new assets, and what they did buy specifically for LTRO was shorter dated bonds, so the problem is unlikely to be big, but will be noticeable. If I’m wrong, and the banks used LTRO money for a lot of longer dated sovereign debt, this will add to the problems.

I, like everyone else is in waiting mode for the ECB. It is far too likely that after this move, they will try and address it during the press conference and we can see a decent recovery. We saw how quickly the U.S. markets rebounded from their lows yesterday. If the ECB doesn’t promise anything new or really address the move in Spanish and Italian yields, I expect the sell-off to resume and take another big leg down.

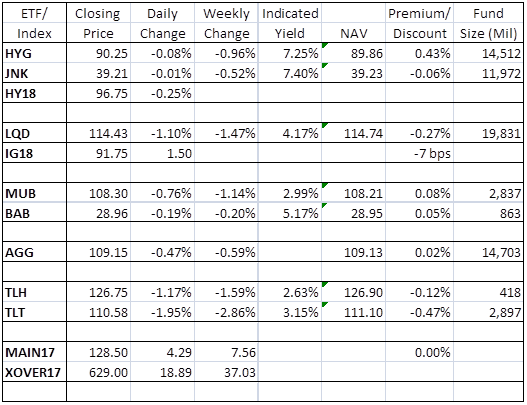

IG18 which looked like an easy purchase into the close yesterday at 90.75 is only at 91.75 this morning. I would leave that as a short since it continues to trade rich, and if the ECB can’t fix the markets this morning, these should move quickly to catch up to problems in other CDS indices.

Main is trading at 128.25 right now. It had spend most of the early morning at 126.25 (which was 2 wider on the day) and did gap to as high as 129.5. Liquidity seems very low, and the index is moving 1 bp at a time on seemingly low volume.

Italian and Spanish CDS are both 17 wider on the day, 410, and 458 respectively. The 10 year yields are 5. 30% and 5.63% and in 5 years they are both near 4.45%. I think the 5 year trade still has room to run, as 5 year Spain should be yielding more than 5 year Italy, but it did close over 20 bps since Friday.

From our “fixed income” allocations, we would not put back on the HY portion we sold, but will sell back the treasuries we bought. HYG and JNK were just too strong yesterday in face of equity and CDS weakness. LQD looked bad yesterday on a yield basis, and I expect that underperformance to continue today, so still nothing allocated to that sector.