The T Report: Are Stocks Giffen Goods?

So when will retail investors start buying stocks? One of the final legs propping up this rally is the belief that retail investors will finally pile into stocks. There is hope that all this “money on the sidelines” will find its way into the stock market. The S&P at 1,350 was supposed to do the trick. Certainly 1,400 on the S&P was going to be enough to chase retail investors into stocks. Basically the argument that retail will capitulate and finally invest in stocks is based on the assumption that higher prices increase demand – aka, a Giffen Good.

Is it realistic to assume that investors will decide to purchase more of something just because the price has gone up? They did it in 2000 with internet stocks, that infatuation ended badly. They did it with housing in the mid 2000’s, which ended even worse. If anything, Americans have become more focused on buying things on sale and getting things at a bargain. Why shouldn’t that apply to stocks as much as it applies to anything else?

We have hit multi year highs, yet most people seem to shrug it off. If the retail investor was about to increase their allocation to stocks, do you not think there would be more hype in the media about how well stocks have done? Expecting “the masses” to buy just because something is already up 20% seems a little silly, if not downright arrogant. The retail investors are not stupid. They can also see that the stock market has decoupled from the economy. While professional investors can easily accept that, retail investors still have some level of conviction that the stock market should reflect economic activity and not just central bank printing and government spending. Retail investors can see that the U.S. debt has continued to grow and that in spite of lip service to deficit reduction, we are creating a bigger deficit. They are nervous about what will happen when finally the spending gets pulled in. They are also very nervous (as are many professional investors) that they will be the last purchase of stocks before the central banks stop pumping fresh money into the system in their never ending attempt to inflate asset prices.

If there is one sector where the upward price movement is sucking in more money it is amongst corporations themselves. The number and size of buyback announcements seems to be increasing. That makes sense, since if any group has shown an ability to buy high and sell low, it is corporations themselves. In 2007 and the first half of 2008, companies, including AIG, were buying back their own stock aggressively. From the second half of 2008 and all of 2009, most companies couldn’t afford to buy back shares and many had to issue. It is just wrong to expect individuals to be as frivolous with their money as corporations are.

I continue to believe that retail is reasonably allocated to equities, under the new allocation model. The new allocation model takes into account debt before determining what is investible. Then there is an actual allocation to ultra-safe “rainy day” money. That “investible” money is then allocated at a much more realistic percentage to equities and fixed income and “other investments”. A myriad of new investment vehicles have helped make it easier for investors to participate in the fixed income market and other asset classes, helping to ensure that the allocation to those remains higher than it was through the 90’s and the first part of this century.

I do not believe stocks are a Giffen good, at least when it comes to retail, so expecting “dumb” money to come in and take out the “smart” money may be just as paradoxical as a Giffen good.

The market is a little weaker again this morning, so I better type quickly, since the “Europe went home” rally now starts before Europe goes home.

Chinese service PMI came in strong, but no one really cares about China as a service economy, so that news was largely shrugged off.

Eurozone PPI came in slightly higher than expected and last month was revised slightly higher as well. Nothing too earth shattering, but rising inflation with falling employment makes for a very bad combination.

Spanish bond yields are once again under pressure – as they should be. Italy is also feeling weaker again. In 10 years Spain is back to 5.40% and Italy is at 5.15%, out by 5 and 7 bps respectively. We have seen support, whether normal market support, or central bank purchase support around the 5.20% and 5.45% levels in the past few days, so need to keep a close eye on these levels. Spain is underperforming more noticeably in the 5 year sector, but still trades at 4.19% compared to Italy at 4.32%. Yes, Spain yields more in 10 years than Italy, but less in 5 years. Spanish 5 year CDS is at 436, but Italian 5 year CDS is at 388. So the 5 year bond inversion is clearly an anomaly and a function of supply and demand and an obvious sign of how inefficient bond prices are. There are so many “technicals” at work in the bond market that it is extremely hard to separate what part of price is reflecting risk as perceived by the market and what part is influenced by other non market factors. That is one reason CDS is so popular – it is fungible and not constrained by who holds what issue.

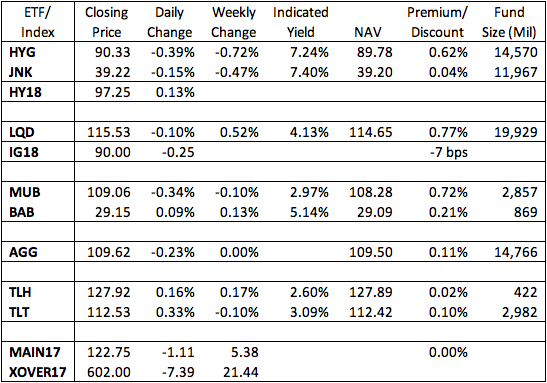

CDS indices are all a little bit better today. European ones were largely catching up to the afternoon move tighter here. IG18 is trading even richer to fair value. This shows a lack of conviction in the rally by the market as a whole since it looks like investors want to set their longs in the most liquid product giving them the greatest ability to exit if necessary. At 7 bps rich with a spread of 90, investors are overpaying for that liquidity. Look for IG18 to continue to lag.

Other anecdotal evidence of this tentative conviction can be seen in the bond markets, where once again, new issue trading is dominating daily flows. Investors have their core longs in bonds, add beta via the index, and look for alpha on new issue allocations and flipping. While not bad in of itself, it is not a sign of a truly healthy market. The ETF’s continue to get some inflows, but the pace has slowed dramatically and much of it can be accounted for by dividend re-investment and “arb” activity. While the ETF’s remain at a premium, “arbs” are buying the bonds that the ETF is willing to accept and exchanging them for new shares, which they then sell into the market. That form of share creation is far less indicative of strength in the market, than when people are truly just buying shares and leaving dealers and ETF managers scrambling to find bonds. That is a subtle, but important difference.