Investment Grade Bonds And The Retail Love Affair

Without a doubt, retail has fallen in love with corporate bonds. Fund flows were originally into mutual funds, and have shifted more and more into the ETF’s. The ETF’s are gaining a greater institutional following as well – their daily trading volumes cannot be ignored, and for the high yield space, many hedgers believe it mimics their portfolio far better than the CDS indices.

The investment grade market looks extremely dangerous right now as the rationale for investing in corporate bonds – spreads are cheap – and the investment vehicles – yield based products.

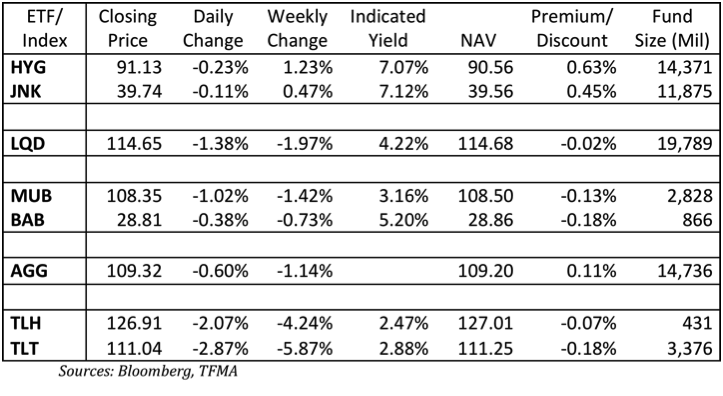

LQD which is up to almost $20 billion in assets is a good proxy for the risk investors are taking. LQD has the advantage of being “market weight” the financials. After the stress tests, that is a positive since portfolio managers that were underweight financials will buy, and the “spread compression” opportunities could offset the rate risk. On the other hand, 4 of the top 10 individual bond holdings have maturities in 2037 and longer. There is an immense amount of duration risk. LQD is down about 2% from its recent higher. Not much, but with a yield of only 4.2%, that will take 6 months of carry to offset. Any investor who bought back in November at 110 is still in good shape, but virtually anyone who bought this year on the back of the Fed’s pledge of low rates is now underwater.

I do not like the move in treasuries. ZIRP can hold down the short end of the curve. Operation Twist can help keep the longer end anchored and focused on the short end, but that is more difficult to accomplish. The further out the curve, the less control the Fed has. With LQD having a very long duration and trading at a premium to NAV, I think there is room for more weakness here. Investors will learn that investment grade bond investments can lose money even as spreads tighten.

High Yield may also have far more rate risk than people realize. Typically HY can do well in a bad treasury environment, because the implied improvement in economic conditions helps spread more than the yield issue. But there is nothing normal about this “high yield” market. The market seems to have 3 distinct asset classes. Yield to call type bonds, that have low yields, but high spread, because they are trading to 2 or 3 year calls. There is virtually no upside left in these bonds. They will generally drift lower towards their call price – horrible convexity. Then there are “story” bonds. Bonds that require a lot of faith in management and the economic turnaround to be comfortable with. Any upside in the market is in these bonds. Finally, there are all the high quality “liquid” bonds that have a decent duration. The problem is that most of these trade at relatively tight spreads, but also very low yields (certainly by HY standards). How many of these bonds can withstand a treasury sell-off without significant price action? High yield investors are particularly good at analyzing credit, they tend not to be as good at managing rate risk – since normally the move in rates is secondary.

With corporate bonds spreads (investment grade and high yield) already reflecting a lot of the move in equities, it will be critical to see how well they can withstand the pressure from the treasury markets – I don’t think they will do well near term, and would look near term declines in NAV and the premium to shrink.