A Complex Simplification of the CDS Market

CDS is once again (still) in the spotlight. We have moved on from debating whether or not a Credit Event has occurred in the Hellenic Republic, to concerns about whether the CDS market will settle without a problem. There is a lot of talk about “net” and “gross” notionals and counterparty risk.

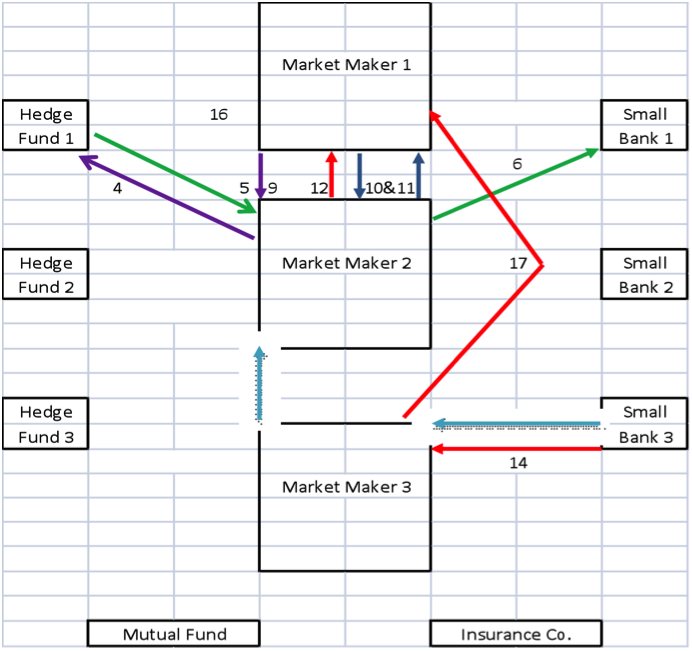

What I will attempt to do here, is build a CDS world for you. We will look at various counterparties, the trades they do, and the residual risks in the system. It will be loosely based on Greek CDS but some liberties will be taken. None of the institutions are real world institutions (in spite of how much they sound like some people we know). It is a simplification, but to make it useful, it has to be robust enough to give a realistic picture of the CDS market/system.

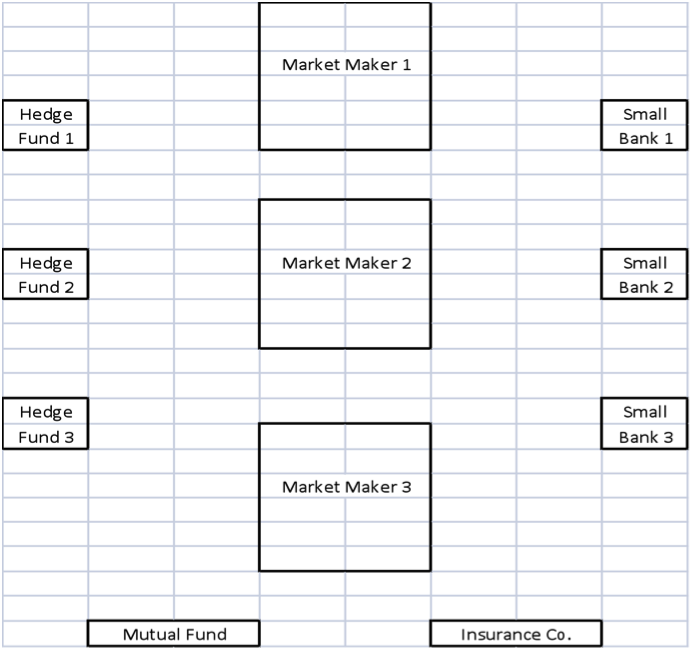

The Players:

Hedge Fund 1 (HF1) is a large global macro fund with a strong presence in the credit market. HF1 is a very sophisticated trading operation with good ISDA Master Agreements (ISDA’s) with all the MM’s.

HF2 is more of a bond focused account that uses CDS primarily as a hedge and for some basis trades. It only has ISDA’s with MM1 and MM2. They didn’t bother dealing with MM3 because they felt like they mostly tried to broker orders and offered no real value.

HF3 is an aggressive trader of CDS (and bonds). When not busy begging for new issue allocations to flip it focuses on ensuring the market is “efficient”. They trade high volumes, but in spite of their efforts to ensure the markets are efficient they are sometime ridiculed as “spivs”. They have ISDA’s with all the MM’s but generally on terms more favorable for the MM’s.

Market Marker 1 (MM1) is the best and most sophisticated of the money center banks acting as market makers for CDS. MM1 also has an active bank hedging book that hedges their exposure to counterparties either from loans or derivative trades. This hedging book is restricted to trading internally, and cannot source risk from outside the bank.

MM2 is a decent market maker. Not quite as good or as sophisticated as MM1, but decent. They have a bank hedging desk as well, but since MM2 is not a great market maker, they are covered by MM1 and MM3 as clients (while the trading desk is a competitor of MM1 and MM3). Definitely a hedge fund oriented strategy, which has some appeal since hedge funds trade far more actively.

MM3 is the weakest of the market makers. Always seemingly a step behind, but they have some strong relationships with a couple of small, weak banks, in their domestic market, that they can still make money on these “captive” clients, while not being as good as MM1 and MM2.

SB1 is a good, well managed small bank. They typically make loans or buy bonds and use CDS as a hedging tool, but will occasionally sell CDS as a way to “enhance” returns. SB1 is big enough and aggressive enough that it has ISDA’s with all the MM’s and on pretty good terms in regards to collateral.

SB2 is similar to SB1 but only has ISDA’s with MM1 (because they are the best) and with MM3 (because they feel a close connection to the bank that is big in its own domestic market).

SB3 is the weakest of the banks. Capital is always tight. Access to funds is tight. They rely on accrual accounting and aggressive regulatory capital treatment. They only have an ISDA with MM3 because MM3 is the dominant player in their domestic market, and MM1 and MM2 had demanded much harsher and “unfair” terms during ISDA negotiations, so they had never been finalized.

Mutual Fund 1 (MF1) rarely uses CDS, but occasionally will use it to hedge or take risk. They have ISDA’s with all three dealers in spite of the fact that they rarely use it.

Insurance Company 1 (INS1) also rarely uses CDS, but only set up an ISDA with MM1 because they got good enough execution with them, and for how little they use CDS, it didn’t make sense to set up more and manage more.

The “Street” are non risking taking brokers who only talk to market makers, market makers show prices to the “street” as well as to clients – not always the same or at same time.

Let the trading begin:

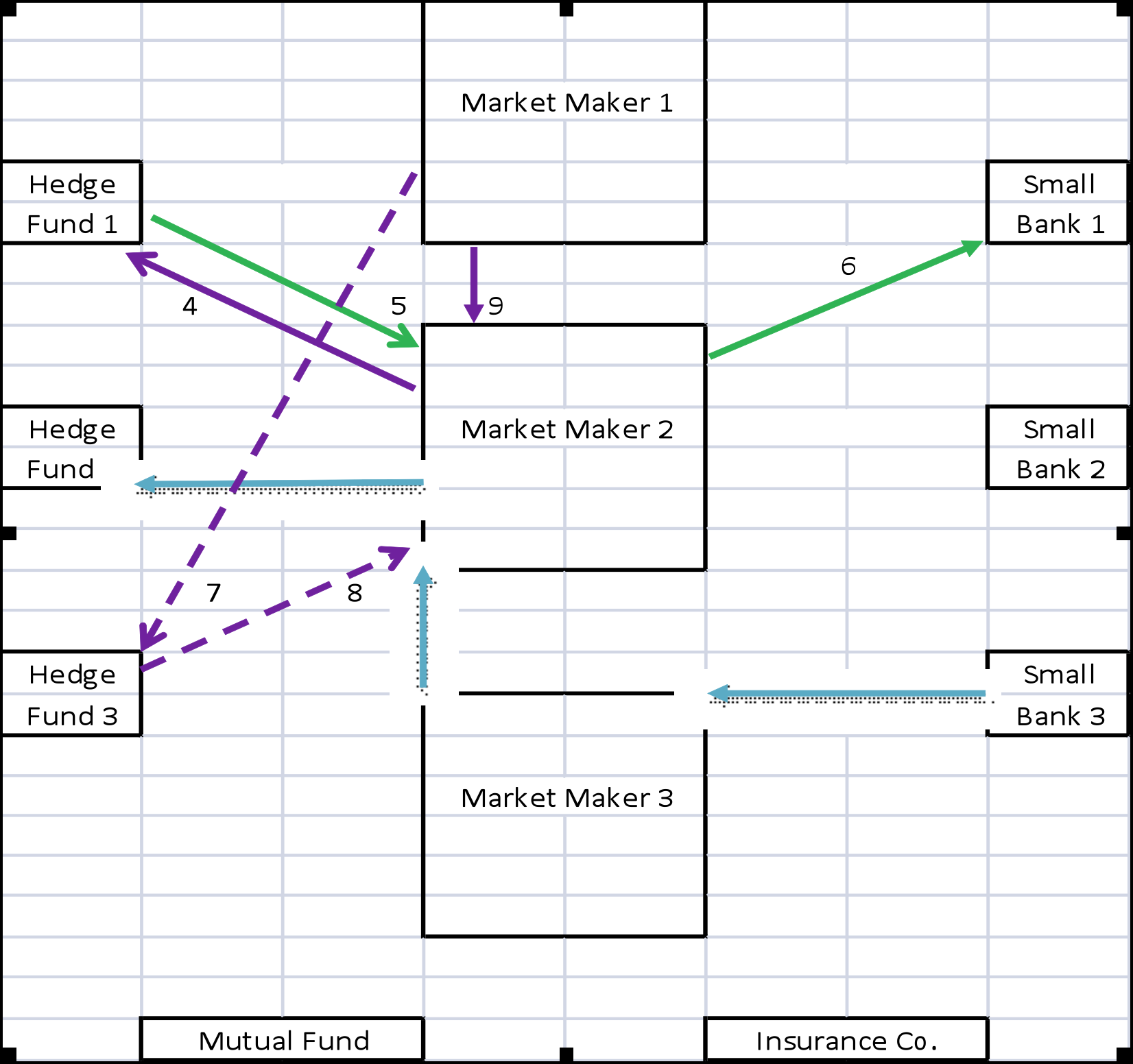

After a series of trades (assuming each on is for 10 units), the market now looks like this.

Blue trades:

1) HF2 decides to buy 5 year protection. They own some bonds and are nervous about the market, but rather than selling bonds, they prefer to hedge with CDS. MM2 had the best offer at the time so HF2 buys protection from MM2.

2) MM2 tries to find a seller of protection to cover their risk, so they put a bid out in the street, MM3 knows that their “captive” client SB3 is looking to sell protection on this name. So MM3 sells protection to MM2.

3) MM3 then buys protection from SB3.

Net notional is 10 with HF2 short 10 or alternatively SB3 long 10. Gross notional is 30 as 3 trades are outstanding.

Green Trades and Purple Trades:

4) HF1 puts on a curve trade with MM2. HF1 is buying 2 year protection and selling 5 year protection, because they think default will occur sooner than market is pricing, this is the purchase of 2 year protection leg.

5) This is the leg of the curve trade where HF1 sells 5 year protection (HF1 has ZERO net notional exposure, but would still post collateral with MM2 since the spread could move, but far less collateral than if they were outright short).

6) SB1 is looking to buy protection, and when they see MM2’s new aggressive 5 yr protection offer (they had just bought protection from HF1), they engage with MM2 and buy protection from them.

7) MM2 now wants to cover the 2 year leg of the trade as well. They go out aggressively to customers trying to buy 2 year protection. They don’t show it to the “street” as 2 year is relatively illiquid and they don’t want to push the market against them. HF3 notices it is very aggressive compared to a 2 year market sent out earlier by MM1 (actually their “run scraper” notices it is aggressive and sends an alert to the trader that there is an “arbitrage” opportunity). Sure enough, MM1 is willing to stand up to their earlier offer on 2 year CDS, so HF3 buys 2 year protection from MM1.

8) HF3 turns around and sells protection to MM2 “on assignment” with MM1. So HF3 will do a trade with MM2, but assign them to face MM1. HF2 will have no trades on the books but will have received a payment equal to the difference they crossed the market makers for (and you wonder why some hedge funds like the market as opaque as it is). Some market makers are better at checking same day assignments than others, in an effort to stay away from clients that “pick them off”.

9) This is the resulting trade in the system after trade 8 and the assignment in trade 9. There is a formal assignment process and MM1 and MM2 have to accept each other as counterparty – ie, HF3 doesn’t dictate who anyone faces, they merely “request” they face each other. In normal times, market makers accept virtually all assignments as they manage the counterparty exposure closely and are comfortable with other market makers. Any time you hear that some market makers won’t take other market makers on assignment, that is pretty much the end of that ostracized market maker (it happened with Bear and with Lehman).

Net notional is now 20 with HF2 short 10 and SB1 short 10, or alternatively because SB3 is long 10 and MM1 is long 10 as well. Gross notional is 70 (there are 7 trades outstanding, trades don’t exist).

It may seem confusing, but if you follow the trades and the arrows carefully, it should all make sense. The trades are just buys and sells, like any other asset. The fact that the contract is a CDS seems to make it more difficult for people to follow, but it really isn’t that bad. The fact that the market makers send prices out via message to customers, but also have a “street” to show prices to each other, is confusing, and that is harder to explain. It is a legacy of how the market started, but does seem strange. In an earlier piece on “index” trading, I tried to highlight how that market, which does have some electronic trading, is still bizarre, because of the “customer market” vs “street market” concept. Volcker rule really has no clue how “credit trading” works.

Now we will look at a simple interesting trade because it really does happen a lot, and doesn’t seem particularly efficient though it makes sense how it happens.

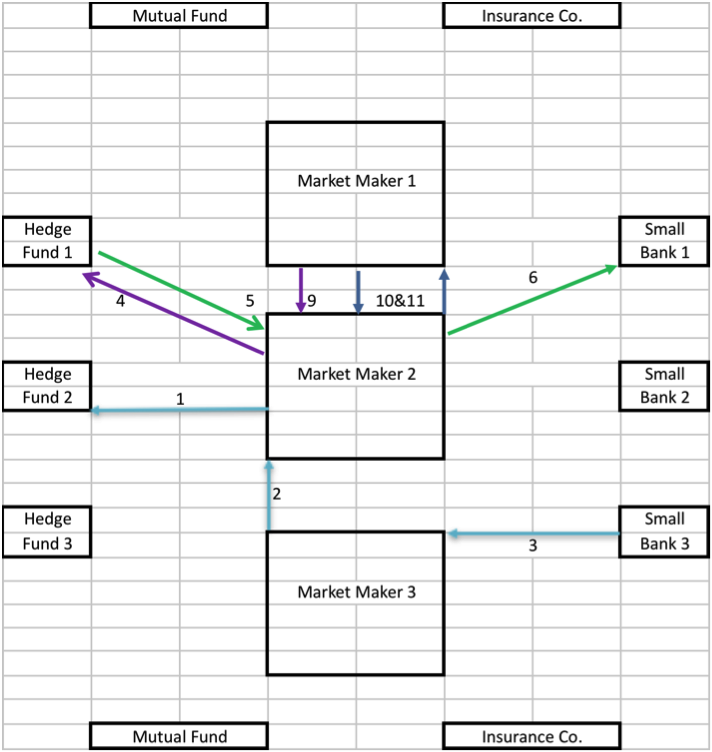

Dark Blue Trades:

10) The bank hedging desk needs to buy protection. They see MM1 is a better offer on the last runs they saw, than their own bank. Their own bank’s market making desk tends to treat them poorly, so they engage with MM1 and buy protection from MM1.

11) MM1 was surprised they get lifted, since they had been a better offer in the “street”. They go ahead and lift the “street” offer for a quick profit. They find out that the street offer was actually MM2 who had just been “trying to get something” going in the street and hadn’t shown that same aggressive level to customers. So MM1 buys protection from MM2 (that MM2’s hedging desk had been under instructions to buy for the banks books).

So MM1 made a little money off the trade and MM2 as a bank didn’t see their exposure to the underlying change, but it did shift risk from the “hedging” book to the “trading” book.

Net notional is still only 20, but Gross notional is now 90 as 2 more trades were added.

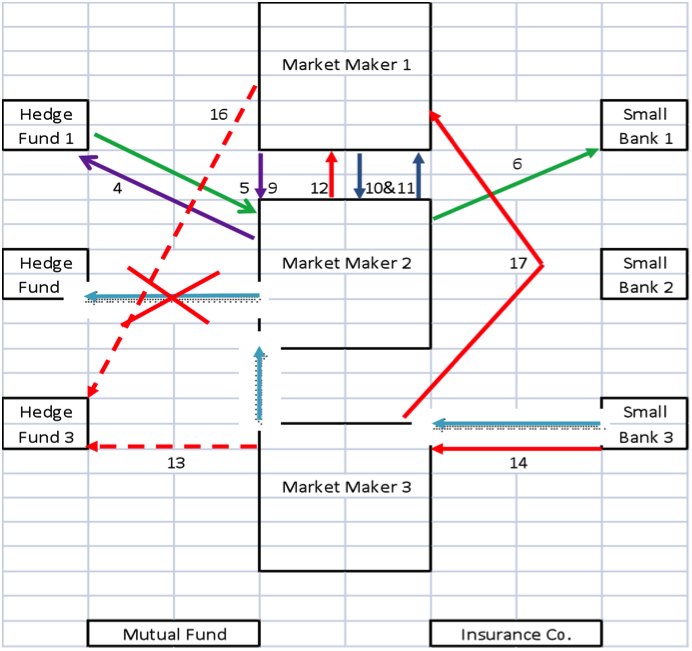

Having slowed it down a bit with that series of trades, it is time to go into the grand finale. This is definitely more complex. More moving parts, and yet, is representative enough of how CDS trades that it is crucial to follow it through.

Red Trades:

12) MM1’s bank hedging desk needs to buy some protection. They are not allowed to trade outside the firm for protection. As the conversation progresses and the bank needs to buy 20 units of protection, the trading desk at MM1 gets into action and lifts the street, which turns out to be MM2 again. So MM1 buys protection from MM2 (though for now the trading desk holds the position rather than giving it to the hedging desk). MM1 updates their clients with fresh pricing showing they are an “axed” buyer of protection.

13) MM2 now also sends out a fresh run, indicating that the protection is trading up and they have a better bid. Our good friend at HF3 see MM2’s updated run and MM1’s “axed” buyer messages and quickly engages MM3 before they realize the market “just went bid”. MM3 saw the trade in the street and is reluctant to sell any protection at these levels. HF3 cries foul, claims MM3 is “never real” that MM3’s “markets suck” and “there is no reason they shouldn’t be able to match the offer from earlier”. Finally after threatening MM3 with the “you will never see our flows again” line, they reluctantly agree to sell to HF3. Maybe MM3 would be better off without seeing HF3’s “flows” but the salesperson who covers them wouldn’t, so the salespeople win a shocking number of those battles.

14) So now MM1 is still working their hedging desk’s order and MM2 and MM3 both want to cover the protection they just sold. MM2 calls HF1 and sees if they want to sell more 5 year protection. HF1 says they are happy with their curve trade right now, so nothing to do. Both MM1 and MM3 reach out to SB3 and see if they are a seller (certain things flow downhill as the saying goes). SB3 actually does want to sell more, but they are scared of how much MM1 might have to do, they can also sense that MM3 is a little more desperate, so they play MM3 off of MM1 and sell protection to MM3 at a very attractive price. The trader is left to book the trade, deal with the loss, and curse the salesperson, who is already long gone on their way to a client event.

15) In the meantime, MM2 has managed to convince HF2 to take profits on their short. They point out it has moved too far too fast, and that once an aggressive bid gets taken out of the market, HF2 should be able to reload at better levels. So MM2 buys protection from HF2 as an “unwind”. So trade 1 will disappear from the system now that trade 15 “unwinds” it.

16) HF3 sees that both MM2 and MM3 are back to being two sided and not so aggressive on the bid. They rush to call MM1. MM1 buys protection from HF3 on assignment from MM3. MM1 actually prefers to face MM3 because they don’t like buying protection on risky names from HF3, even with the strict collateral requirements they have. Then MM1 fills their hedge desk on 2 blocks. They make a small mark-up on the trade with HF3 and take a little more profit on the piece they conveniently bought from MM2 before the market went wider. Since the hedge desk is an internal client, won’t see the street trade, and it is CDS, not a security, and the market making desk “took risk”, it is just good trading, not front-running or any other nasty term that might be running through your mind.

17) This is the assignment so that HF3 once again has no trades, and MM1 has bought protection from MM3.

So now we have built out a system of CDS positions. You have seen how the trades were created, what the motivations and needs were and how it came about. I have not included any trades with Mutual Funds or Insurance companies, because although some use CDS, they are a relatively small part of the market.

Let’s take a look at the trades that are now outstanding and the risks in the system.

The Net notional is 20. SB3 has sold 20 or alternatively, MM1 and SB1 have each bought 10 net. The Gross notional is 110.

HF1 has a curve trade on. They bought 2 year protection versus selling 5 year protection. They did it even notional in this example (rather than duration weighted, which is fair for a name like Greece that trades in points up front). They will likely have a little collateral tied up. In the event of default, MM2 will owe them money, so MM2 is well hedged from a “counterparty” risk with HF1.

HF2 and HF3 do not have any trades outstanding.

MM1 and MM2 have 2 sets of offsetting trades. If they run “trioptima” or some other service that looks for “netting” opportunities, trades 9, 10, 11, and 12 will go away. They do not have any counterparty risk to each other if a Credit Event occurs. At that time the payments owed each other will be netted, so it isn’t like money goes back and forth, they just cancel each other out. So there is no counterparty risk to each other.

SB1 bought protection from MM2. They have counterparty risk to MM2, but as a too big to fail bank in any case, MM2 should be able to make the payments. Certainly if that was in question the CDS referencing MM2 would be very wide.

Both MM1 and MM2 have exposure to MM3 who sold them each protection. MM3 may not be great at trading but is a big enough bank that they are unlikely to have any problems paying if there is a credit event. Furthermore, they will have collateral provisions with them on a mark to market basis. The “thresholds” of how much MM3 has to owe before collateral kicks in, is much higher than for a typical hedge fund, but should be well managed.

Which leaves us with the exposure MM3 has to SB3 and the exposure SB3 has to the underlying CDS. SB3 is long 2 contracts, they have the biggest position in CDS. They are the weakest entity in the chain. They write CDS because they don’t have access to capital. They only have an ISDA with MM3 because MM1 and MM2 impose stricter credit terms in their ISDA master agreement. If a problem is to occur it will be because SB3 cannot pay after the Credit Event. That is bad, and would be the end of SB3 as it would default on everything once they missed that payment to MM3. MM3 will lose money because they didn’t collect from SB3. MM3 is still obligated to pay MM1 and MM2. MM3 is big enough that SB3’s failure to pay them will be a big hit on earnings, but not enough to stop them from paying MM1 and MM2. NO DAISY CHAIN of failures. It stops once it hits the big banks.

Again, this whole scenario analysis is purely hypothetical, but is probably a decent representation of activity in the market and what positioning winds up looking like.

Any questions, comments, or thoughts are greatly appreciated.