Slow Start To The Week As Market Digests Jobs, New Data

Weaker than expected trade data from China got the markets off to a slow start. Europe has been trying to bounce them up since then without much luck.

The jobs data came in strong, but there seem to be enough questions about the quality of jobs, weather impact, and what had already been priced in, that market reaction has been only tepid (we are at 1,370 already on the S&P).

We should start seeing more headlines on the consequences of the Greek debt default/write-off/restructuring/Credit Event.

Using rough numbers, about €200 billion was directly affected. That has now been written down to €100 billion, so at the very least the system has €100 billion of losses that have to be recognized (if banks choose to hold the new bonds at par rather than market value). Looking at the market value of the debt, the total loss that needs to be accounted for is €150 billion.

A lot of the loss has already been taken. Anything that was in mark to market accounts was already trading around 25% of par, and is unchanged since the events, so those losses already have been fully recognized. How much of the Greek bond “float” was in mark to market accounts? I’m guessing less than €50 billion. A lot of the mark to market float wound up in the hands of the ECB – their SMP purchases were getting done with bonds that were marked – and unlikely coming from the small banks that adore accrual accounting. With about €30 billion of holdouts assumed to be hedge funds, who rely on mark to market, assuming less than €50 billion of already fully marked bonds seems about right.

Then there are the reserves and charges banks have already taken. There have been some big write-downs in the past couple of quarters – Commerzbank, DB, RBS, and SocGen come to mind. I’m not sure they fully took the charge, but the big banks as a whole seem to have taken a lot of the hit. Many of these banks seemed to have reasonably small positions, so any remaining charges should be minimal. The big question is how much of the debt did they hold? I’m guessing this is about half of my “non mark to market” float, so about €75 billion.

That would leave, in my guesswork, about €75 billion largely sitting in smaller banks. Their reporting is far more opaque. What reserves they have taken is less clear.

If only 10% of the potential losses due to Greek debt have gone unrecognized, that is €10 billion that needs to come out of the woodwork by the end of the quarter. That is the problem with such a big restructuring, even small percentages lead to big numbers. If there is a problem in the system, it won’t come from CDS, it will come from some concentrated holdings in good old-fashioned bonds, that haven’t been marked or been reserved against, in spite of all the clear evidence that they needed to be. Just be ready for some headlines, unlikely to come out of a big bank, but unlikely to be positive or confidence inspiring. Also, more details on what happens to all the bonds that were guaranteed by the Hellenic Republic needs to come out.

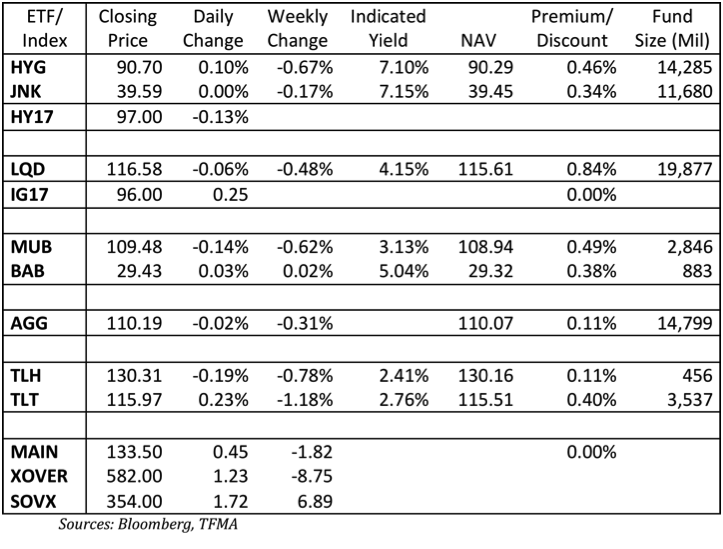

The S&P 500 managed to eke out a tiny gain last week, but the HY ETF’s both actually finished the week lower. Not only that, but HYG went 4 entire days without any share creation, and JNK actually had OUTFLOWS. The rate of inflows seems to have been slowing. Is retail fully positioned in fixed income? Will this look like a cheap hedge for funds as they focus on trying to buy cheap new issues and try not to get hurt on illiquid secondary bonds? Very early stages, but for a run that had seemed tired as it was, this is further evidence that the easy money in HY may be gone. In spite of all the talk about how cheap high yield looks on a spread basis, the bonds generating a lot of the “spread” are trading yield to call and have limited upside, and the bonds with the most duration are more exposed to moves in treasuries than at any time in my memory.

LQD saw some inflows in spite of weak performance. I’m not sure why it would be getting inflows while showing poor performance and seeing reduced interest in high yield funds, though the flows are small enough it may be an anomaly. IG17 struggled all week to rally materially. I thought it might have been related to outflows in LQD/Investment Grade mutual funds – possibly even as those investors moved into equities (which would be a positive development). But LQD had inflows, so that theory was wrong too.

Across the board the ETF’s are trading close to fair value, and the CDS Indices are trading close to their intrinsic value as well, showing the market is reasonably balanced.

Credit in Europe is a tad wider, nothing to write home about, but sovereign debt yields are higher across the board (marginally, but higher nonetheless) and CDS is a bit wider and continues to trade worse than the bonds.