Daily Credit ETF and Index Summary (12.01.31)

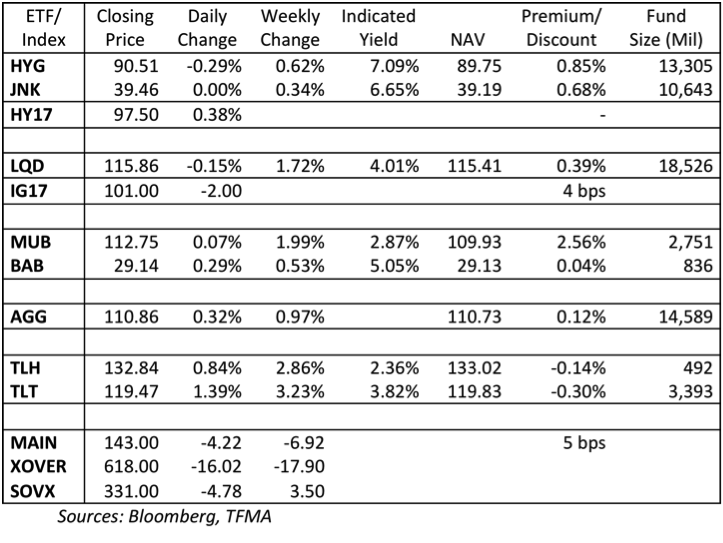

In the meantime the beat goes on in ETF land. HY ETF’s are on target to have received $4 billion by the end of this week. The premium is actually reasonable given the strength in the underlying market, but I remain dubious that there is much upside left in the portfolio as too many of the bonds generating the yield have real problems, another group of bonds trades at yields that are hard for “real” money to justify buying, and the final group of bonds have convexity that is bordering on horrific.

The indicated yield of MUB is now below the 30 year treasury yield. Clearly not the entire MUB portfolio is 30 year debt, but this is worth watching. The argument that muni’s, even with their tax advantage are trading wider than treasuries is disappearing. It is a very illiquid market, so maybe the premium is justified, but paying more than 2.5% above NAV for muni’s seems like a bad idea. The funds have been attracting fresh money, but nowhere near as quickly as the high yield ETF’s.

The CDS industries remain strong and aren’t trading extremely rich, showing that single names have been performing in line with them.

Listening to the “chatter” you would think the market is on fire, yet S&P is barely up in almost 2 weeks (it closed 1308 on the 18th). For the past couple of weeks, fading rallies has been working well, and I don’t see that changing as more and more people become convinced that “Europe is priced in” and ignore that strong earnings were priced in and aren’t really materializing.