Daily Credit ETF and Index Summary (12.01.18) – Not So Strong So Far

As confusion still seems to reign supreme the markets swing from feeling well bid to well offered on next to nothing. Having said that, the universal opinion is that anything you are short is inexplicably strong, and anything you are long, is weak.

Yesterday we were strong at the start of the day and the cash market even seemed poised to have a strong rally. Bonds did okay, but once again failed to experience a full on “ripfest” or “liftathon” and ended the day feeling extremely tired. This morning is a little weaker across the board. The early morning moves aren’t material, but the markets, Europe and the US, cash and CDS, single names and indices, are failing to retain some early morning strength.

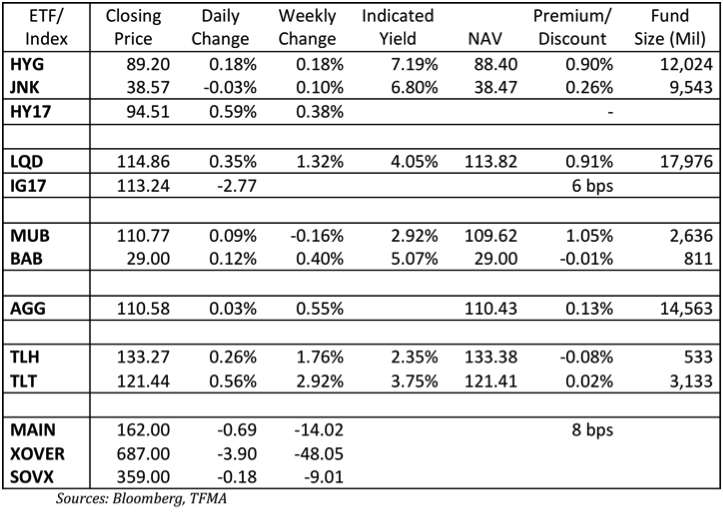

I would be flat HYG and JNK. Still enough strength from retail that they might not sell off, but neither the yields nor duration of the underlying portfolios appeal to me. The failure to ramp up so far is disappointing, and although at least one HY new issue that is coming today is looking to be well priced and will have big demand, it isn’t following through to the broader secondary market. HY17 is worth shorting again (still). We may get some “Greek PSI deal” announcement, but the markets just seem a bit overdone, and with fixed income trading revenue light across the board last quarter (or so it seems from the banks that have reported already), it is unlikely they decide to build an inventory of capital intensive junk bonds, and with virtually all bonds “trading by appointment” hedge funds are unlikely to add much, and in any weakness will have to smack HY17 bids as there won’t be live bids in any actual bonds.

On LQD I’d be flat our outright short (on a yield basis). I wouldn’t own it on a spread basis any longer. It is trading at a premium that is big enough to be meaningful, and with financials still heavy, there is little impetus to push already tight corporate spreads tighter. IG17 is a better short. It is trading too rich, and the recent strength has been on such low volume that it is easy to see a quick reversal. I don’t see IG17 outperforming.