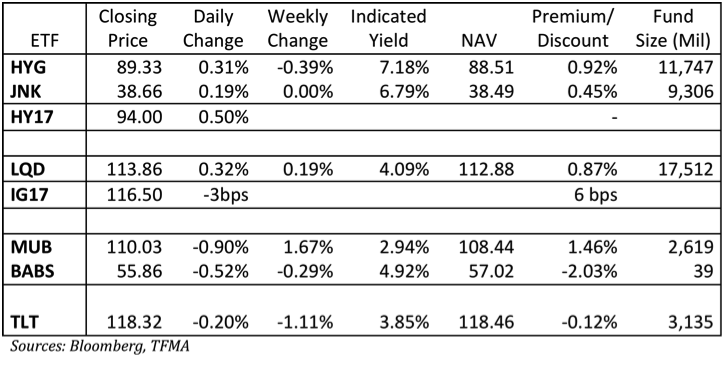

Daily Credit ETF and Index Summary (12.01.11) – A Focus On HYG/JNK NAV

The flows into HYG and JNK have now topped $1.1 billion for the year. HYG is dominating the flows by more than 2:1. Personally I have liked the rigor of HYG in terms of how they attempt to track the index better than JNK. This is in spite of very mediocre performance year to date, though that was largely because the premium the indices finished the year at was unsustainable and the underlying market hasn’t been that strong. The ETF’s and HY17 both finished off the highs of the day and are trending weaker again this morning as they track stock futures.

It is actually hard to find anyone who is bearish high yield. Even the bears reluctantly admit high yield seems to offer value. That level of complacency is troublesome. The supply should start to come, it will be interesting to see how well the market digests the new supply. I suspect they will come cheap enough that the new issues themselves will rally, so it will be key to see if the buying looks like new money being applied, or if people are swapping out of old issues to buy the new. There is probably enough cash lying around to absorb the early deals, so I remain neutral on HY.

Some questions keep coming up regarding the high yield ETF’s. The one question is whether they are paying too much current income at the risk of future price declines. On a quick glance, this doesn’t seem to be the case. The YTM and YTC of the underlying portfolios seem to support this level of dividend (though we are trying to verify the calculations). What is more difficult to answer, is whether the portfolios themselves are overpriced. The NAV of the portfolio is calculated correctly, but are the bonds themselves overpriced because of the demand from the ETF’s and the “indexing” they are subject to? The CIT 7% of 2017 is the largest single bond holding of HYG. The concern some people have expressed is that these bonds will trade rich because they are included in HYG. It is not obvious to me that this is the case. There seems to be enough flexibility in what HYG (or JNK) can include that there doesn’t seem to be a big bias in prices of the bonds they own, though there could be a small bias. To the extent these bonds are overpriced relative to the market, the ETF’s will underperform. I think the bigger concern will be what happens in a market decline.

While the ETF’s have a lot of flexibility around their index when they are adding bonds, they can only sell what they own if they are going through a period of contraction. That could easily put pressure on the specific bonds held by the ETF, and although the ETF would trade at NAV, that NAV would be falling faster than the market as dealers try and avoid buying bonds that are held by the ETF, knowing they have to sell. With the current strength in the market, that seems like a far-off risk, but is worth thinking about, particularly when looking for specific bond short ideas.

One thing that does concern me as the ETF’s take in so much money is that they often wind up with the weakest bonds. If a dealer can sell a bond at a good price they are less likely to include that in a bond for shares exchange (at least in my opinion). This may lead to the ETF being stuck with relatively weak bonds. The fact that 2 of the top 10 holdings are Sprint and Clearwire doesn’t make me too excited about owning HYG. That seems like a decently large bet on a “story” credit. First Data and Intelsat are also part of the top ten. More “story” credits in the tech sector. Two CIT bonds and Springleaf Finance are in the top 10. So 3 of the top ten holdings are financials. One of the things people like about high yield in general is that it is corporate and not financial risk. The market has more financials than in the past, but the portfolio construction does have at least the hint that it is being created by what dealers can’t easily sell, rather than what a bond investor would want.

For longer term investors, the good mutual funds managers or separate account managers can more readily address these issues. The ETF’s are great as a broad asset class investment, but if you aren’t planning on using the liquidity, there are alternatives that might be able to outperform.

On the investment grade side, LQD continues to struggle to perform on an outright basis. It won’t as the yield is just too low. On spread it is doing okay, but without a big rally in financials, it will be hard to do much even on a spread trade. IG17 is once again looking too rich relative to the tone of the underlying market. IG17 is probably the best short in the credit market right now, but HY17 is also starting to look a bit toppy as it couldn’t hold yesterday’s highs and got weak quickly this morning.

In Europe MAIN is a couple wider but somehow the SNR Financials index is 6 tighter. That is causing some heads to be scratched. I saw an interesting trade idea today. Sell France CDS at 220 and buy Main at 173. France is trading 47 wider than Main, rather than being 30 bps tighter. Not sure I like the trade yet (particularly with the FX component of sovereign CDS) but it is interesting. Can the individual companies in Europe really do well if France continues to struggle? Definitely something to watch at the very least.