Daily Credit ETF and Index Summary (12.01.09)

European indices, MAIN, SNR (fins), and SOVX are all right around flat to a touch wider.

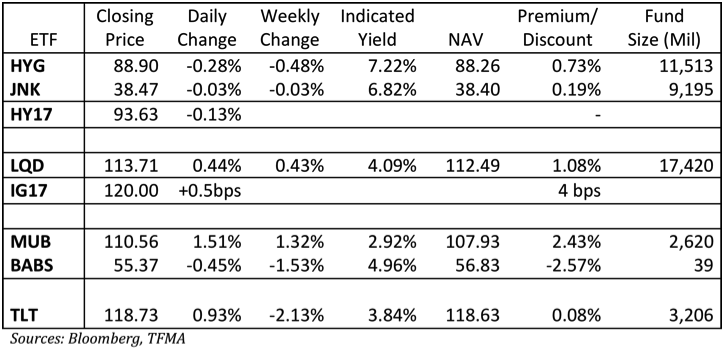

HYG and JNK attracted close to $750 million of new money last week. That many new shares were created, yet the funds were down on the week. The premium has shrunk for the indices. At these levels, they are no longer obvious shorts (at start of the week, the 2% premium without follow through in the actual junk bond market was a clear signal that risk/reward was messed up). HY17 outperformed.

We remain bearish HYG and JNK and would also be bearish HY17. It is more risky to be short since they are all trading close to fair value, but with continued problems in Europe and no clear indication that QEX is on its way here in January, it makes sense to wait and see. Earnings won’t necessarily support the market this week and the yields are at best mildly interesting, but largely offset by how negatively convex the bonds are right now. Too many of the bonds generating high current income, are at quite high $ prices and trading to relatively short call dates.

LQD did well for the week, particularly on a spread basis. The high percentage of financials in LQD let it do better than IG17 (and the fact that IG17 was trading far too rich). LQD just doesn’t look attractive on a yield basis, so would continue to avoid owning it outright. Owning it hedged with treasuries remains interesting, but not particularly compelling.

MUB did extremely well. It was impressive outright, but even more so for those who traded it on a “spread” basis as treasuries had a tough week. Barron’s talked about the seasonality of the Muni market, so we continue to like MUB hedged, and BABS as well (hedged better than outright, but even outright is tolerable on BABS).