Naked in Europe

So Europe is getting closer to announcing some form of ban on naked CDS. What they hope it will accomplish and what it will actually accomplish are two very different things.

First, let’s look at the mindset. It about a ban targeted at entities that buy CDS (go short the credit). It doesn’t target those who are selling protection. Why is it fine for an institution to sell protection? If the goal is to support the bond market, ban the sellers of protection. Anyone who sells protection is doing that rather than buying bonds. If an institution couldn’t sell CDS “naked”, and they wanted exposure to the sovereign risk, they would have to buy bonds. Isn’t the contagion risk and counterparty risk all related to those who sold CDS? Yes. Wouldn’t an exchange or full clearing help this without hurting the market? Yes, but somehow that is “off the table” as too complicated.

Anyways, so what do they hope to get by banning naked shorts? They expect CDS to tighten. That will likely be the initial reaction. They expect a tightening in CDS to lead to improved purchases for bonds. That is unlikely to occur.

Let’s take a close look at Italy to show why their expectations are likely to be disappointed. First, it is important to remember that CDS on Italy trades in $’s and their bonds are denominated in Euros. That is a key difference. If you buy (or sell) CDS on Italy, the flows are in $’s. So as Italy widens you make money on the CDS. You would also make money being short Italy in the bond market. If the correlation between Italy widening, and Euro weakening is high, the CDS is a better way to be short. This creates a basis that is far more complex than a straightforward CDS where the CDS is denominated in the same currency as the underlying bonds.

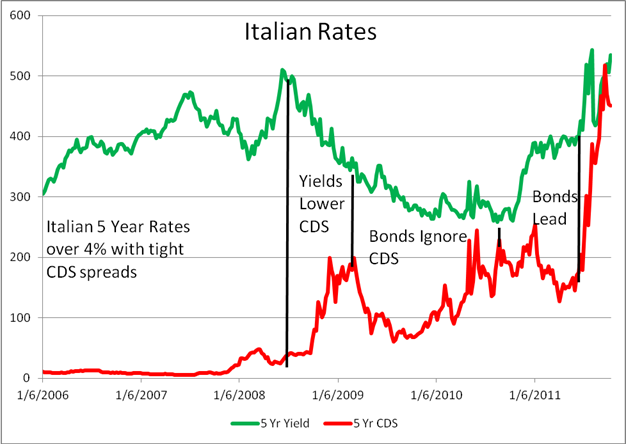

Italian 5 Year Bond Yields, Spread to Bunds, and CDS

It is easy to see that there is relatively little correlation between Italian bond yields and CDS. Spreads are in many ways more important, but at some level it is the yield a country is paying that matters. It is also true that as a country becomes deemed to be a real credit risk it no trades on a spread basis, it trades on a yield basis, and ultimately moves to trading purely on price. Investors in Ireland and Portugal are looking at yield now. Those countries have moved past the point where anyone thinks of them in terms of spread to bunds. Greece has moved purely to trading on price. No one really cares what yield they are getting, it is all about price. It is also useful to note that yield is not well correlated with CDS because much of what is being discussed as part of a European “Solution” would cause German yields to increase – partly as the flight to safety bid dissipates, and partly because they will be shouldering a larger debt burden to prop up the rest. In any case, if any politician is expecting Italian yields to move with CDS, there is very little historical data to support that.

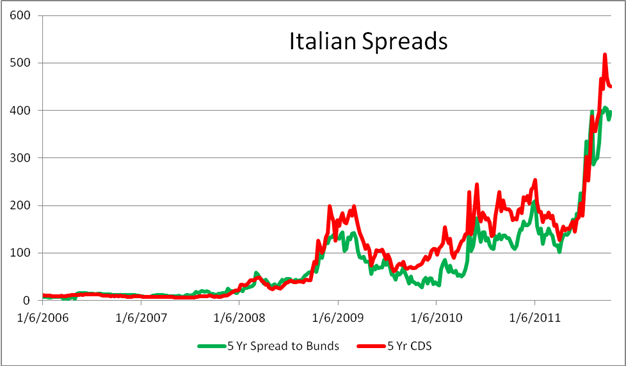

CDS and the spread to bunds are more correlated.

The spread to bunds and CDS are definitely more closely tied together. This chart at least gives hope that if the EU can get Italian CDS to go a lot tighter, the bonds could trade tighter. Working against that argument is the fact that the CDS is already trading at a wide basis, so some of the tightening in CDS would just normalize the basis, and as mentioned earlier, some of the spread tightening will be offset by rising German yields (absent a massive rate cut by the ECB). So at least from this graph, there is some reason to believe that collapsing CDS levels would help the problem in the EU, but even here it is not horribly compelling as they seem to move inline more often than not (CDS isn’t a clear leading indicator) and the basis right now is quite high anyways (the correlation between Euro Credit Spreads and FX rates at very high right now).

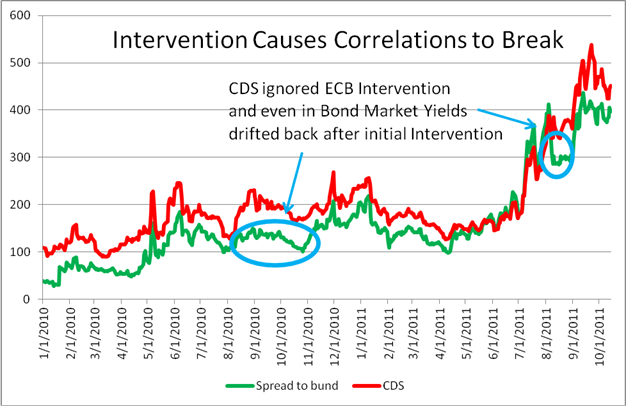

The next chart might be the most interesting. The ECB entered into two big bond purchase programs, last fall and August of this year. It is interesting to see how bond spreads tightened as they were the direct beneficiary of the ECB intervention, but the CDS market relatively ignored the intervention. It is also worth noting that after the period of intervention the bonds drifted back to their fair market value rate.

I would expect a similar reaction to intervention in the CDS market. The CDS market would react as it is the “beneficiary” of the government intervention, but the bonds would not blindly follow CDS tighter. The bond market would realize that the CDS move was artificial. You would likely see some initial move tighter as investors scramble out of bad hedges, but then what? Expecting bonds to respond to a manipulative intervention is a bad idea.

Move and Countermove

Let’s assume the EU bans naked shorts in sovereign CDS AND lets the ECB or EFSF sell protection. This is even more than is mentioned in the current rumor, so the market should respond amazingly well, right? Not so fast.

CDS will tighten. Potentially tighten dramatically. I could easily see Italian CDS trading from 440 to 200 in the short run if naked shorts were banned and some EU entity started selling CDS. The big question is how much of that spread tightening will transfer to Italian bonds? My guess, and it is only a guess, is that bonds will tighten by less than 100 bps, and possibly less than 50 bps. The CDS market largely ignored the intervention in the bond market the two times that was in full throttle. Why would this be different? Don’t forget, the CDS market is tiny in comparison to the bond market. The net outstanding CDS on Italy is only about 2% of the bonds outstanding. Talk about the tail wagging the dog. Manipulating a small fraction of the market will do little to instill confidence and will only take away a source of pricing.

What will happen to German Bund yields? It is hard to see them reacting well to this. At the very least some of the premium built into German bunds as a flight to safety will disappear. Depending on the rest of the “Grand Plan” Germany will become more risky and may need to borrow debt (or crowd out its own direct issuance with all the guarantees they are providing). So for Italian bond yields to fall, the impact of the Grand Plan and CDS manipulation will need to impact spreads more than German bund yields rise. That is possible, but I suspect the results will disappoint and Italian 5 year debt will struggle to get below 5%.

Well, the ECB could slash rates to zero. That would lower the yield of bunds (the closest Europe will have to anything resembling a risk free borrower by that point). That lowering of yield should translate to Italian bond yields, though as we are seeing in the US, it is hard to push certain assets below a threshold yield. Investment grade bond spreads here have become more volatile recently in part because they cannot move in line with treasuries when treasuries do better. Operation Twist caused IG spreads to widen, at least in part, because too many investors can’t afford to own corporate bonds with such a low yield. A part of the recent move tighter was just this unwinding. Look at how stable LQD has been relative to TLT.

So now the EU will have banned naked CDS, sold CDS, cut rates to zero, announced a Grand Plan and Italian 5 year bond yields could still easily be above 4.5%. What have they accomplished? They will have accomplished very little and certainly nothing that is sustainable. What happens the next time the Italian government votes down an austerity package or the deficit comes out worse than expected? I think just like when they ban anyone being short stocks, they will regret not having the short covering bid on the next down leg.

The New Short

Since nothing mentioned does anything to actually fix the economies or balance sheets that are in trouble, it is reasonable to assume that some investors will remain bearish or become bearish at these new levels. They might buy some CDS depending on how tight it is, it may be worth doing it, although they will be concerned about not only price intervention but some form of legal intervention as the EU seems willing to at least consider bending the rules to avoid triggering Credit Events and the ECB seems willing to say and do anything to ignore their mark to market losses. But at some level the basis will become worth at least putting some risk capital to work. Some investors will want to short bonds, putting that pressure on the bond market. That would clearly be banned quickly and borrowing sovereign debt to short would be scary as the rules could be changed. Then what? Short bank stocks? No, you can’t do that. So then what? Shorting indices and playing the FX markets will be the only option. Expressing a view on sovereign credit will have to be done through other markets. That could cause pain for the shorts, but also could create a spiral in the stock market. If the wealth effect is so big and the confidence from a rising stock market is so important, this could backfire. Now policies could be made that make the market look cheap or to help earnings. Money could be printed. Lots could be done, but as you can see, all this does is shift the battleground and make it ever more complex.

Until something is done to demonstrate that Europe is on a sustainable path to being able to pay back debt, or the ECB prints money and takes a chance on unleashing inflation, little manipulations will not help. In fact they will likely hurt in the long run.

Unintended Consequences seems to have taken on a new meaning. Unintended consequences means to me, that a lot of thought went into the consequences and the end result surprised. I no longer believe that significant thought goes into the potential consequences. The analysts see what they want and get tunnel vision on the series of consequences they want to see, rather than really trying to figure out what might happen. Europe is not only behind the curve, they act like they are playing checkers with a 4 year old, when the markets are a game of chess, and they should be seriously analyzing the moves and countermoves that can occur before determining their next move. They also have to remember the risk side. So much focus is on the possible benefits of a “Grand Plan” that no resources are being devoted to what happens if that plan fails. Maybe they should strive for less potential upside to the plan in order to sure that this isn’t the last plan they can try.